The investment unit of the Bank of East Asia (BEA) anticipates that the contribution to gross gaming revenue (GGR) per tourist in Macau may increase by 6% this year. This aligns with the 6.3% year-on-year nominal growth in the disposable income of Mainland residents in the first three quarters of last year.

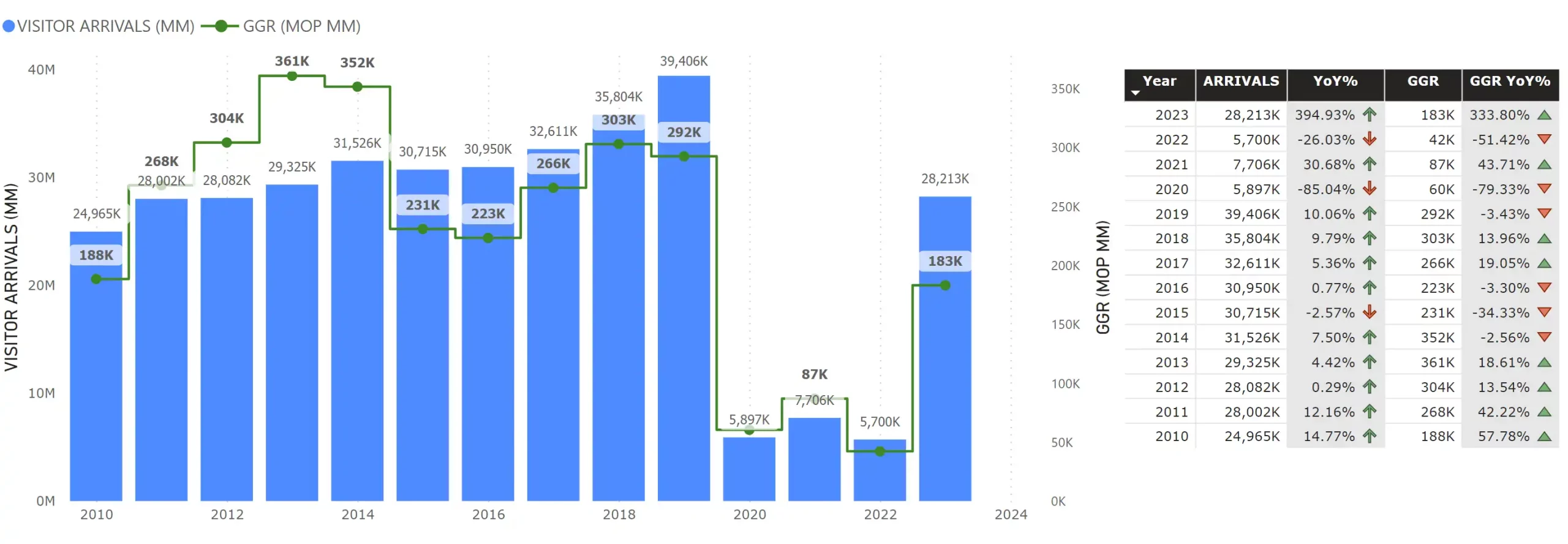

The research team from East Asia Securities notes that as China’s economy gradually stabilizes, travel demand remains stable, and traffic gradually returns to normal. It is expected that Macau’s gaming revenue will further recover in 2024, and the annual gaming revenue may increase to MOP234 billion ($29 billion), marking an annual growth of nearly 28%, returning to the level of about 80% in 2019.

