Revelations from an inquiry into Star Entertainment are an “unmitigated disaster” for good corporate governance in Australia and it may be time to consider breaking up casino monopolies, says Ben Lee, managing partner of IGamiX Management & Consulting.

The Bell Inquiry in New South Wales is looking into whether Star is suitable to hold a license for its flagship property in Sydney. It follows hot on the heels of three separate probes into Crown Resorts, which all found the company was unsuitable in the states of Victoria, New South Wales and Western Australia.

So far the Star inquiry has heard revelations of how clients put $900 million on their China UnionPay cards, mostly to gamble. It has heard how when questioned, the operator mislead National Australia Bank by saying the cards were used for hotel accommodation and expenses.

One high roller told how he spent $11 million in one day on his CUP card without any red flags being raised, while another employee told how the regulator was provided with misleading building design submissions that failed to mention a cash window provided to junket operator, Suncity.

Suncity was technically not permitted to be handling cash at the casino, although the probe was shown CCTV footage of people walking into its VIP rooms with backpacks of cash.

CEO Matt Bekier, who resigned on Monday, stated publicly in 2019 that Star was no longer doing business with Suncity after revelations to have emerged from the Crown inquiries. However, this was not the case, the junket’s operations were moved to a different room without its high-profile signage.

The two biggest casino operators in Australia, which account for 95 percent of the country’s gross gambling revenue, have shown “complete disregard for corporate governance and good management practices,” Lee said.

The inquiries have also highlighted significant deficiencies with the country’s regulators, with steps now being taken to remedy the situation. Victoria has demerged the body that regulates casinos from the agency that oversees liquor to give it more focus.

However, Lee says this likely isn’t enough and breaking up the monopolies in some states may be more effective as it would ensure that the regulator is not beholden to the same commercial interests when handing down decisions.

The Royal Commission in Victoria had urged for Crown to be stripped of its license in the state, arguing that the problems ran too deep to allow them to be fixed in a reasonable period of time.

The government instead gave it two years to reorganize and regain suitability under a special supervisor. Concerns over employment and the impact on the regional economy overrode the voices seeking the toughest possible sanction.

“The problem is when you have one regulator and one target is that the regulator becomes the captive of its subject,” Lee says. “The government doesn’t want to kill them as it has become reliant on the revenue, so they will bend over backward.”

“You need to get rid of the monopoly. In this day and age, there is just no good reason to have a casino monopoly.”

Lee argues that monopoly ventures seem to adopt a mindset of assuming they can do what they want and the blatant disregard of the rules in Australia seems to prove the point.

Most of Australia’s states have one operator. Star has the only operating casino in Sydney, Crown Resorts has not yet been able to open its casino at Barangaroo due to losing suitability for its license, which it obtained without a competitive tender. Crown had the monopoly in Western Australia, where the regulator came under strong criticism by the recently concluded Royal Commission.

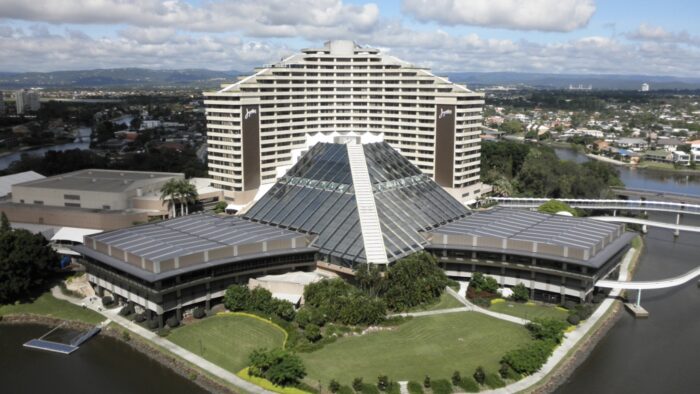

Tasmania has two casinos, but both are operated by the same group, while Queensland is more open with four casinos, with two owned by Star. The monopoly in South Australia is held by New Zealand’s SkyCity for its Adelaide property.

Lee says there has been a push for a second license in Melbourne for some time, although he concedes he doesn’t believe the political will is there to make the change, potentially due to concern over problem gambling.

At Star itself, Lee says Bekier’s departure won’t be the last and like Crown, the company will need to clear out its senior management.

Crown has agreed to a takeover by the U.S. Blackstone Group, although this is unlikely to be an option for Star, Lee says. Star has a lower market share and Crown was a much better proposition.