Digital wallets provide users with a secure and rapid tool, enabling them to access contactless payments easily. This payment option is increasingly being adopted by users as it provides them with the possibility to have their balance in just one place, avoiding the inconveniences of multiple accounts and payment options.

Moreover, e-wallets are considered a much safer method compared to credit and debit cards. According to some investigations a number of factors, which are related to consumer perception about privacy, security and benefits have an important incidence when deciding whether to use this solution.

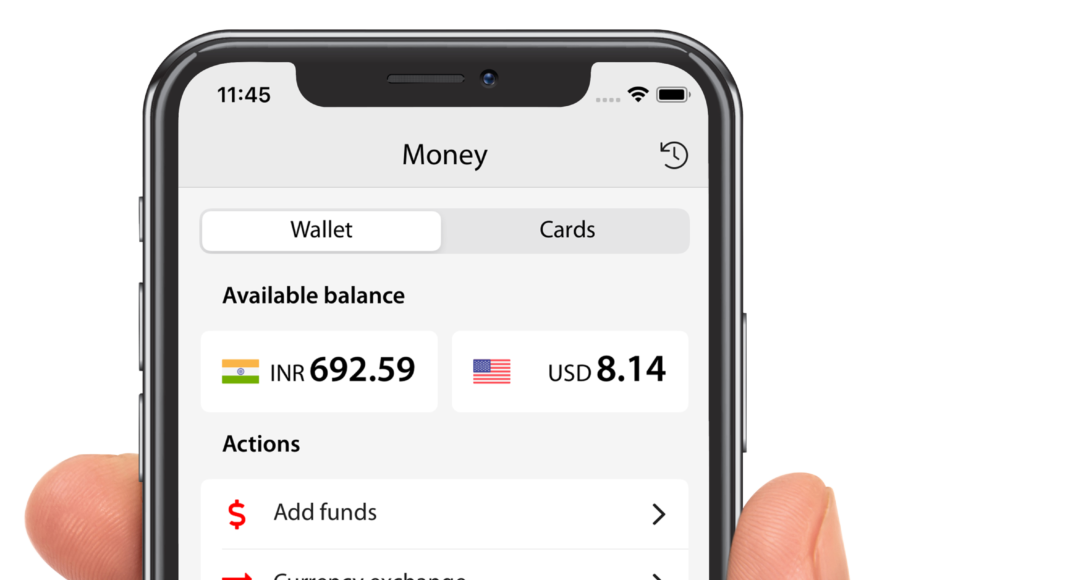

Recently we have launched One Touch, a digital wallet that takes these factors into consideration and offers a variety of benefits: the possibility to identify users from a single code, allowing greater control over the transactions and minimizing risk; the ability to receive deposits with a simple “touch”, with automatic approval for recurring users, which will generate a smoothest interaction between the merchant and its customers; KYC verification and identification control; and a simplified integration process through an auto enrolment channel, with little to no IT intervention required on the merchant side. They also have access to analytics and reports, as well as to fraud alerts that meet the levels of security and compliance that the industry requires.

Our extensive experience in managing the specificities of different markets, allows us to offer an efficient solution to all our customers: merchants, end customers and business partners. We are a B2C company that has been operating in different countries for more than 11 years.