Macau’s VIP baccarat gross gaming revenue (GGR) grew by 68 percent year-on-year in the first quarter, according to government data.

The rate of VIP annual increase aligns with the 69 percent year-on-year growth recorded for mass-segment baccarat GGR, according to the city’s regulator, the Gaming Inspection and Coordination Bureau, also known as DICJ.

The first-quarter aggregate VIP GGR was slightly below MOP14.38 billion ($1.78 billion), compared to MOP8.57 billion ($1.06 billion) a year earlier. VIP baccarat revenue as a proportion of all casino GGR in the first quarter stood at 25 percent.

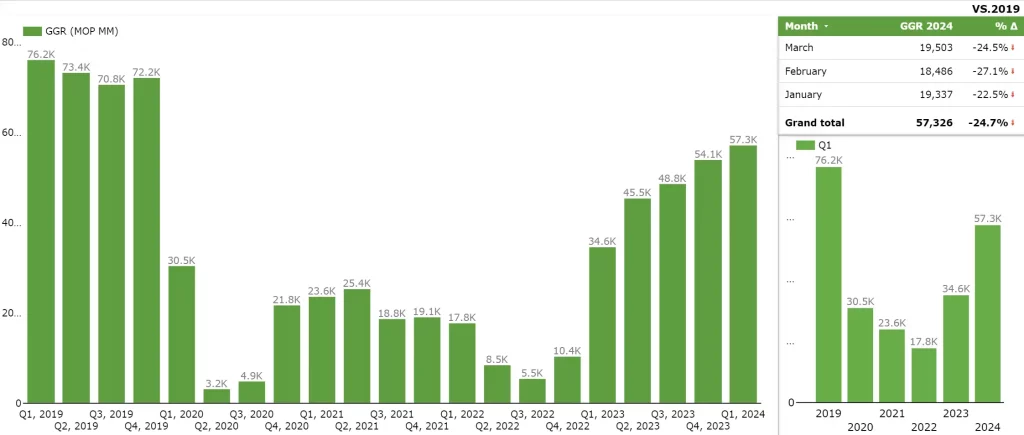

The aggregate of Macau casino GGR for the first quarter of 2024 stood at MOP57.33 billion ($7.11 billion), which includes other gaming activities such as horse racing and lottery. The market-wide GGR stood at MOP57.5 billion ($7.13 billion) in the first quarter of the year.

According to official data released on Tuesday, GGR from slot machines was just under MOP3.22 billion ($399 million) in the first quarter, up 31.5 percent from MOP2.48 billion ($304 million) in the first quarter of 2023.

The number of live-dealer gaming tables in the Macau market stood at 6,000 in the first quarter this year, the same as the previous year.

The number of slot machines in the Macau market also remained at 12,000 in the first quarter compared to 2023.

1Q GGR outpacing seasonality

Commenting on the GGR results, the investment bank Goldman Sachs notes that 1Q24 GGR grew 6 percent quarter-to-quarter, ‘outpacing historical seasonality driven by ongoing visitation recovery’.

Analysts indicate that, after posting 11 percent quarter-to-quarter growth in 4Q23, Macau’s GGR growth moderated to 6% sequentially in 1Q24, tracking at 75 percent of pre-COVID19 levels.

‘Looking back in history, we note that 1Q GGR tended to be fairly steady quarter-to-quarter with fewer travelers post the CNY holidays. The stronger momentum this year was driven by further cyclical recovery in Macau’s daily visitation from 86-95k in 4Q23 to 92-114k in Jan-Feb, almost fully back to pre-COVID19 levels.’

By segment, discussions with casino operators and industry participants suggest resilient mass-market GGR again led by the premium mass segment, while VIP GGR might have been dragged by lower win rate in February.

‘Against the slowdown in luxury spending in China, Macau’s tenant sales held up well, although non-gaming revenue of select operators may have retreated due to seasonality and accounting treatment.’

MGM, Wynn and SJM gained GGR market share

Goldman Sachs notes that MGM, Wynn, and SJM gained GGR market share at the expense of Sands, Melco, and Galaxy, indicating that MGM China’s strong performance this quarter ‘would not be a surprise’ since the company had highlighted at its 4Q23 results call back in February that its GGR market share surged from 16.3 percent in 4Q23 to 20 percent in January, benefiting from the Bruno Mars concert.

Although MGM’s share had normalized to 15.5-16 percent in February-March, it still grew its GGR share by 0.7 percentage points quarter-to-quarter to reach a 17 percent share in 1Q24.

Similarly, Wynn Macau increased its share by 0.4 percentage points quarter-to-quarter to reach 14 percent. This reflects that the GGR recovery remained premium rather than grind mass led year-to-date, to which both MGM and Wynn are more exposed.

The brokerage points out that SJM has also performed better after adopting its “One SJM” strategy, capturing an additional 0.4 percentage points of GGR share to reach 12.5 percent, by making better use of its spare hotel rooms at Grand Lisboa Palace for players at its other casinos.