Any lingering hope that Macau was exempt from China’s crackdown on its citizens crossing overseas to gamble has now been dashed, with the local government urging operators to look elsewhere for their clientele.

In mid-May, China’s National Immigration Administration boasted significant success in stamping out illegal cross-border gambling. Since 2021, it said it has identified more than 90,000 people who had been suspected of attempting to leave the country to gamble and “persuading” them to remain in the country.

Amendments under Article 303 of China’s Criminal Law came into effect in March last year, giving teeth to Beijing’s effort to stem a flood of capital out of the country into the region’s casinos. It is now a crime punishable by up to 10 years in jail to organize or seek to entice Chinese to gamble.

The day following the National Immigration Authority’s statement, Macau legislators said the city’s six operators need to look elsewhere for their customers.

They are now proposing a reduction of 5 percent in tax for operators can bring in tourists from outside of China. However, that proposal has come with a sting in its tail in the form of a 1 percentage point increase overall to 40 percent.

Chan Chak Mo, the chairman of a legislative committee evaluating amendments to Macau’s gaming law, told local media that the city has to diversify its tourism base due to China’s ongoing crackdown on cross-border gambling.

“Before, almost 80 percent of gamblers and tourists came from mainland China, 10 percent from Hong Kong and five percent from Taiwan. But we also used to have more tourists from Thailand, South Korea and Japan,” he was cited as saying.

“Considering the changes in the Chinese gaming criminal law, maybe we need to explore other markets, that’s why the government changed this article, to try and attract more foreign clients,” Chan added.

It was the most direct acknowledgment so far that Macau’s status as a Special Administrative Region of China doesn’t exempt it from China’s cross-border gambling crosshairs.

In fact, up until recently, many commentators had argued that Macau may actually benefit as it is technically part of China.

However, analysts are now noting that frequent gamblers are being denied visas to visit Macau and business travelers who cross the border frequently are facing more stringent checks.

In the short term, there is no possibility for Macau to attract gamblers from elsewhere. The borders remain closed to all non-residents from outside the Greater China region and the government has reiterated that it will continue pursuing a zero-Covid policy in lockstep with Beijing.

Before the spread of the Omicron variant earlier this year, there had been hope that the borders between Hong Kong and China would be opening imminently, shortly followed by those with Macau.

There is now no visibility as to when talks on an opening may resume. Hong Kong has historically accounted for about 20 percent of Macau’s gross gambling revenue and the return of visitors from the city would provide a significant boost.

Even when borders do reopen, Macau is likely to face an uphill battle to diversify its tourism base. Although its integrated resorts, food and beverage, and retail offerings are world-class, they cater predominantly for the Mainland Chinese market. There is also stiff competition from cheaper destinations around the region.

Analysts at J.P. Morgan have estimated that if the Macau government does follow through and cuts its tax rate by five percentage points, there would be a boost of between 12 and 15 percent to the operators’ EBITDA.

“Any reduction in tax would be positive for future profits and cash flows, all else equal,” the analysts wrote “While it’s much too early to comment on the possibility of this happening – especially considering likely preconditions for this tax cut – we think ‘it’s always the thought that counts’ when it comes to regulation.”

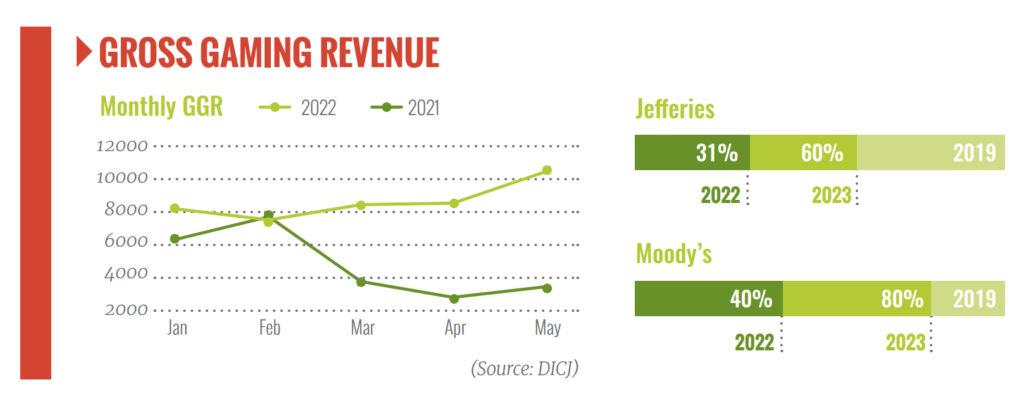

In the meantime, predictions for when the Macau market will recover are being pushed out, with doubts gross gambling revenue will ever return to pre-pandemic levels due to the collapse of the junket model and the subsequent loss of the VIP gamer.

Moody’s has lowered its forecasts for the city’s mass-market GGR in 2022 and 2023 to around 40 percent and 80 percent of 2019 levels, respectively. It doesn’t expect a full mass-market GGR recovery until 2024.

Satellites get lifeline under gaming law amendment

Macau’s draft gaming law has been amended to help satellite casinos, which will now be able to operate for longer than the original three-year transition period, but without revenue sharing. The original version of the law stated that all satellite casinos must be operating out of property owned by one of the six concessionaires.

They were given the three-year timetable to comply. It was one of the most contentious areas of the gaming law, due to the potential impact on employment in Macau were they to cease to do business.

There are about 18 satellite casinos in Macau, out of a total of 40. Though some have already announced plans to close since the gaming law was published at the beginning of this year.

The new version states that even if the property where the casino is based is not owned by the concessionaire, it can continue operating as a managing entity if a contract is established with the operator.

Apex court confirms operators and junkets jointly liable

The Court of Final Appeal ruled in mid-May that operators and junkets are jointly liable for client deposits in all nine cases presented before the court. Eight of the cases related to Wynn Resorts and Dore, while one related to MGM China and Suncity, the court said in a press release.

The plaintiffs were all members of the VIP rooms of the two junket operators and the amount claimed ranges between HK$1 million to $6 million. After attempts to get the cashback were rejected by the junkets, the plaintiffs filed a lawsuit in the lower courts requesting that the operator be made jointly liable.

The nine cases have been appealed to the higher court where “ the collegial panel held that the gaming concessionaire must be jointly and severally liable to the third party for the debts incurred by the gaming licensee in relation to the activities carried out by its gaming promoters in its entertainment venues,” it said.