Macau gaming operator Galaxy Entertainment Group (GEG) has bolstered its marketing team amidst intensifying competition in the high-end premium mass segment, says Goldman Sachs.

According to the equity research released on Monday after hosting an investor tour in Macau, Goldman Sachs notes that Galaxy Entertainment tripled the marketing team from 100 to 300 hosts right before Chinese New Year (CNY), as the operator ‘wants to capture at least 20 percent gross gaming revenue (GGR) market share’ compared to 17.8 percent in 4Q23.

The goal is ‘similar to their comments at the 4Q23 results calls, casino operators all mentioned that market recovery year-to-date is still led by premium mass,’ it explains.

Speaking to the research team, Galaxy management has highlighted three key factors that include (1) relationships, focusing on the depth of understanding marketing hosts have with their customers; (2) packages, involving the provision of various rebates and incentives; and (3) products, hardware such as luxury hotel suites and other amenities.

‘They still believe their products are highly competitive, especially with the addition of Raffles, Andaz, and GICC at Galaxy Macau Phase 3.’

However, Galaxy also acknowledged that they have not paid enough attention to relationships and packages. The expansion of the marketing team aimed to improve the problem. In this context, Galaxy started offering more competitive packages (e.g., reinvestment rates increased by up to 25 percent) for the high-end premium mass players, placing itself on a more level.

SJM has also expanded its marketing team from originally 12 to about 100 people as of late, with a target to bring it up further to 200, in line with MGM and Wynn.

However, ‘Sands and Wynn are still refraining from turning overly aggressive. Sands still sees investing capex to upgrade its hardware or products as a better long-term approach to stay competitive.’

Goldman Sachs indicates that in theory, those turning more aggressive by increasing their investment rates may see some margin pressure in their upcoming results, although this would also depend on the effectiveness of their marketing efforts and actual GGR share shift.

In a summarized market watch, the investment bank concludes that Macau’s visitation and gaming demand ‘appear more resilient than anticipated’, while operators such as MGM and Melco indicated that the sharp pullback of weekly GGR recorded after the CNY holidays might have been distorted by luck factor and the pace of their underlying volume slowdown was no worse than the typical post-CNY seasonality.

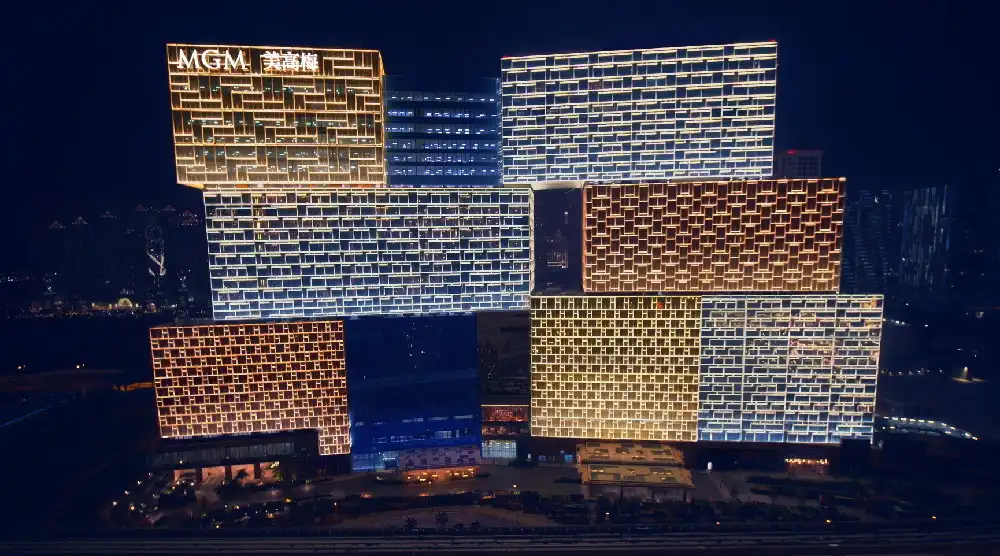

MGM’s market share normalized

The same research also finds that after recording a very strong performance in January, with 20 percent of GGR market share versus 16.3 percent in 4Q23, benefiting from the Bruno Mars concert and other events, ‘MGM China’s GGR share has normalized to mid-teen % – a level which the company believes it can maintain, supported by its 13 percent/6 percent table count and hotel room shares’.

Correspondingly, Galaxy has gained back some market share to 18-19 percent after stepping up its promotional efforts as mentioned above and also without the disruption of renovation work at its gaming floors, which had been completed right before the CNY holidays.

Melco also updated that its market share has bounced back to the 4Q23 level of 14.7 percent.