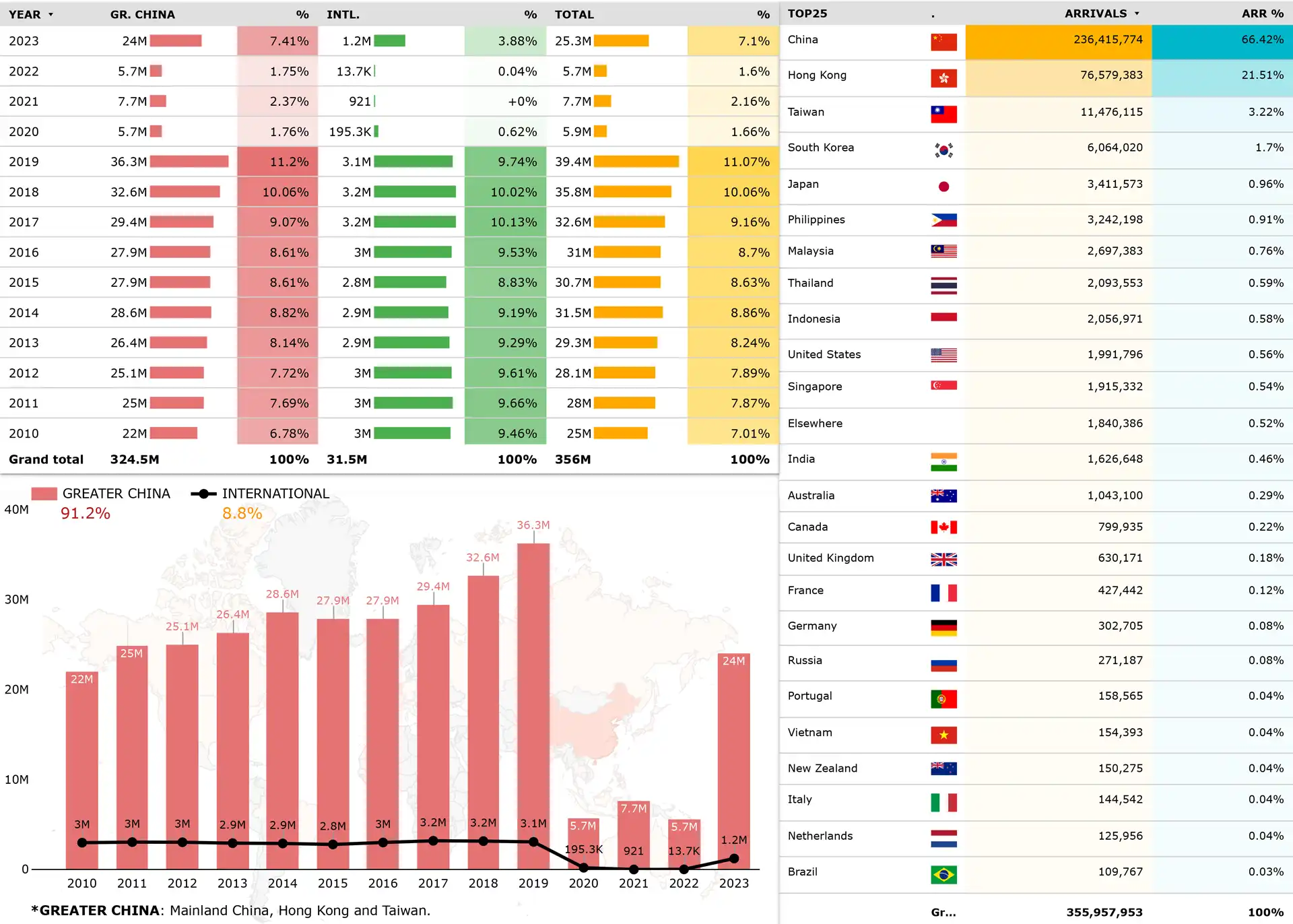

The broker expects Macau’s inbound visitor arrivals to recover to 86% of 2019 levels, representing nearly 34 million visitor arrivals.

In pre-pandemic times, the city’s casino sector generated about MOP292 billion ($36.2 billion), while receiving some 39 million visitors. However, in 2023, the city welcomed about 28.21 million visitors, with the total gaming tally for the year, including casino gross gaming revenue (GGR) for calendar year 2023, standing at MOP183.06 billion ($22.75 billion).

East Asia Securities notes that Macau’s GGR could continue to rebound, and the profit of Macau gaming stocks is expected to recover in the short term. Coupled with the opportunity to cut interest rates in the United States this year, the reduction of refinancing costs is conducive to expanding the net profit margin of Macau gaming stocks, and individual gambling companies even have the opportunity to restore symbolic dividends this year.

At the same time, the broker indicates that the current valuation of Macau gaming stocks is attractive, giving the Macau gaming industry an “overweight” rating. Investors can prioritize market share growth potential and valuation discounts compared to peer gaming stocks.

Uncertainties

The same report also mentions that there are some potential factors that may drag down Macau’s GGR. These include the weaker-than-expected economic recovery in Mainland China and the continued weakness in the Hong Kong and Mainland stock markets, which may bring about negative wealth efficiency, affecting the spending power of tourists.

It is also worth noting that Hong Kong has been one of the most important source markets for Macau, following mainland China. At the same time, the volume of Hong Kong tourists has already recovered to pre-COVID levels in 2023.

The rapid recovery in 2023 has been encouraging for the tourism industry. In the early stage of Macau’s recovery, the Macau government launched transport subsidy schemes to attract Hong Kong tourists.

The same broker also mentions that large mainland trust companies have filed for bankruptcy; most of their clients are high-net-worth individuals, and the gross income of VIP rooms and high-end gambling may be affected. Meanwhile, Chinese authorities have strengthened the regulation of cross-border capital flows, which could have a direct impact on GGR.