New visa policy changes for mainland Chinese visitors to Macau will be ‘marginally beneficial in the short-term’ and the ‘sentiment around the Chinese government with respect to Macau is certainly positive’, notes analyst Vitaly Umanski.

The analyst with Seaport Research Partners notes that while some six visa-related measures were introduced, focused on group package tours and business visas, the one regarding the multi-entry visa between Hengqin and Macau was ‘watered down to apply only to group visitors entering/exiting Macau together as part of a package tour’.

Authorities have justified the move as facilitating Macau’s access to Hengqin hotels, lifting potential room capacity as Macau struggles to keep up with the surge in visitation and aims to keep tourists in the SAR for longer to boost spending.

The analyst notes that the new measures ‘may have more marginal impact’ but also highlights that ‘there is no indication that the Chinese government is looking to reign in Chinese visitation (and spend) in Macau or curtail gaming activity in the city’.

Coupled with the addition of two new cities to the Individual Visit Scheme (IVS) – Qingdao and Xi’an (from March 6th), Umanski opines that ‘the current policy changes […] are all positive’.

The analyst cautions, however, that ‘the ability to quantify what these measures may mean in the short-term and longer-term, is very limited’. The doubt means that the research firm retains its current gross gaming revenue market forecasts.

The measures do imply shorter processing time for visitors coming from China’s top 20 cities, all included on the IVS list.

This would be ‘more impactful for VIP and Premium Mass who frequent Macau more than several times per year’.

The new measures could also help boost MICE and cultural-oriented visitors – allowing a one-year multi-entry visa for certain activities – which Umanski notes could ‘have a larger impact in premium (and high end base mass)’ but only if the policy allows such issuance for ‘concerts and other cultural events with no scrutiny’.

Macau’s six gaming operators have been heavily investing in their non-gaming spend, and focusing on events and entertainment as a key driver, therefore event-driven visas could drive further punters to the table.

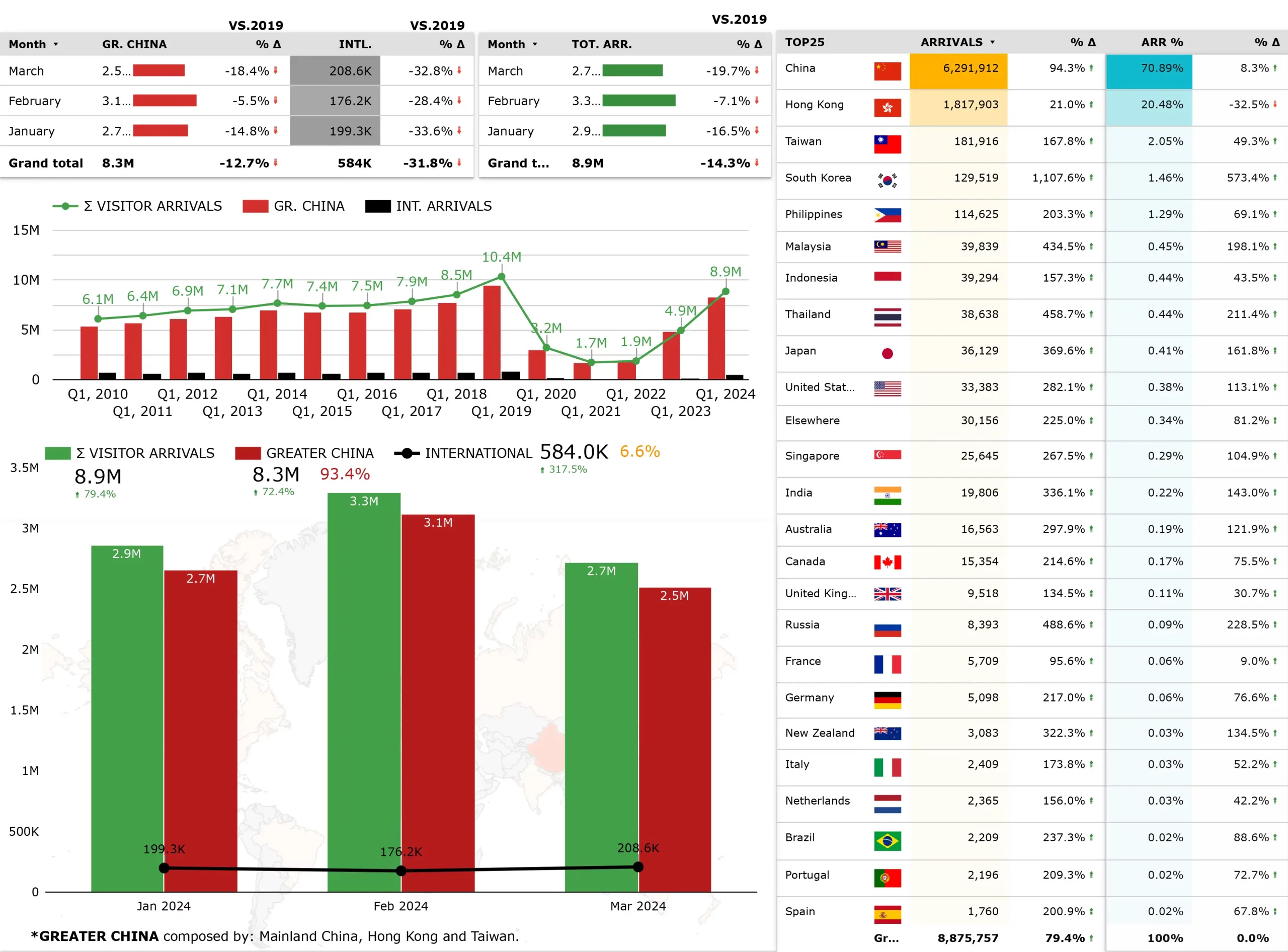

Macau visitation

Overall Macau visitation still remains below 2019 levels, with the analyst noting that ‘lower end visitation remains subdued’- primarily impacting Sands, Galaxy and SJM. Hotel occupancy is also trailing 2019, but hotel rooms have increased (45,000 versus 37,000 in 2019) and the average room rates are equal to or higher than before the pandemic.

This also means that more affordably-priced rooms in Hengqin would go hand-in-hand with the new Hengqin-Macau border policy.

The analyst notes, however, that Hengqin’s hotel room build out and multi-entry group visa policy ‘will take some time to fully positively impact the Macau gaming industry’.

But who is visiting? Umanski notes that it is ‘clear […] that the premium customers are coming to Macau in force, while lower-end gaming customers are still lagging’.

This could be aided by new travel policies, such as the measures mentioned above, ‘but the base mass customer return will return when the Chinese economy and consumer confidence improves,’ notes the analyst.

China is undergoing an economic downturn and average spending has been falling, with consumers tightening their purse strings. Meanwhile, Macau has made it mandatory that operators focus on mass, effectively shutting down junkets, in its bid to revamp its image as a non-gaming hub.