Until a few years ago, Macau’s junket kingpins were considered potential candidates for a new generation of gambling kings. However, the story is heading towards a bad ending.

The crackdowns from authorities seem endless, leading the market survivors to lose hope.

Speaking to AGB, Junket Association head Kwok Chi Chung laments the recent government legislative proposal to ban the city’s licensed junkets from issuing credit to casino gamblers.

In mid-December, the Macau government proposed amending a draft bill titled “Legal Regime of Credit Concession for Gambling in Casinos.” The amendment suggests that junkets, officially known as gaming promoters, would no longer be allowed to have a credit-supply role.

Kwok notes that, from a risk management perspective, gaming promoters have a “conservative” attitude towards issuing gaming credit. “Since the junkets have no right to share the gaming revenue, they will never have the same criteria to give gaming credit as in the past.”

Pushing away VIP players

U Io Hung, the president of the Macau Professional Association of Gaming Promoters, was surprised by the ban decision, emphasizing that junkets hadn’t been consulted before the government’s U-turn.

U believes that the current situation will drive high-value VIP players away to Southeast Asian casinos, as Macau’s offerings are losing their appeal.

His inference aligns with industry observations. In an academic paper titled “Death of a Salesman? The New Junket Regulation and Practice in Macau” from last year, it was indicated that amid challenging circumstances, some Macau-based junkets have gradually relocated their business operations, along with their players, to small-scale casinos in Southeast Asia.

Much-diminished sector

The total change will further squeeze the survival space for the already much-diminished sector.

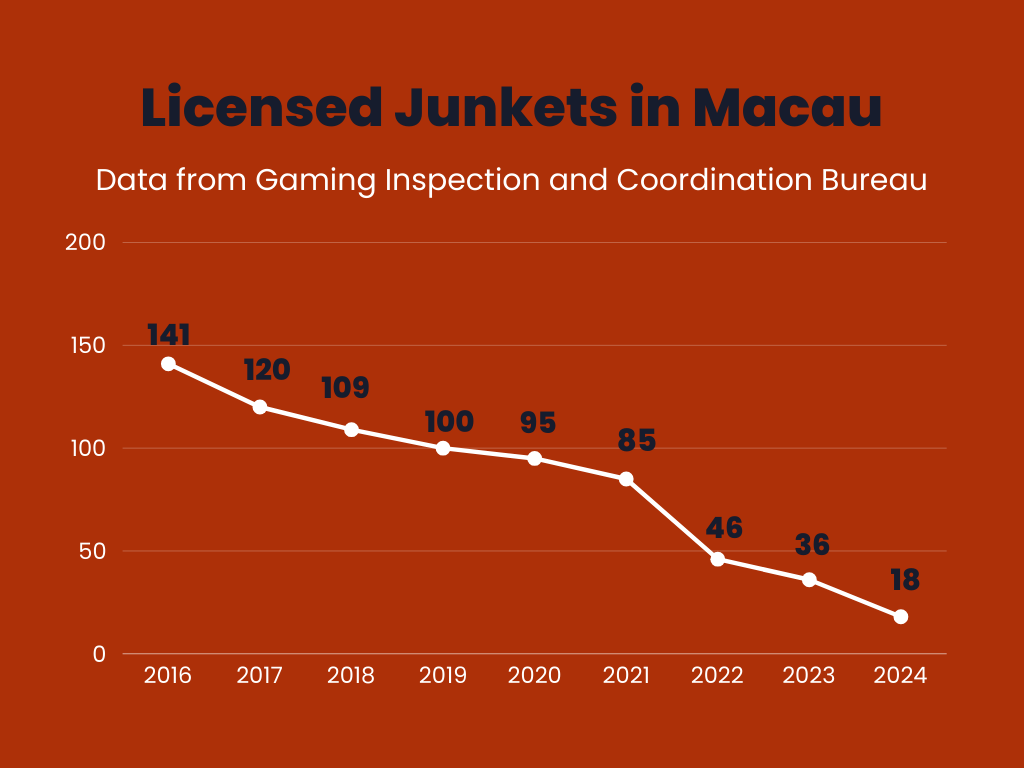

According to recently released statistical data, the number of licensed junkets in Macau has experienced a drastic halving, plummeting to half of its previous level (36) and now standing at only 18.

Macau’s junket sector has witnessed a 92 percent decline over the past decade. In 2014, when Macau’s casinos reached their peak with gaming revenue exceeding $45 billion – three times that of Las Vegas, there were 235 registered junket operators – contributing around 60 percent of the city’s casino revenues.

The Macau gaming regulator has set a cap of 50 junket licensees for 2024 and a cap of 250 junket collaborators or intermediaries.

According to the law, each Macau junket is permitted to partner with a single gaming concessionaire. Junket operators can earn a commission, capped at 1.25 percent of rolling chip turnover, for their gaming promotion services but are prohibited from sharing casino revenue with the casino concessionaire they work with.

Additionally, junket licensees are currently obligated to pay a 5 percent tax on their rolling chip commissions, with no exemptions. The reintroduction of the commission tax on gaming promoters could be interpreted as a sign that Macau is attempting to discourage the expansion of the junket business.

This policy direction is also in line with the territory’s current priority of developing into a family-friendly and business-ready destination.

Junkets’ contribution to GGR

Since junkets were excluded from sharing in gaming revenue, calculating the revenue generated by junkets in the city has become more challenging.

Macau’s casino GGR reached MOP183.05 billion ($22.68 billion) in 2023, with VIP baccarat contributing MOP45.2 billion ($5.6 billion). This equates to nearly 25 percent of Macau’s total GGR coming from the VIP segment.

However, the VIP rooms directly operated by gaming operators are the mainstream. There is no official statistical service to indicate the percentage of GGR contributed by the junket business in the VIP segment. Kwok Chi Chung confessed that he didn’t know the concrete number either, but he knew that the junket’s proportion was “very small.”

Pending criminalization of illicit money exchange

Macau police authorities are studying the possibilities of criminalizing illicit money exchange in the Asian gaming hub; however, as of now there has been no formal draft bill presented by the government.

Kwok indicates that the criminalization move would have a more significant impact on the mass market than on the VIP segment.

Regardless, the junket representative believes that the general impact of the crackdown on money changers in the city is still unclear, as there is no accurate data regarding the dimensions of the business.