Las Vegas Sands 3Q22 EBITDA US$158 mln loss was broadly in line with estimates with Macau reopening still dependent on China’s COVID policy, a note from Jefferies read.

Management expects strong pent-up premium-mass-driven recovery, but timing remains unclear as the rapid China quarantine lockdown policy continues to deter overseas travel, a view shared by Jefferies.

The brokerage remains optimistic about the eventual recovery in Macau, but the exact timing remains unclear.

Jefferies noted the key points from the conference call, namely:

- License renewal will be concluded by year-end, in line with expectations.

- Sands expects strong pent-up demand once Macau is fully open without travel restrictions with recovery led by Premium mass.

- Current visitation hails mainly from Guangdong province with China’s COVID policy impacting non-Guangdong visitors.

- Group tours and e-visa are still expected to be reinstated by the end of October or early November.

Performance

Sands 3Q22 hold-adjusted EBITDA loss of -US$158 mln was broadly in line and mid-point between Jefferies’ forecasts of -US$145 mn and the consensus, at -US$175 mln.

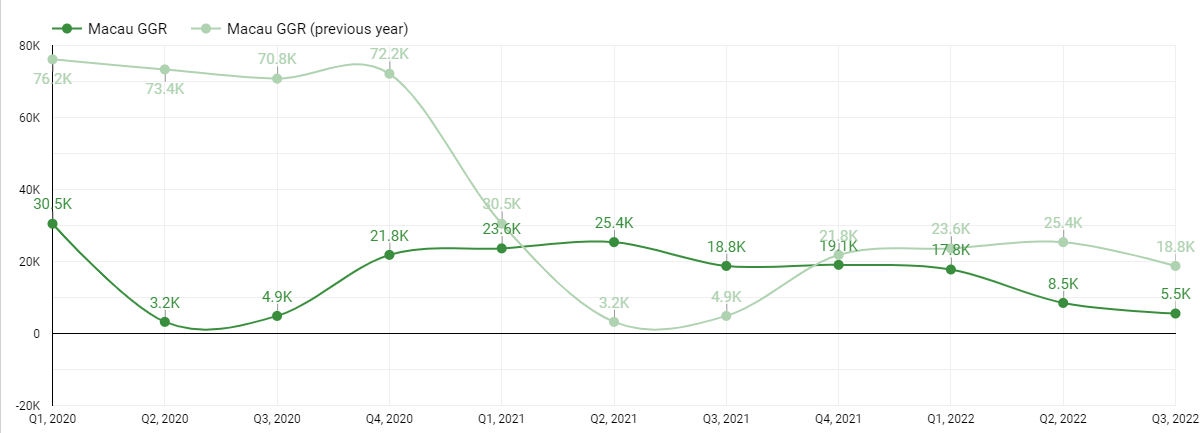

Quarterly EBITDA loss continued to increase q-q from -US$18 mln in 1Q22, -US$123 mn in 2Q22 with larger 3Q loss already expected given 3Q22 GGR declined -35% q-q to only MOP60M/day, the brokerage noted.

Jefferies underlined that amongst the property portfolio, The Plaza (Four Seasons) remains the only EBITDA positive property, with Venetian and Parisian reporting the largest losses (-US$37 mln each).

Unattractive

The quarantine period for non-Mainland China inbound tourists continues to ease but still includes seven days of medical observation, which means Macau is still an unattractive overseas destination, Jefferies argues.

The potential resumption of group package tours, and potential e-visas under IVS (Individual Visit Scheme), is slated for end-October or early-November, but no further timing details have been offered, Jefferies underlines.

E-visa are more important given history suggests that IVS players are among the highest value players in Macau, while package tours are focused on shopping and eating, the brokerage notes.

Local China confirmed COVID infection cases in the past week ranged between 200-400, which we expect will mean the immediate China quarantine lockdown policy is unlikely to change given China’s COVID policy.

Jefferies tweaked its Macau gaming revenue assumptions with 2022 GGR at 14 percent pre-pandemic levels, but lower 2023 and 2024 GGR to 41% and 71% of pre-pandemic levels to MOP328M/day and MOP568M/day (previously 45% and 73%).