Macau’s premium mass gaming market seems to have made a full recovery, with JP Morgan indicating that premium mass gross gaming revenue (GGR) in August reached 110 percent of 2019 levels.

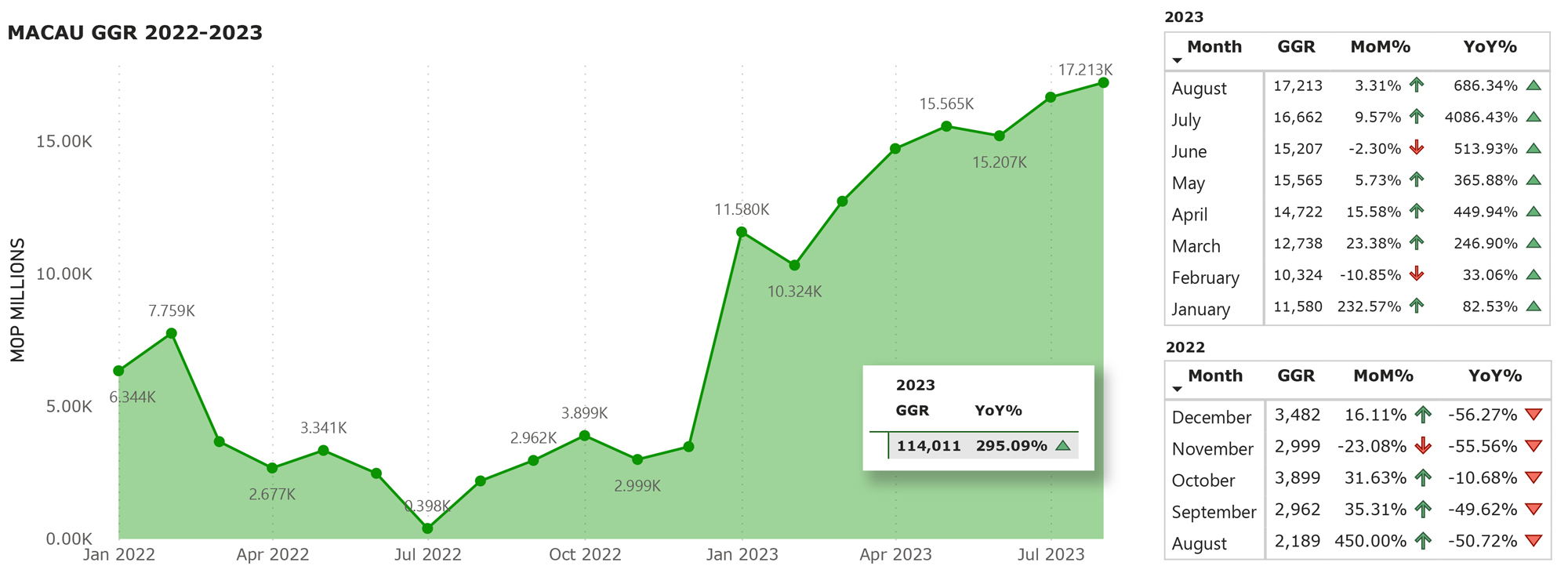

According to comments from the investment bank, after the release of Macau’s August results on Friday, Macau’s GGR increased by 3 percent month-on-month, hitting another post-pandemic high at MOP17.2 billion ($2.1 billion). This implies a daily average of MOP555 million ($68.7 million), which is an improvement over the daily averages of MOP500 million ($61.9 million) in the second quarter of 2023 and MOP537 million ($66.5 million) in July. Macau’s GGR in August recovered to 71 percent of pre-COVID levels.

This data suggests that mass GGR has rebounded to approximately 93-94 percent of pre-COVID levels, with premium mass seeing a 110 percent recovery, while base mass is at 75-80 percent, according to JP Morgan. VIP recovery also increased to 28-29 percent in August, compared to 23-24 percent in the second quarter of 2023.

