Fitch Ratings anticipates that SJM Holdings Limited will experience a positive free cash flow (FCF) in 2024, with further expansion in 2025-2026. This positive trend is expected to drive a reduction in debt balance from HK$ 29 billion ($2.7 billion) at the end of September 2023 to HK$ 26 billion ($3.3 billion) by the end of 2025 and HK$ 23 billion ($3 billion) by the end of 2026.

In a recent investment memo, the rating agency upgraded the outlook on Hong Kong-listed SJM Holdings Limited’s Long-Term Foreign-Currency Issuer Default Rating (IDR) from “Negative” to “Stable.” The upgrade reflects the robust recovery in visitation and gaming revenue in Macau, despite the economic downturn in China.

Fitch also notes that in the foreseeable future, SJM Holdings will ‘focus on deleveraging as it maintains a conservative financial policy.’

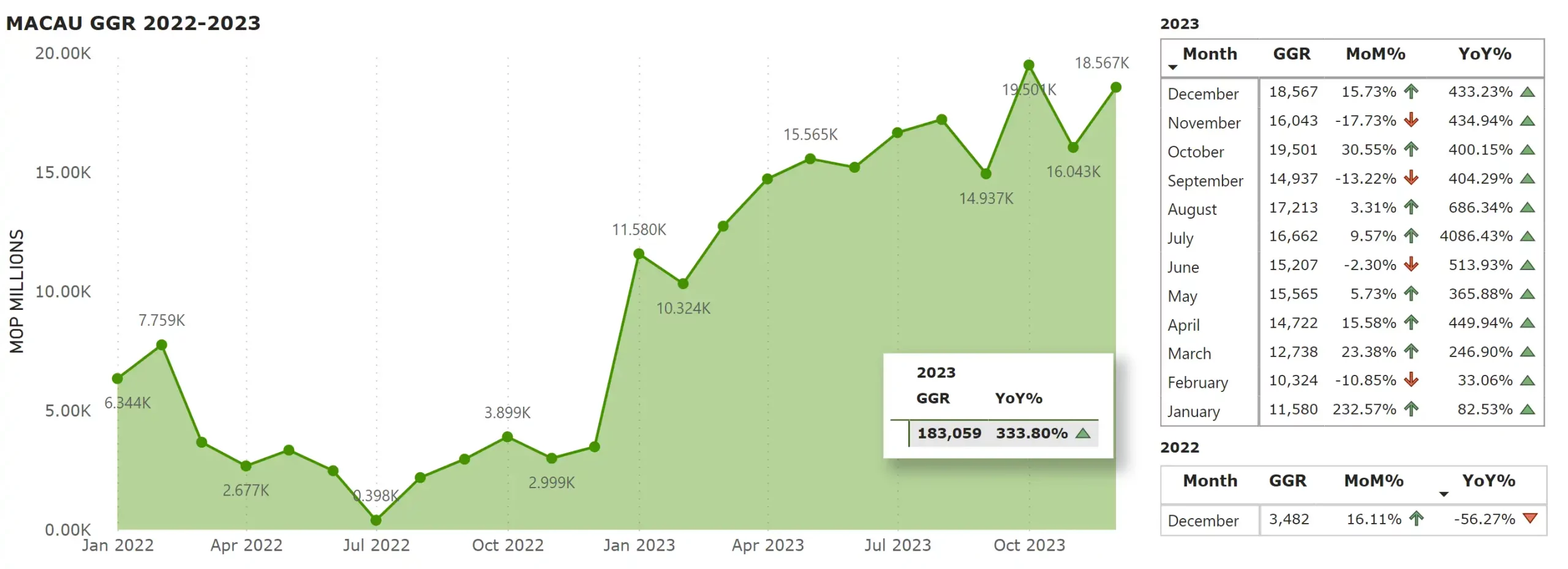

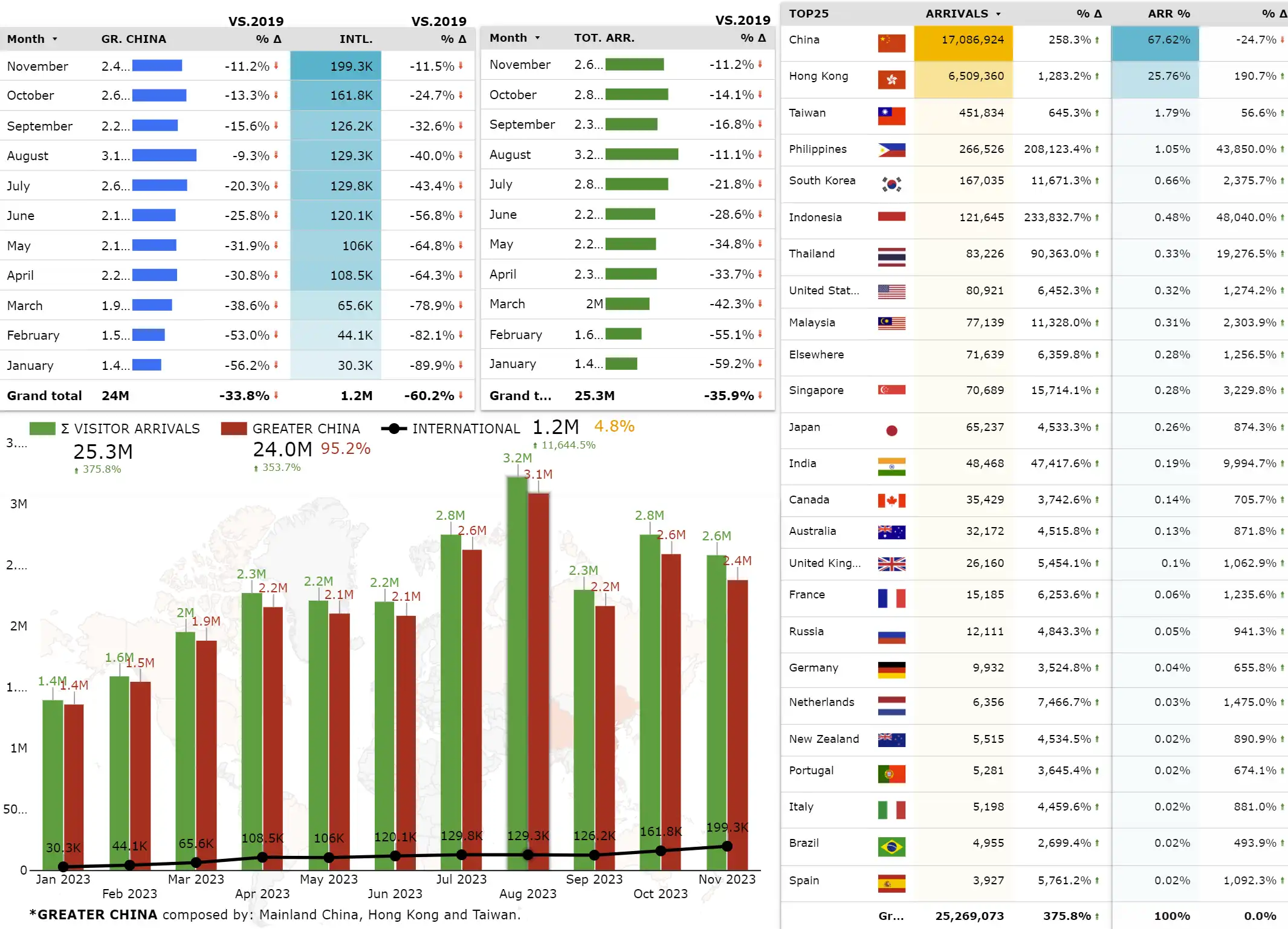

Fitch has highlighted some key rating drivers, including the rapid rebound of Macau visitation and gaming performance. ‘Overall gross gaming revenue (GGR) reached 75 percent of 2019 levels in 4Q23, as mass market GGR is likely to have improved to over 100 percent of 2019 levels. Visitation to Macau also continues to improve, with overall visitation reaching 89 percent of 2019 levels in November 2023, or 70 percent through 11M23. We expect moderate sequential improvement in 2024 as air travel capacity continues to normalize in Hong Kong and Macau.’

SJM’s first property in Cotai and also the first integrated resort, Grand Lisboa Palace (GLP), are key drivers for financial improvement. Fitch mentions that GLP continues to ramp up, even though the progress has been slower than expected.

‘In 3Q23, GLP recorded GGR of HK$ 783 million ($48.4 million), translating to a market share of 1.6 percent. This has allowed it to narrow the property EBITDA loss to HKD 27 million ($3.5 million), close to break-even.’

‘Visitation continued to improve gradually in 3Q23 (+21 percent QoQ), along with mass GGR (+41 percent QoQ). Management expects to reach 5-6 percent market share in the longer term and is working on plans to improve its connectivity, and mass appeal through food and beverage, retail, and event offerings.’

