Macau’s 4Q21 GGR and EBITDA are not expected to vary significantly from the previous quarter, with the rise in mass gaming revenues offset by the closure of junket rooms from December.

The fourth quarter started with muted performance in October due to an outbreak of Covid-19 in Macau. Chinese Golden Week, traditionally one of the busiest holiday periods for Macau’s gaming concessionaires, this holidays instead saw tightened travel restrictions and limited visitation.

The situation began to improve in November, with visitation quickly reaching back to regular (post-pandemic) levels by the end of October.

However, the arrest of junket boss Alvin Chau in December and the subsequent closure of junket operations in a number of casinos saw Macau’s gross gaming revenue fall 12 percent week on week on the second week of December – dragged by lower visitation and drop in VIP revenue, according to channel checks from Bernstein Research.

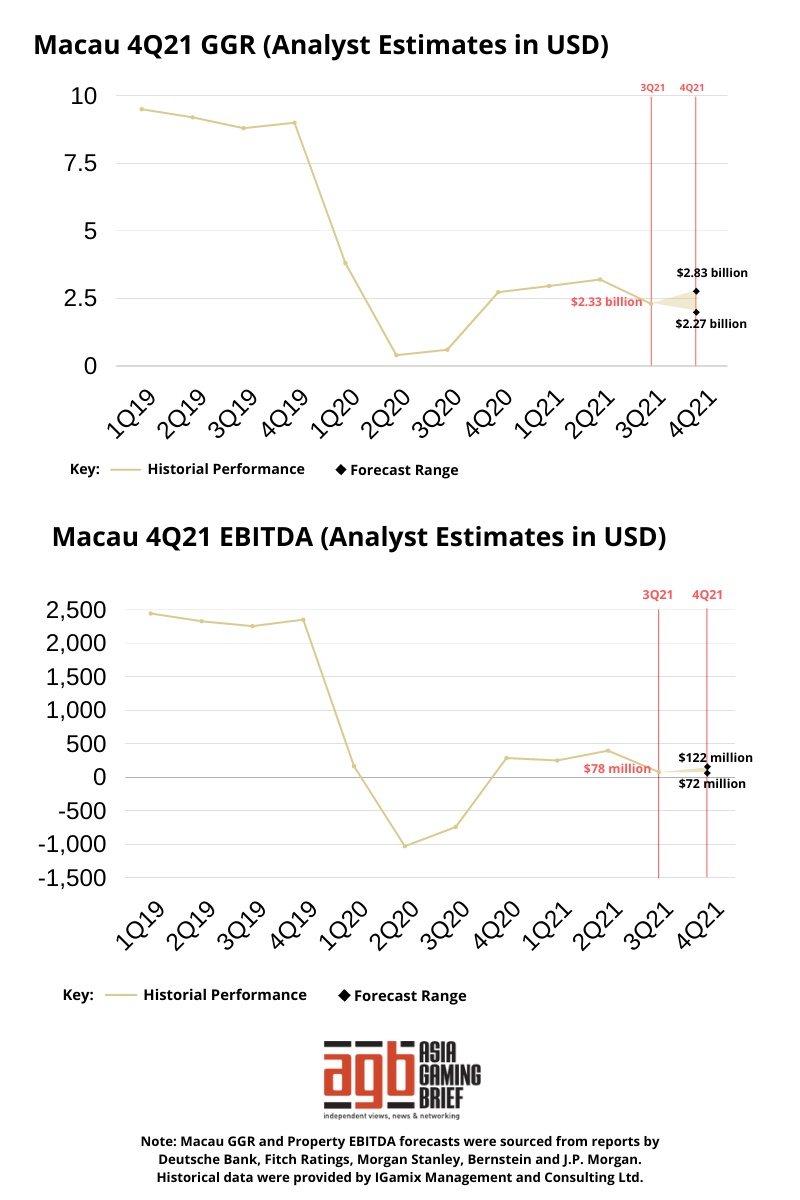

In this week’s infographic, we compile the forecasts from Macau gaming analysts including J.P. Morgan, Bernstein, Deutsche Bank, Fitch Ratings, and Morgan Stanley about what they expect Macau GGR and property EBITDA to reach by the end of the fourth quarter of 2021.

Our quarterly GGR numbers are taken from the Gaming Inspection and Coordination Bureau numbers, converted to $USD.

Our quarterly property EBITDA numbers are taken from analyst reports and are not luck-adjusted.

Looking into 2022, it is not fully known what the impact Macau’s junket closures will have on the market, particularly how it will impact the premium mass segment.

Time will also tell whether the new Omicron strain of Covid-19 will impact the opening of Macau’s borders – seen as key to recovery for Macau’s six gaming concessionaires.

Earlier this month, Trip.com chairman James Liang said he predicted Asia’s borders to begin reopening in March, and for Mainland China to do the same around June.