Much to expect in October Golden Week

Analysts at JP Morgan anticipate that “September GGR isn’t going to impress anyone,” partly due to seasonality and the impact of Super Typhoon Saola. The market’s focus is likely to shift to the upcoming Golden Week, with a very short booking window for Chinese travelers (only a few days) and an even shorter window for Chinese gamblers. It’s noted that “we know that all the rooms at Macau casinos will be sold out, as has historically been the case.”

The Macau Tourism Office (MGTO) has high expectations for visitor arrivals in the second half of 2023, with more public holidays and events scheduled by year-end. This year’s October holiday is expected to be an exceptional “Super Golden Week”, as Chinese authorities have set an extended week for Mid-Autumn and China National Day, providing eight consecutive days off from September 29th to October 6th.

Deutsche Bank forecasts $1.94 billion GGR in September

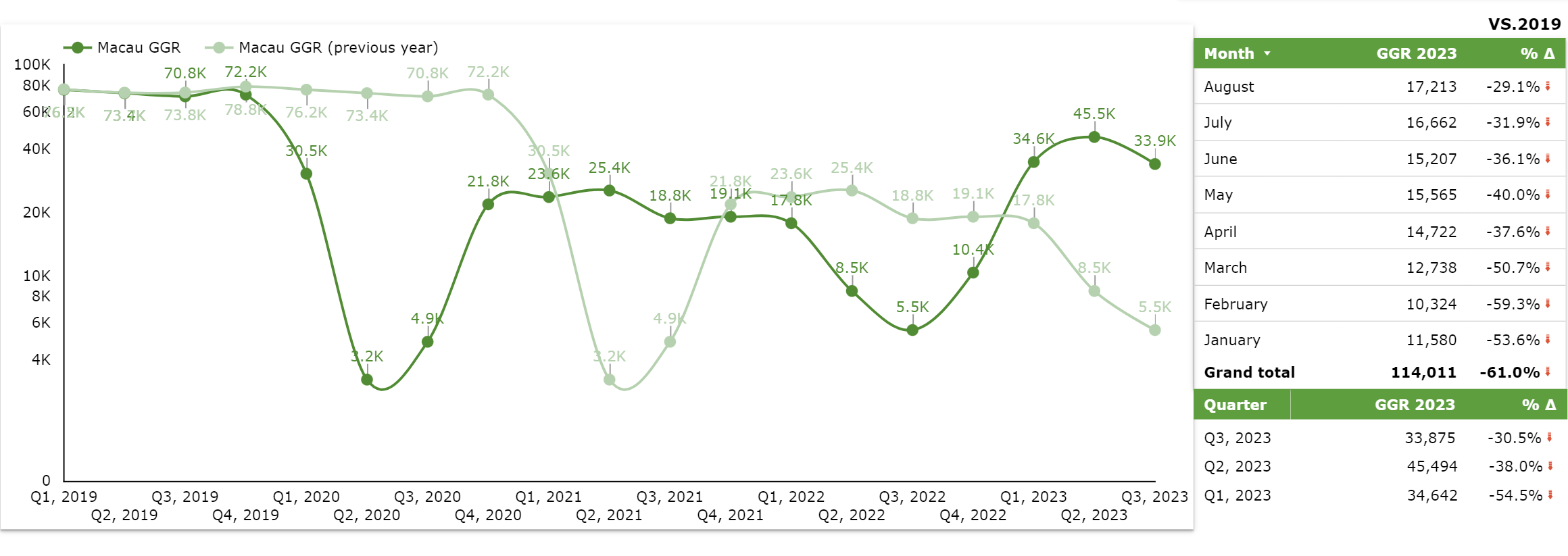

According to Deutsche Bank analyst Carlo Santarelli, Macau’s GGR could reach $1.94 billion in September, representing a 29.8 percent decrease compared to September 2019.

Carlo Santarelli points out that Macau’s August GGR results were still 29.1 percent below August 2019 levels.

GGR for the third quarter of 2023 to date is down by 30.5 percent compared to the same period in the third quarter of 2019, as of August.

Based on the latest data, Deutsche Bank has updated its forecasts for 2023 and 2024, expecting Macau’s GGR to reach $22.7 billion, a 329.3 percent increase compared to 2022. GGR for 2024 is expected to grow by 27.3 percent year-over-year, reaching $28.9 billion.