On the same note, the research team from Fitch also mentions that there is a strong recovery at its self-promoted casinos, projecting that Grand Lisboa (GL) and other self-promoted casinos’ adjusted property EBITDA will recover to 95 percent of 2019 levels in 2024.

‘Mass GGR of Grand Lisboa (GL) and other self-promoted casinos reached 91-92 percent of 2019 levels in 3Q23, in line with the overall market. SJM Holdings has shifted focus away from the VIP segment at these casinos, resulting in VIP revenue at GL recovering to only 9 percent of 2019 levels and no VIP revenue generated at other self-promoted casinos. This has led to a lower GGR contribution, but the EBITDA impact is much more limited, as VIP has low margins.’

Satellite casinos

Excess costs from redundant staff due to the closure of five satellite casinos at the end of 2022 continue to hinder the company’s recovery. The same rating agency notes that excess costs amount to HK$488 million ($62.6 million) through 9M23, and these costs are expected to be fully absorbed through attrition and redeployment by 2025.

‘Steady progress has been made so far, with the headcount dropping below 2,000 in 3Q23, from 2,700 at the end of 2022, and the daily run rate of excess costs dropping to HK$1.6 million ($249,000) in 3Q23 from over HK$2 million ($256,200) in 2022. Excluding the excess costs, the EBITDA margin from satellite casinos was normal at 3 percent in 3Q23.’

Non-gaming investment stipulation

SJM Holdings and its parent, Sociedade de Turismo e Diversoes de Macau (STDM), have initially committed MOP12 billion ($1.5 million) for non-gaming activities over the new 10-year concession term through 2032. This includes MOP6 billion ($746 million) in capex, of which MOP4 billion ($498 million) is for further GLP upgrades, the renovation of GL, and the rejuvenation of the nearby area.

‘Most of the capex is likely to be used in the next few years,’ it wrote in a note.

SJM is also committed to an additional MOP2.4 billion ($299 million) for non-gaming investments, as Macau’s GGR exceeded MOP180 billion ($22.4 billion) in 2023, although such investments are likely to be made later on.