Higher sports betting taxes lead to increased prices for gamers and ‘inevitably’ drive gamblers to illegal betting markets with better odds but fewer customer safeguards, the most recent Asian Racing Federation (ARF) report states.

The group conducted a recent analysis on the impact of Betting Duty – tax levied by governments on betting services providers – on turnover, illegal betting and tax revenue of sports betting.

The report posited that, high Betting Duties lead to pressure for a higher takeout rate (for totalisator operators) and a higher theoretical margin (for fixed odds

bookmakers) that results in higher prices passed on to customers.

This causes more people to migrate to illegal betting markets where prices or odds

are better value, since illegal betting operators and customers do not pay any tax, and to a consequent decrease in legal betting as well as decreased taxation.

According to the report, government policy makers and gambling regulators should seek a ‘commercially reasonable and stable Betting Duty rate’ that provides a

balance between channeling gambling demand to the legal betting sector

and allowing licensed betting operators to effectively compete with the illegal

market.

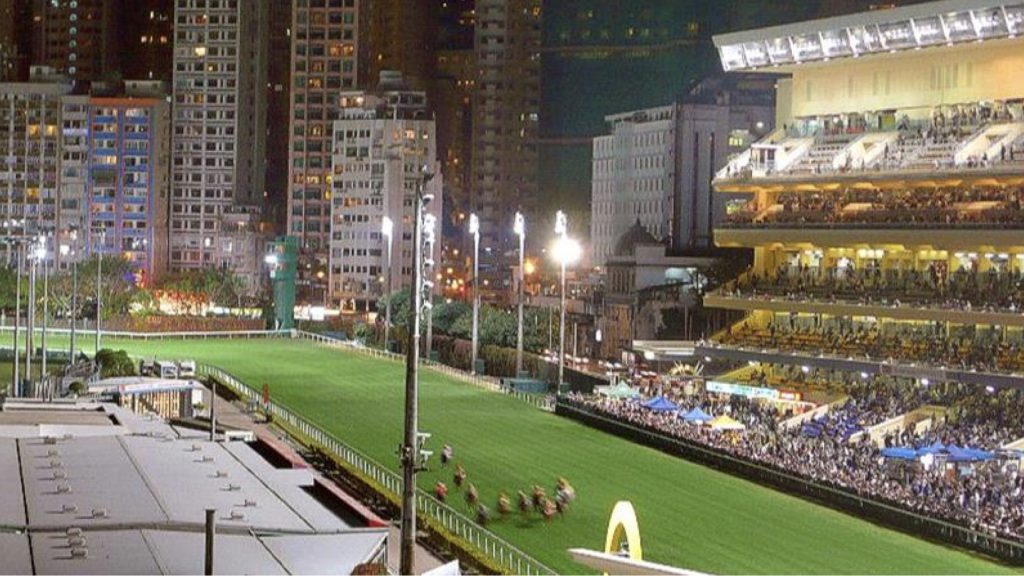

The Asian jurisdiction of Hong Kong was used as a case study, being the region with the highest rate of Betting Duty, at 75 percent of GGR.

At the same time, the estimated illegal betting market in Hong Kong was said to be some $1.91 billion or $257 per head of population.

This was considerably higher when compared to illegal markets per head of population with correspondingly lower Betting Duty rates, such as $61 in Singapore (25 percent Betting Duty), $59 per head in South Africa (6.5 percent), $30 in Australia (10 to 20 percent), and $11.44 in the USA (6.75 to 51 percent).

The Chairman of the Council on Anti-illegal Betting & related financial crime for the Asian Racing Federation (ARF), Martin Purbrick, recently discussed the scope of illegal betting in Asia in an interview with AGB.

The report also points out that there is some similarity between the Hong Kong-Macau situation and the New York-New Jersey situation in regard to how betting tax and resultant pricing can impact customers migrating across boundaries to an alternative jurisdiction.

‘The tax rate on sports betting in Macau is 25 percent of GGR, and the tax rate on horse racing betting is up to 10 percent of the amount wagered. […] sports betting prices (odds) offered in Macau are around 2.25 percent more attractive (i.e. lower prices) than in Hong Kong, indicating that the Betting Duty rate of only 25 percent in Macau has an impact on prices’

The report argues that there are clear indicators of an inverse relationship between betting tax and legal betting revenue, and that when betting tax increases, legal betting

revenue decreases.

‘This is because it is almost inevitable that the operator will have to pass on tax increases to customers due to pressure on operating costs and hence a significant and potentially catastrophic decline in profit margin,’ the ARF report notes.

At the same time, Higher Betting Duty rates were said to also have increasingly less impact on consumer protection as raising rates has the impact of migrating customers from the more expensive legal to the less expensive illegal betting market, where there are no player protection measures.