Macau continues to hold its gaming crown, the Philippines will see continued growth, while Thailand could see a casino even before Japan, and up to half of the Emirates could be seeking casino licenses. Expert and independent consultant Michael Zhu breaks down the state of play in Asian and regional gaming in this week’s Face to Face.

We’re joined today by Michael Zhu, an independent industry consultant who has decades of experience within the gaming industry. We’ve seen a huge resurgence in Asian gaming within this year, but who do you think has seen the most extensive growth?

Thank you, Kelsey, for this opportunity.

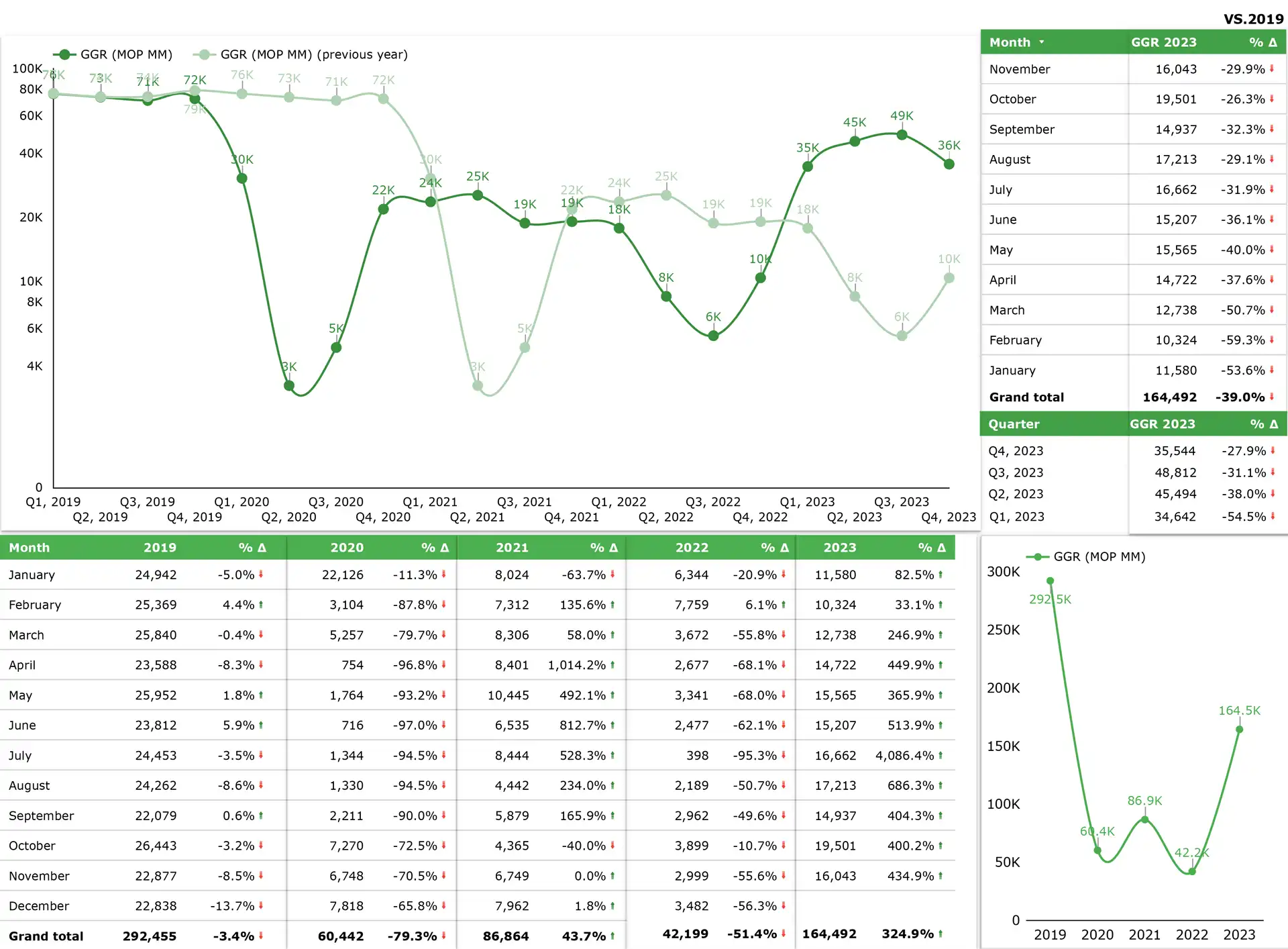

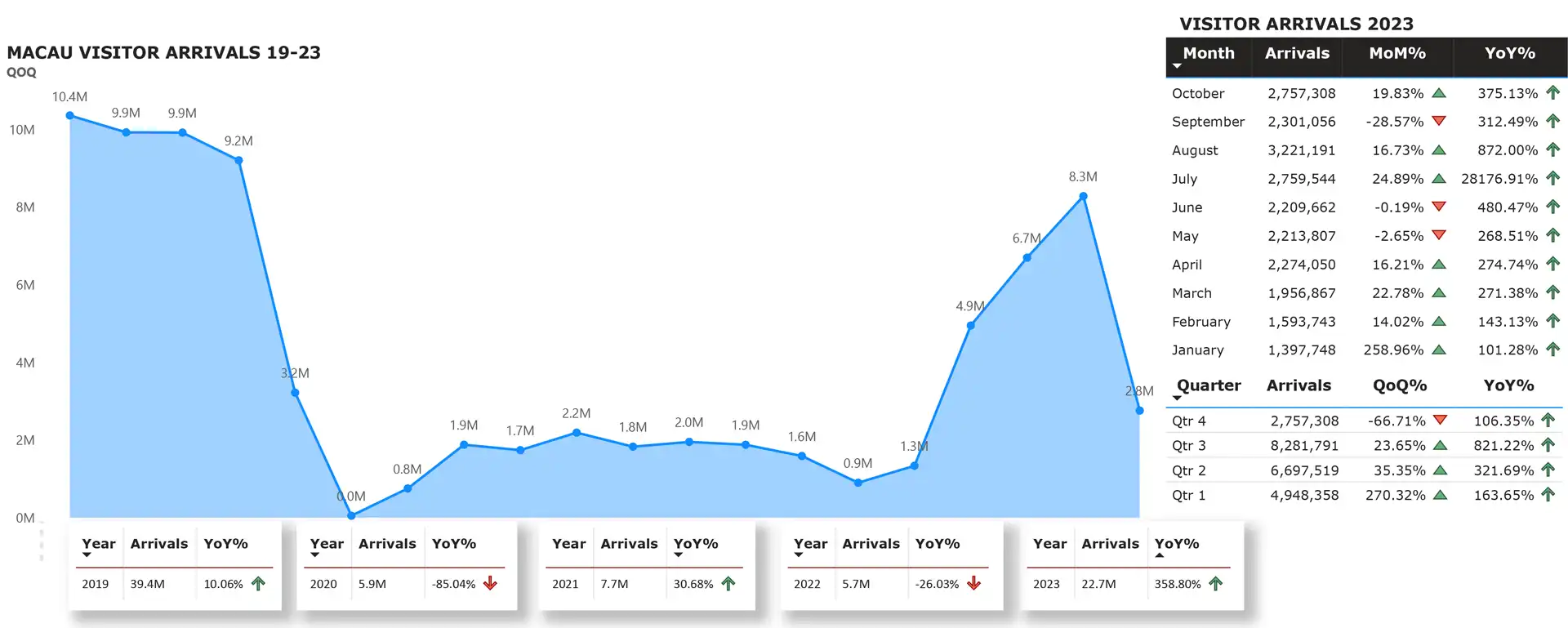

I think that question, I would like to rephrase as who have seen the most robust growth or the greatest growth this year in the region, and I think my category one would include Macau, Singapore and the Philippines. Especially in Macau, I think after all these challenging COVID years, eventually we started seeing a light at the end of the tunnel earlier this year. And since then the growth has been really amazing. The rapid recovery, fueled by additional visitations and a wider reach of customers.

Very true. And I mean, we’ve got a lot happening for the individual companies. So I want to look at those companies themselves and and see: is there any particular Asian gaming operator that has managed outstanding growth and development within this year?

