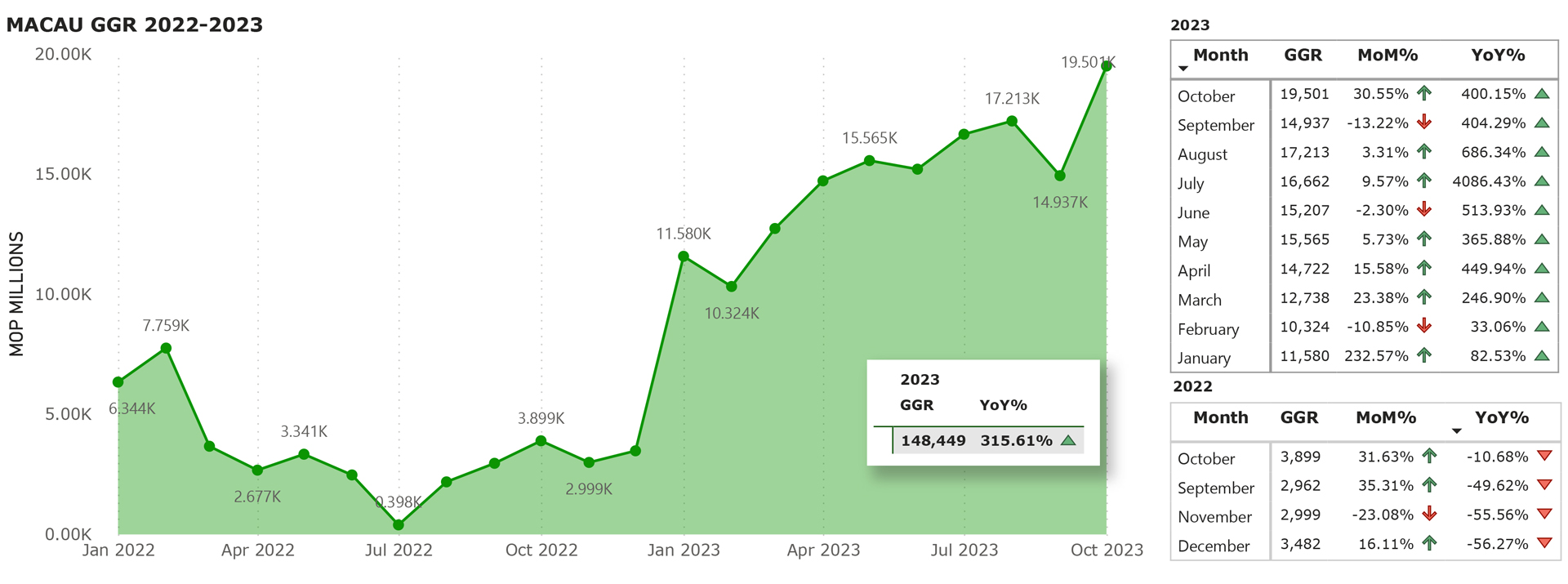

Macau industry-wide 3Q23 gross gaming revenue (GGR) in Macau is still 31 percent below the 3Q19 levels, according to the calculation of Deutsche Bank following all six gaming operators’ reported financial results.

Regarding the mass GGR, many investment research firms indicated that Macau’s mass GGR in October is already surpassing the pre-COVID levels. Based on Deutsche Bank, Macau’s mass GGR is only 5 percent lower than the 3Q19, and VIP GGR, despite an 849 percent yearly growth, is still 77 percent below the 2019 levels.

Regarding property EBITDA metrics, Deutsche Bank says that the industry margins were 29.3 percent in the 3Q23, which the 3Q19 was at 29 percent, as net revenue was down 21 percent from 3Q19 levels while non-gaming tax-related operating expenses declined 9 percent versus 3Q19.

There are still some changes in GGR market share: SJM has turned out to be the only loser of market share in the mass market, while Sands China, Wynn, MGM, Melco, and Galaxy are all gainers.

Regarding the VIP business, Melco and Sands China were losers for their VIP market share, while the rest have gained more market shares.

In October, Macau’s GGR reached its highest level since the beginning of the pandemic, topping out at $2.42 billion.

