Despite draconian curfews, never-ending lockdowns, and unabating travel bans that characterized much of the last two years, the Covid-19 pandemic appears to have done little to dampen the enthusiasm of racegoers and punters, with data showing that the racing industry was insulated from the pandemic.

Last month, the Hong Kong Jockey Club managed to set a turnover record at its Lunar New Year Race at Sha Tin – this was despite the racecourse being closed to the public, allowing only race officials, jockeys, and key staff to be present. It follows a record turnover year for the jockey club in 2020-2021, with a 27.9 percent rise in turnover in the year to HK$279.7 billion (US$35.8 billion).

Part of this is due to HKJC’s industry’s first “Racing”.

Part of this was due to the Hong Kong Jockey Club creating the industry’s first “Racing Bubble”, which barred spectators from entering racecourses, allowing only trainers, jockeys, racing staff, and racing officials – all of whom had to undergo frequent testing and strict hygiene measures. As a result, not a single race was canceled during their 2021 financial year.

Another reason, according to the HKJC was commingling agreements (taking bets from international partners) which increased by around 15 percent in 2020.

“Without this flexibility for the licensed betting operator to collaborate with international partners through Commingling of bets on racing, the pandemic would have resulted in a significant decline in racing betting revenue.”

This was, in addition to being able to successfully migrate its customers to digital platforms throughout the pandemic.

Across the water, Asia’s largest gambling hub for land-based casinos has not been able to tout a similar success story. Without the ability to offer remote gambling, in the same way as the Hong Kong Jockey Club, GGR saw a sharp drop in the two years since the start of the pandemic.

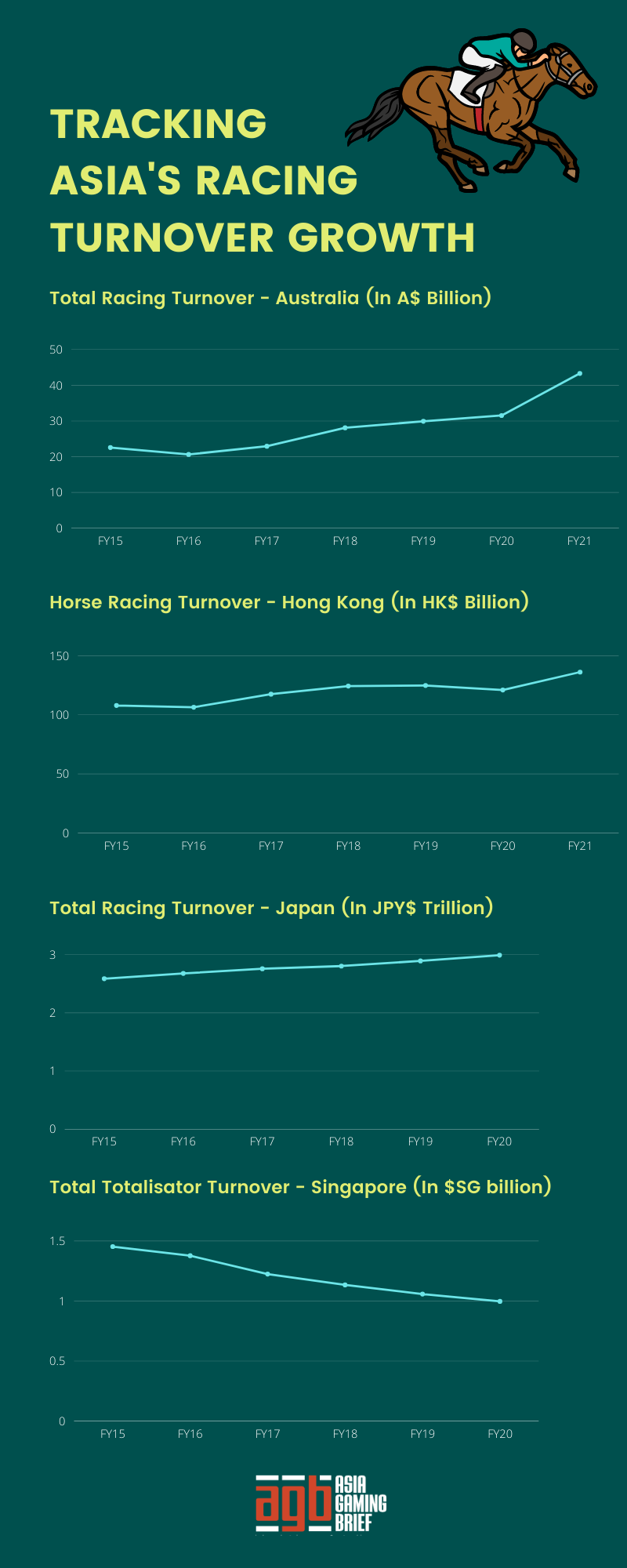

A similar story can be seen in Australia – a country with one of the highest gambling spend per capita in the world. In 2020, racing, including greyhound racing, was one of the last organized sports still operating even after shutdown rules were put in place. Australia’s total racing turnover, including thoroughbred racing, harness racing, and greyhound racing, hit a record high in the 2021 financial year, reaching A$43 billion (US$31 billion).

On the land-based casino side, three major casino operators, Crown Resorts, The Star Entertainment Group and SkyCity Entertainment Group instead noted a significant impact to its earnings during 1HFY22 as a result of Covid-19 related shutdowns.

In late 2020, a study from the Australian Government titled “Gambling in Australia during Covid-19” found that the percentage of people gambling on racing products increased during the pandemic, particularly those that may have already been racing punters before the pandemic hit.

It reported not only an increase in spending but also a significant increase in the frequency of all gambling during the pandemic, with the proportion of participants gambling at least once a week going up from 79 percent to 83 percent. In a time when land-based casinos were closed, that meant that all the business went to online wagering and gaming.

It remains to be seen what the impact of the pandemic has had on racing turnover in Japan and Singapore however, as results for the 2021 race calendar have not been made available yet, however, data from Australia and Hong Kong seem to point to Covid-19 restrictions having no negative impact on racing turnover.