I think in Macau I would give credit to all the six gaming concessionaires, out of which in particular Galaxy Entertainment Group, Sands China, and MGM China would be truly the leaders among the competition, who have seen outstanding growth, an outstanding recovering process, fueled by sustainable and continuous growth in the years to come.

“Thailand has a very good chance to see its first integrated resort before the one in Osaka”.

Michael Zhu

They’re very different in terms of their actual makeup. I mean, Galaxy is targeting its particular market, Sands is a bit more mass and MGM saw spectacular growth, I mean, also given the fact that they got that new table allocation, which definitely helped them. But branching out from Macau, let’s look a little bit at the new emerging growth markets because there’s so much excitement going around what could happen. Macau is kind of an old story, Singapore is a little bit of the same type of thing. The Philippines is very exciting, but then you’ve got things like Thailand and Japan. So what timelines do you think are in place for those two markets? We’ve got kind of the contrast between who is going to come first.

So we’ve seen the reports, we’ve seen the the timeline published, or announced, by the Tokyo government. It looks like Japan would likely see its first integrated resort in Osaka by the end of 2030, which is about six years out.

Thailand, on the other hand, has more recently become the focus of being the shoe-in. I think the government is working very hard to expedite the process. Just as recent as last week, I think the national parliaments just set up a specific committee to study the market potential, the community impact, economic benefits, all those things along the line. To your question, Kelsey, I would personally believe Thailand has a very good chance to see its first integrated resort before the one in Osaka.

It does kind of feel that way. It seems like there’s a little bit more of a fire happening within Thailand. And it seems like there’s less opposition from the public in particular, in regards to having casino legislation and even setting up local casinos. So looking at the the kind of division between larger scale IRS and smaller casinos, which they’re looking both at within Thailand, which do you think would come first? Do you think they would move forward with a larger multi-billion dollar scale IR or try and set up some of those local smaller casinos before moving on to the bigger projects?

I think the question is not necessarily, you know, which one they want to go first, the multi-billion dollar destination resort or sort of the more regional in smaller tourist cities. I think it’s likely that we see both types of both categories go on simultaneously. I think from the government’s perspective, the larger scale will be of more importance and the higher priority in just the sheer scale itself.

And the community impact economic benefits that goes with it would definitely have a quicker return and a better impact on the local community. However, on the other hand, that requires a more thorough study and planning process, and a large investment scale for the developers. So I don’t think there would be any preference for which one to go first, I think the market will give its answer. And we’ll see how things unfold naturally.

Zooming out from those emerging markets, we want to look at one which has been doing very, very well, and which the head of PAGCOR, in the Philippines, has expected to surpass the levels that they saw within 2019. That’s a big thing to do, meaning they’ll break even their previous records. So what do you think have been the major factors that have contributed to the success of the Philippines within the growth this year?

That’s definitely one of the greatest markets in the Asia Pacific region. I think a couple of things here. From the demand side we have been talking so much and putting so much focus on the local market segments, including the domestic Filipino patrons, as well as a expat population living in Metro Manila, in particular. I think these local segments not only have helped the gaming industry in the Philippines go through those challenging pandemic years, but they have also provided opportunity for further sustainable and long-term growth.

I mean, looking at the local demographics with rising income age wise, I think relatively they are younger than many other gaming jurisdictions in the region. So, we are looking at sustainable growth in the next 2/3/4 decades or even longer. The rising average income level has been going up, especially after the pandemic, the country is facing many exciting opportunities, so the demand I think is going to get strong.

