The year 2023 was undoubtedly a significant rebound time for Asian gaming. In this week’s Under the Scope, IGamiX Managing Partner Ben Lee takes a look at three top Asian gaming hubs: Macau, the Philippines and Singapore – seeing which operators gained most and which lost out as demographics, legislation and visitation shifted.

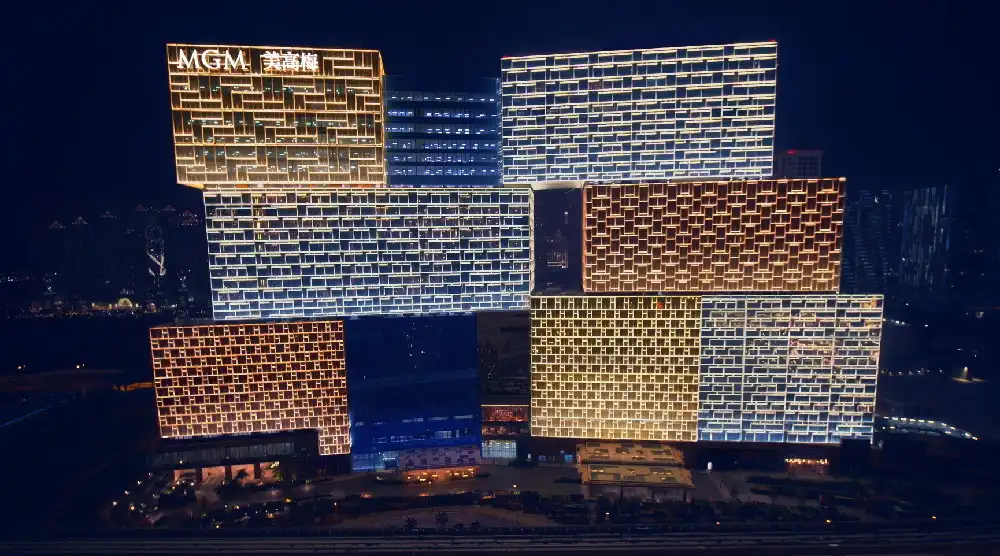

Macau: MGM wins big as SJM and Galaxy lose market share

Due to the prolonged COVID measures in place in Macau, Hong Kong and China, the territory was one of the slowest to rebound, with measures only lifted in January of 2023, corresponding with the new six gaming licenses for Macau’s operators.

Under the new licenses, MGM China stood out as the clear winner in regards to its market share increase.

Pulling from IGamiX’s recently released estimates (for November 2023), MGM China gained some 6.5 percent in market share when compared to November of 2019 – for a total of 16.5 percent.

While still shy of the 24.5 percent market share held by Sands China in November 2023, and the 19.5 percent seen by Galaxy Entertainment Group, the increase from approximately 550 tables MGM China had in 2019 and the 750 tables it started the year with (under its new gaming license), MGM was able to pilfer market share – primarily from Galaxy and SJM.

Both operators had focused heavily on “the VIP segment that is now gone”, notes Lee, as Macau mandated that operators move to a mass market model.

Market share

- Sands China – Nov. 2019: 24 percent; Nov. 2023: 24.5 percent

- Galaxy – Nov. 2019: 19.5 percent; Nov. 2023: 16.5 percent

- MGM China – Nov. 2019: 10 percent; Nov. 2023: 16.5 percent

- SJM – Nov. 2019: 16.5 percent; Nov. 2023: 13 percent

- Melco – Nov. 2019: 16.5 percent; Nov. 2023: 15.5 percent

- Wynn – Nov. 2019: 13.5 percent; Nov. 2023: 14 percent

Philippines: Newport wins big, Okada falls

“The Philippines has been on a tear since the beginning of the year,” notes Lee, but particularly the “fantastic growth seen in Manila peaked in September,” with the last quarter results all seeing negative yearly comparisons.

That being said, compared to pre-pandemic levels, data indicate that Newport World Resorts achieved the highest growth in market share, while Okada Manila lost out.

Newport grew from a 16 percent market share of gross gaming revenue in December 2019 to nearly 28.7 percent, while Okada Manila shrank from a 32.7 percent market share to just 21.1 percent.

Market share

- Newport World Resorts – Dec. 2019: 16 percent; Dec. 2023: 28.7 percent

- Solaire – Dec. 2019: 28.8 percent; Dec. 2023: 28.5 percent

- Okada Manila – Dec. 2019: 32.7 percent; Dec. 2023: 21.25 percent

- City of Dreams Manila – Dec. 2019: 22.5 percent; Dec. 2023: 21.1 percent

IGamiX’s Managing Partner notes that the domestic market is fueling Entertainment City, ending the year with GGR growth of 24 percent yearly “with most of that coming from mass tables and slots”, as the “biggest loss in December was from the local VIPs”, with GGR falling in the “mid-single digits”.

Despite the growth of Clark, Lee notes that it “hasn’t taken much share from Manila” so far.

Singapore: Marina Bay Sands clear market leader

The results seen over the course of 2023 in Singapore merely served to reaffirm Marina Bay Sands’ position as the market leader in the duopoly – by a long shot.

In 2019, MBS held 70 percent of the market share, notes Lee, as the group brought in some $2.45 billion in GGR (compared to a 2019 result of $2.72 billion).

MBS’ market share shifted to 76.3 percent in 2023, as Resorts World Sentosa’s FY23 GGR fell to just $875 million (compared to a 2019 result of $1.18 billion).

The addition of new hotel rooms, currently in the pipeline, could cause a slight shift in the balance, but is unlikely to change the status quo.

Keeping an eye on Vietnam, as Thailand poses a threat

Continuing to look at Southeast Asia, Lee notes that there is growth potential, but also a significant possibility of cannibalization, with all eyes on the possibility that Thailand will quickly push through casino legislation. This would be a particular threat to Vietnam.

“The Vietnamese gaming market is currently slumbering. It has the potential to do much better however there are some regulatory overhangs still in place that have proven to be stumbling blocks to the growth of the industry,” notes Lee.

“If Thailand unleashes the Kraken there, they could well render Vietnam’s nascent IRs (integrated resorts) stillborn,” points out the expert.

Despite political maneuvering, Thailand could possibly move forward with casino legislation within this year, paving the way to open a casino before Japan’s Osaka IR comes online. Given the strong local propensity for gambling, and the country’s reputation as a hotspot for Chinese tourism, alongside overall interest to visit new and shiny IRs, legalized gambling in the nation is likely to cause a ripple effect across most Asian gaming jurisdictions – causing operators who don’t explore a chance to set up shop in the country to reevaluate their tactics.