The latest figures bring the cumulative tally for 2023 GGR to MOP148.44 billion – $18.44 billion (January–October), a 315.6 percent yearly increase.

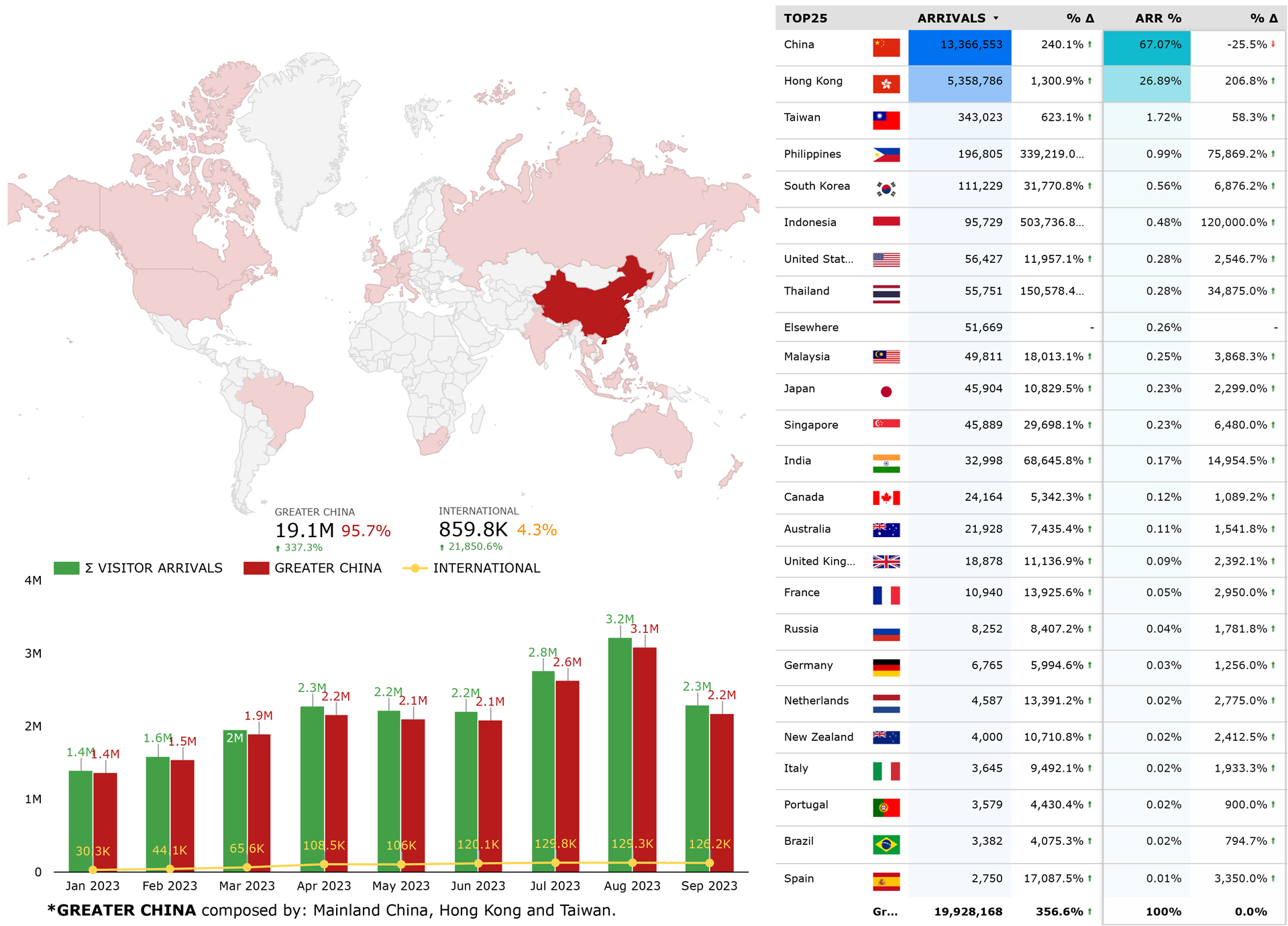

In general, Macau had a better-than-expected recovery, as in the middle of the year, government officials were expecting nearly 20 million tourists by year-end. And recently, they raised the projection to 27 million tourists.