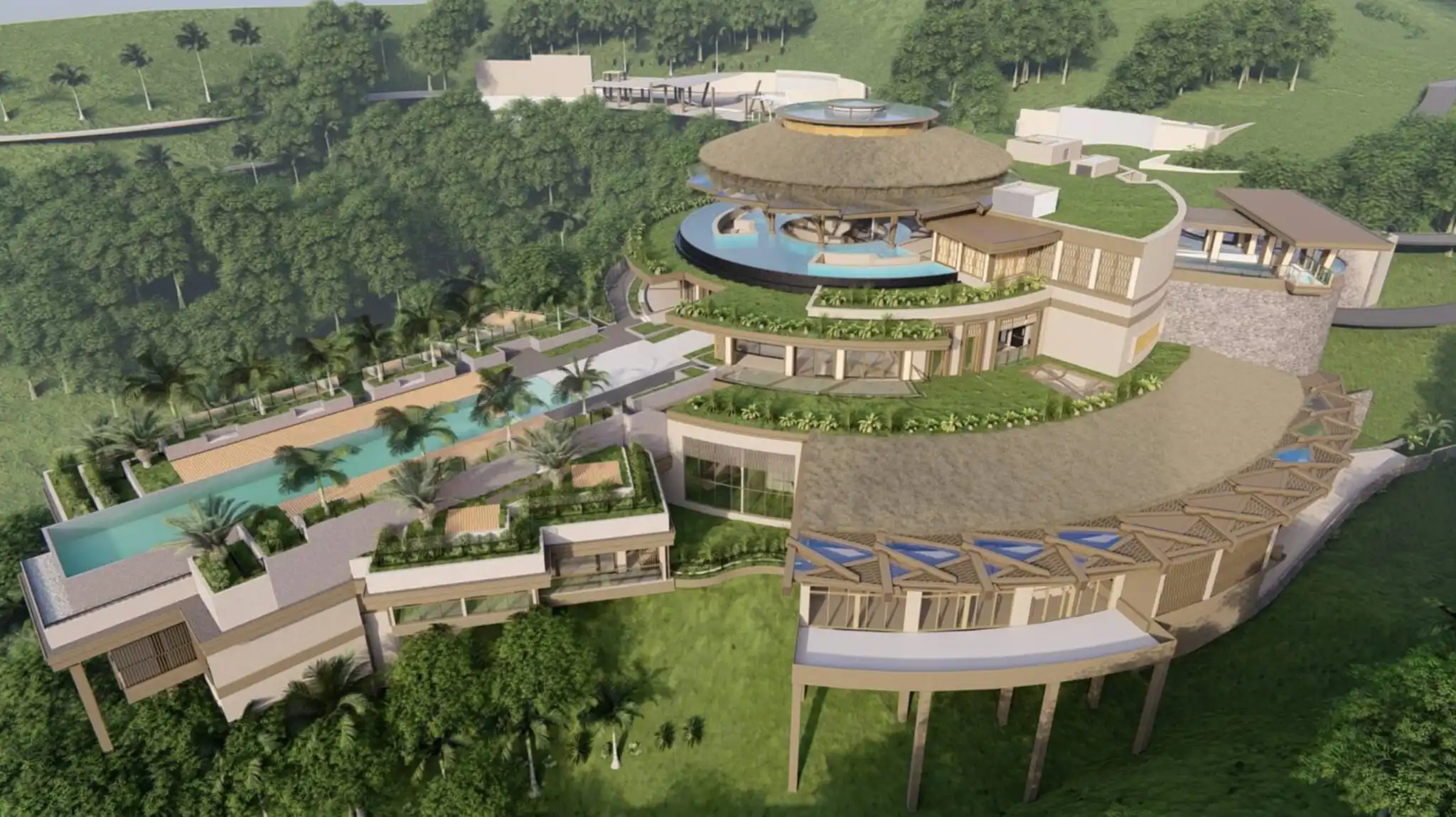

Then switching to the supply side, we’ve seen exciting developments in Metro Manila, for example, Bloomberry, they are going to complete the construction of the Resort North in Quezon City, which is also in Metro Manila Area. The focus for that property is to capitalize on the strong domestic demand.

A little bit out, further north, in Clark Freeport Zone, the Hann Resort, we have seen them bring in a large number of international hotel brands, they have a strong management team, together with the natural beauty, the amazing golf courses, as well as other attractions. I think that whole region is becoming more than just a regional gaming market, it is increasingly becoming a destination market.

A little bit further south actually looking at the city of Cebu, for example, we’ve seen the opening of NUSTAR, the ongoing development efforts by Emerald Bay, in Mactan Island, and Cebu International Airport is itself also planning the next stage of renovations/expansions. So that will not only increase the capacity and really help the air lift capacity, but also become a much better, more convenient, infrastructure wise, more convenient and travel pattern.

“…all of these will help make Cebu a more interesting, more attractive destination market”.

