Investment bank Citigroup notes that there is still ‘plenty of room for top-line gaming revenue growth’ for 2024 in Macau, as its research team indicates that the sector’s current valuations imply over-pessimistic opex inflation.

In Citigroup’s latest investment memo, analyst George Choi notes that Macau casino operators have had a ‘decent 2023’, with industry EBITDA already recovering to 80 percent of pre-pandemic levels in the 3Q23 earnings season. However, the gaming companies’ stocks have been ‘suffering from a series of armchair theories’ over the past few months.

The analyst exemplifies that the weak economy in China impacting luxury spending, casino operators engaging in a price war on player incentives, and other factors may have affected Macau gaming revenue. However, Citigroup concludes that China’s GDP ‘does not’ correlate with Macau’s Mass GGR.

‘While it might be intuitive to link Macau’s mass gross gaming revenue (GGR) growth potential to China’s GDP, historical data suggest a weak correlation. Visitation, gaming spending, and time spent at casinos together have a more significant correlation with Macau’s mass GGR,’ notes the analyst.

Both Citigroup and the Macau government have anticipated Macau 2024 GGR to reach MOP216 billion ($27.1 billion) in 2024, yearly growth of 19 percent.

The investment bank says that for Macau to achieve the forecasted GGR growth, Macau’s visitation volume needs to be flat-lined from the 3Q23 level, which means about 85 percent of pre-COVID levels.

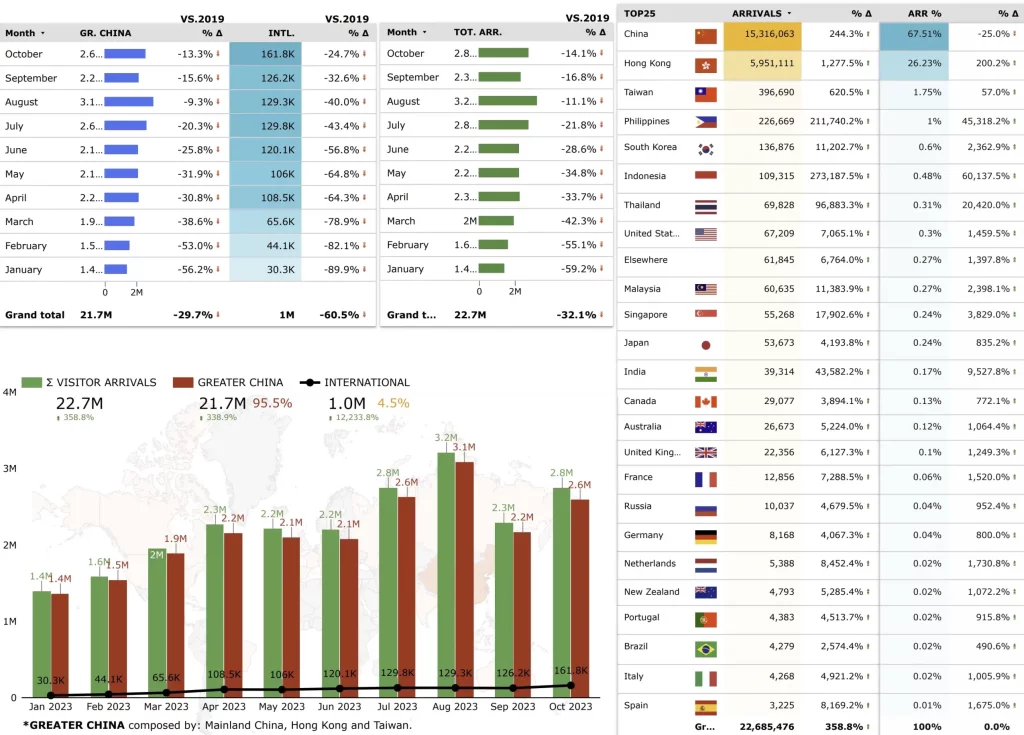

According to the official data, Macau received 22,685,476 visitors in the first ten months of 2023, with a significant 358.8 percent growth in visitor arrivals compared to the previous year.

The investment memo also elevates some concerns regarding overspending on player incentives. If a company does not spend on marketing, it runs the risk of losing ret share. However, in reality, Citigroup points out that ‘the six Macau casino operators should not be penalized upping expenditure on player incentives, so long as their EBITDA margins are not materially diluted.’

‘Assuming investors are convinced that GGR can grow 19 percent year-over-year in 2024, our analysis shows that Macau’s current valuation is effectively implying that investors expect an unprecedented 58 percent rise in opex from the annualized 3023 levels.’