The latest investment memo from JP Morgan reveals that Macau’s gross gaming revenue (GGR) from the mass segment has surpassed pre-COVID benchmarks for the first time, reaching 105 percent of the October 2019 levels.

This rebound, up from 94 percent in the third quarter, marks a pivotal moment in the industry’s path to recovery. The memo sheds light on the resurgence across various market segments, with even grind and base mass demand bouncing back to 85-90 percent levels, while premium mass surged to 110-120 percent. Meanwhile, the pace of VIP recovery remained steady at 23-24 percent, mirroring the 3Q23 performance.

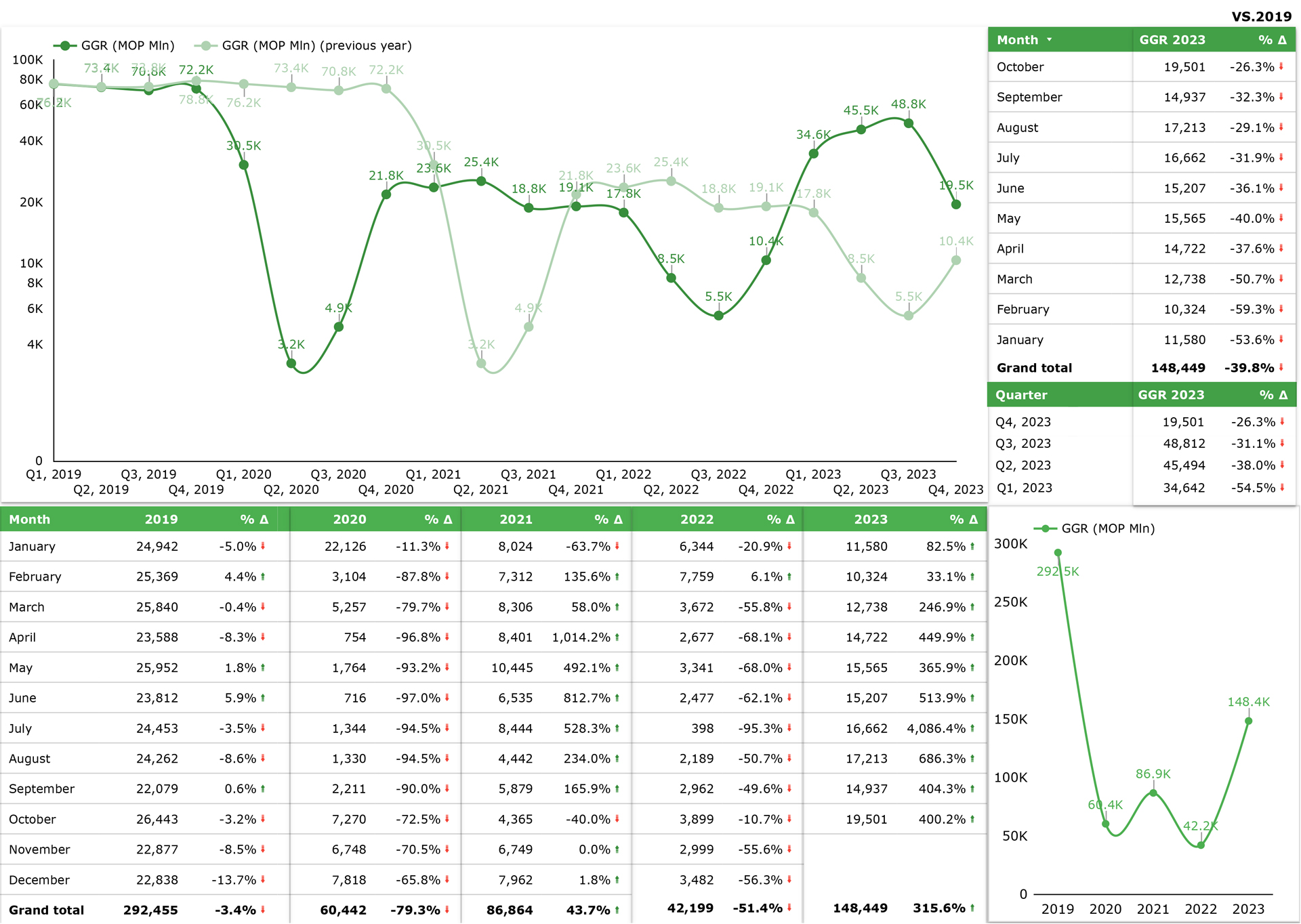

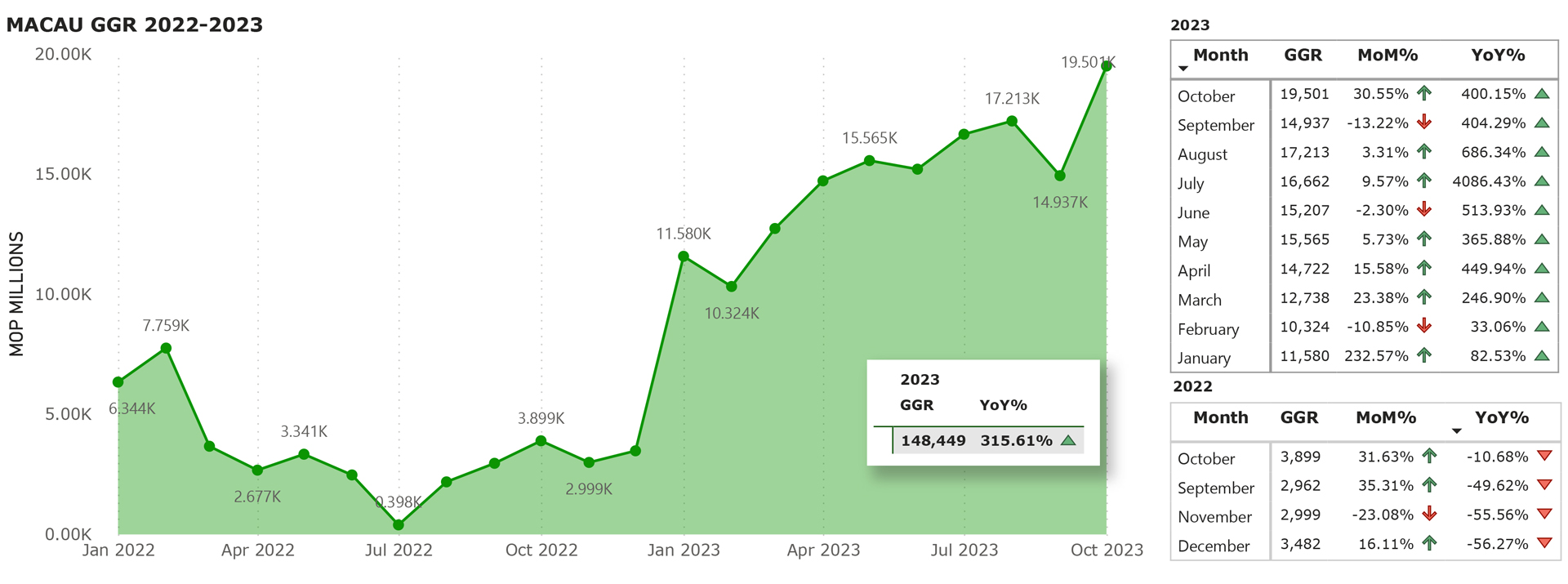

In October, Macau’s GGR reached its highest level since the beginning of the pandemic, totaling MOP19.5 billion ($2.42 billion), a 400.2 percent yearly increase and surpassing the previous 2023 high of MOP17.21 billion ($2.13 billion) seen in August by over MOP2 billion ($248 million).

The October figure implies a daily run-rate of MOP650 million ($36.8 million), compared to an average of MOP531 million ($33 million) in 3Q23.

Regarding the current month, analysts from JP Morgan note that November GGR ‘isn’t going to wow anyone, given the seasonality. However, we expect the pace of recovery to pick up in December, reaching 80 percent levels.’

The analysts expect that this means that November GGR will reach MOP16 billion ($1.98 billion), at 70 percent of pre-COVID levels, while December GGR is anticipated to reach MOP17.5 billion ($2.17 billion) to MOP18 billion ($2.23 billion), at 80 percent of 2019 levels.