Michael Zhu

It’s very interesting, because all of these main properties, to see the expansion of NAIA airport, the expansion of the Clark airport, and then also the expansion of the Cebu airport. It’s interesting to see how these go hand-in-hand with the possibilities for investors who are looking to set up and expand the casino opportunities within the Philippines.

You had previously mentioned that you think that the Philippines could almost double its GGR within the next decade and reach $10 billion. You had said that earlier this year. I’m wondering, are there any new factors that could contribute to or change that estimate?

No, I think I will still hold that estimate. You know, if we break it down, the math tells us as long as you can achieve, 7.2/7.3 percent and year-over-year increases or for consecutive years, then you would be able to double the current level in 10 years. 7.2 or 7.3 percent is not too much of a challenging target. Again, on the supply side, we’re looking at a large number of new properties coming to the market, with better connectivity, improved infrastructure and a more tourist-friendly environment.

Then on the demand side, the local market remains strong. The demographic’s still young, and they are seeing rising income year over year. In addition to that, you know, with COVID related restrictions easing or lifted completely, I think the international tourism is poised to rebound in a faster pace in the in the next couple of years.

Well, that’s definitely true. We’ve already seen that already within this year the tourists are coming back. One thing that has been a little bit slower to return has been the Chinese visitation. Now that does come down to multiple factors. But is that they’re suffering the impact of a slowdown within the Chinese economy.

And without looking at Macau – because it’s kind of its own little paradigm, do you think that companies within the Philippines and then within the broader Asia region have had to kind of retool to compensate for the fact that their clients are not working with as much cash as they had before?

I actually would not be too concerned about that, in that if we look at China, mainland China as a whole, the propensity and the frequency of gaming, of going to visit integrated resort is still so low. I mean, we’re looking at, you know, 1.4 billion population out of which just the top 5 percent or 2 percent of the population – we’re talking about 10s of millions of affluent population of wealthy, middle class, solid middle class population, who would still want to go abroad and visit someplace, have a unique experience.

As you mentioned, Macau is sort of unique. But then when it comes to the Philippines or other Asian markets, I think every place has its own unique attractions, either natural beauty or the local cuisines or the history, the culture, they’re still points that attract the middle class people from China. And we’re not expecting them to have three visits or four visits a year, I think as long as you can get one visit out of the millions of population, the frequency and the propensity was still be able to support solid performance in the near future.

Macau, despite the new 10 year concessions, is kind of a boring story. It’s still the same six operators, there’s not been too many new changes despite the death of VIP, the push away from junkets. But I want to look at another market, which could be even more stagnant or have plateaued within a sense: Singapore. Is there anything else that we can expect out of Singapore? Is this going to be exciting within the next five years?

I think Singapore will remain in its position for at least the next five years.

I think land availability is something we need to keep in mind. However, with the ongoing renovation effort at Marina Bay Sands and Resorts World Sentosa, I think they are going to have better products and a richer mix of hospitality offerings.

There are more emerging markets that we haven’t talked about yet. The UAE has come rapidly onto the scene. We’ve seen with Wynn Al Marjan, what’s happening within that property. And now there was recently a report that maybe even the UAE might grant a casino license to each one of its Emirates. What is the speculation that you’re hearing about that?

To my knowledge, there are at least different three Emirates that are discussing the potential development plan for the Integrated resorts. Now, we’ve seen the report that the central government will approve one license to each of the seven emirates over there.

I don’t believe each emirate will have a casino within the next two to three years. But I think at least more than half of them are thinking about the plan. And once they have the right development partners or they have the right operators, we will likely see casinos up and running in those Emirates in the near future. Let’s see.

Do you think that this is going to be a record year for Asian gaming operators? Or do you think that 2024 could surpass what we’re seeing in 2023?

I think we will get really close by the end of this year, and 2024 is likely to be the year where we exceed the previous 2019 record.

Well, I know that everybody is hoping for the same. We’ve delved into a lot of territory here. We’ve covered a lot of jurisdictions, but all of them seem to be growing. So it’s good news for the Asian gaming industry. Just want to thank you again, Michael Zhu, independent industry consultant. We look forward to speaking with you again soon, hopefully at the ASEAN Gaming Summit.

Thank you, Kelsey.

Thanks for your time. We appreciate it.