Citigroup has trimmed its forecast for Macau’s gross gaming revenue (GGR) from MOP18.5 billion ($2.3 billion) to MOP18 billion ($2.23 billion) for April due to the anticipated flattish daily run-rate.

According to the investment memo issued on Monday by analysts George Choi and Ryan Cheung, citing industry sources, Macau’s GGR for the first 21 days of April is likely to have reached MOP12.5 billion ($1.55 billion). The implied daily run-rate of last week was about MOP600 million ($74.4 million), which was 2 percent higher than that of the prior week at MOP586 million ($72.7 million) per day.

Macau VIP volumes were 5-6 percent lower month-to-month, while mass volumes were 4-5 percent lower month-to-month. The VIP hold rate appears to be below the normal level, reflecting the lower-than-expected VIP hold rate.

In this context, the research team from Citigroup cuts April’s GGR forecast, implying the daily run-rate to ‘stay largely flattish for the rest of the month’.

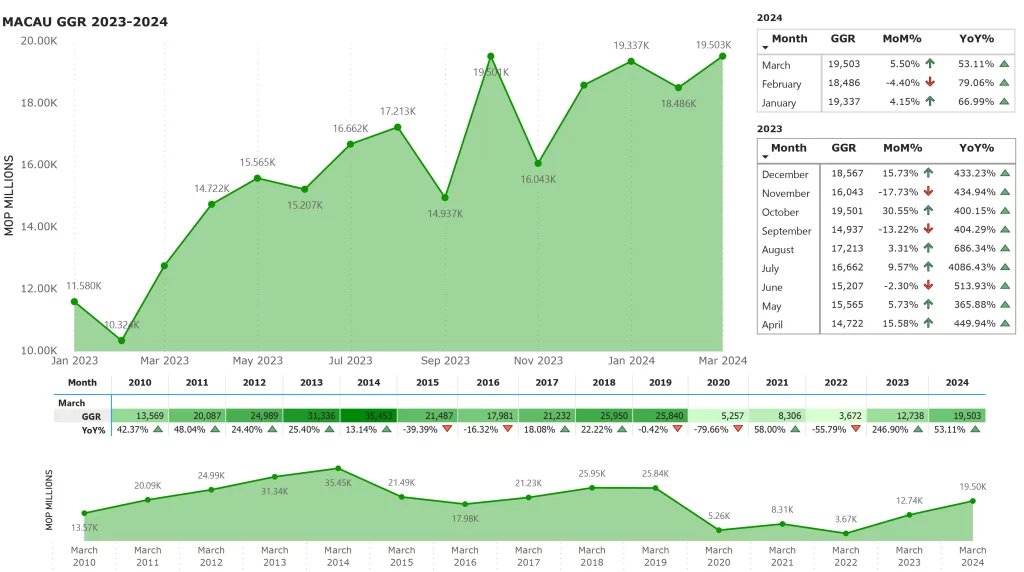

Macau’s March GGR amounted to MOP19.5 billion ($2.42 billion), reaching a new 49-month high.

The results reflect a 5.5 percent increase from February’s MOP18.5 billion ($2.29 billion) and a 0.01 percent increase from the last post-COVID October high of MOP19.5 billion ($2.41 billion).

The new post-COVID high GGR was attributed to the holidays falling in March, as Macau received an influx of visitors from Mainland China and Hong Kong during Easter and Cheng Ching.

Earlier last week, the Macao Government Tourism Office (MGTO) projected that Macau may receive an average of 130,000 inbound tourists per day during the Labor Day break. The projection surpasses the numbers seen during the Cheng Ming and Easter holidays.

The Labor Day break spans from May 1st to May 5th for mainland China. Citigroup has projected that Macau’s hotel occupancy is expected to reach 90 percent during the period.