Veteran gaming expert and consultant Niall Murray takes a deep dive into Macau’s shift away from junkets and VIP, possibilities and challenges for MICE and the cancellation of Macau’s horse racing concession.

Drawing from insights from Sheldon Adelson, the consultant analyzes how Macau can make the most of its new normal, leveraging neighboring non-gaming Hengqin to its advantage, even as it strives to find the right mix to meet government expectations and ROI hopes. An added bonus: estimates for Chinese New Year’s impact on February GGR.

We’re joined today by Niall Murray, the chairman of Murray International. Thanks for being with us.

It’s a pleasure to be here. Thank you for giving me the opportunity to join you.

I know that you’re here in Macau as I am, as well. And we’ve seen some interesting things happening over the course of the week with the surprise announcement that the Macau Jockey Club was going to be effectively relinquishing its concession. Did that strike you as a surprise?

The speed with which the decision was made – and it came out of the blue a little bit. But it was something that was bound to happen at one stage, or they were going to be given a warning to improve. I was surprised that it was cut cold turkey like that, as opposed to them being given some more time to, improve … or else. But I think it was another strong and clear message that the government is not messing around. Similar to what they did with the junkets last year. I think it was it was a strong move.

They had until 2042. And, at the end of this quarter, that’s going to be effectively the end of horse racing in Macau. So, the end of an age.

The government is going to have the land revert to them in 2025, by April 1st of 2025, once they’ve managed to send the horses either to mainland China or back to other respective countries. Who stands to gain out of this – aside from the government who’s getting its land back?

I think what’s really great is the Macau government is now retaking control of a really sizable plot of land and it’s in a prime location. It’s quite close to Cotai, which is very convenient. But more importantly, it has very fast and easy access to Hengqin. You notice there’s a new flyover being opened this week, which is coming directly down by the Jockey Club. And there was there was others opened last year.

That makes it very easy to get to either the Lotus Bridge and potentially – if there’s more shuttles introduced between the back of Broadway and Hengqin – these are easy access points, potentially, to Hengqin. So I think that could create a great linkage there.

We talked about speculation and what’s going to happen there. Well, definitely it’s not going to be gaming, in my opinion. There’s some potential for non-gaming amenities, including additional hotel rooms.

There’s also potential for additional residential but I feel that’s unlikely because I think that demand seems to be covered by elsewhere in Taipei, with the new reclaimed land in front of Ocean Gardens etc, and the reclaimed land also under the Public Housing initiatives near the Hong Kong-Macau-Zhuhai bridge – so I don’t think it will be headed for residential use.

I think it’s most likely a great potential space for the plus four (gaming +4) industries for diversification. We still need to have somewhere for the new modern finance and the big health and the high tech and the sports and culture. So, I think they this could be a potential site for either satellite or main offices of those industries that’s linked to their Hengqin equivalents.

So, either the main office is in Hengqin, with a satellite in Macau, or vice versa. But I don’t think it’s going to be used for MICE, because I think MICE will be taken care of by the IRs quite well.

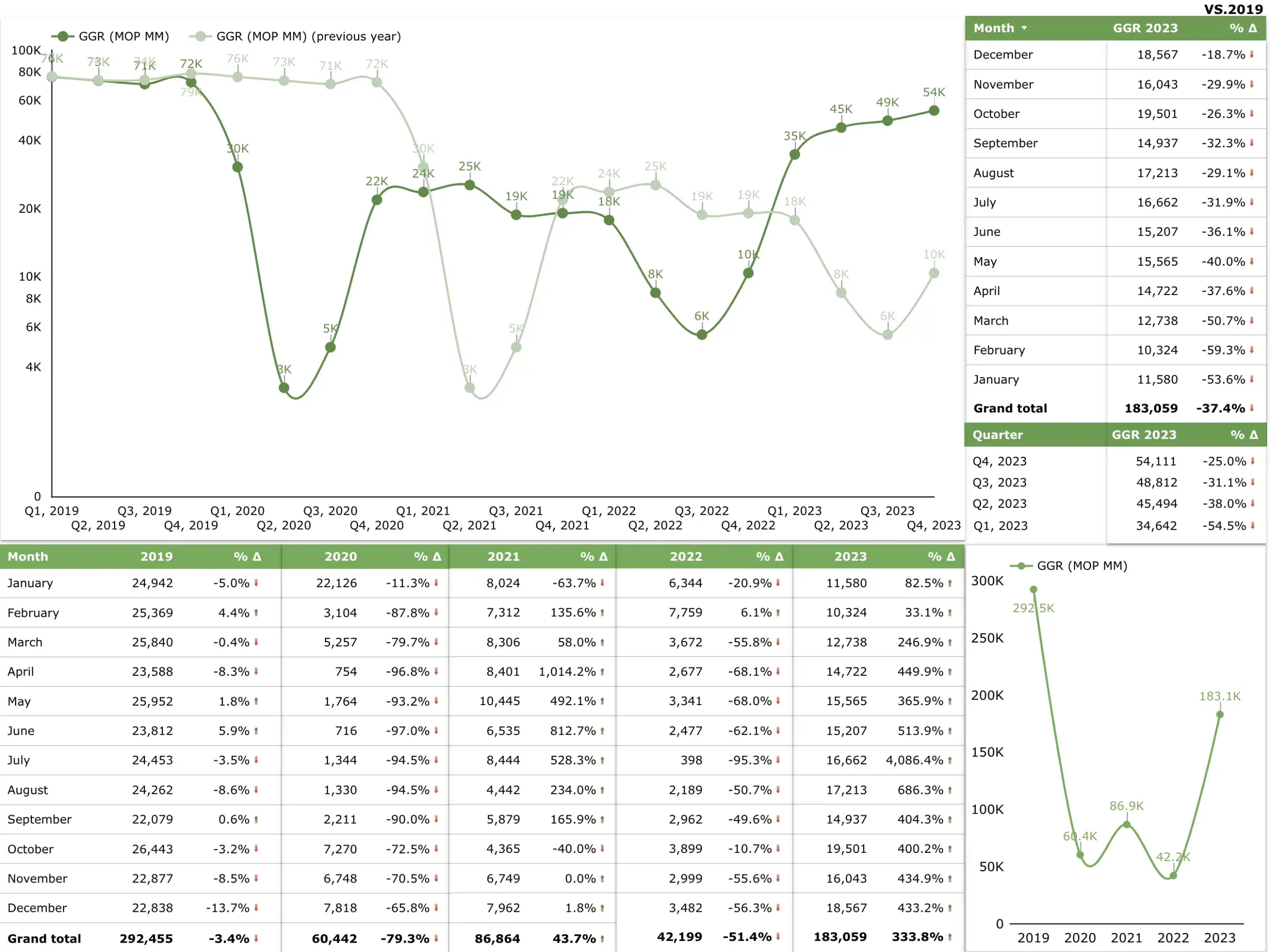

We did have the DICJ (Macau Gaming and Inspection Coordination Bureau) results come in also, with the GGR just recently. And there were some interesting surprises there. Also, we saw that VIP in the fourth quarter actually saw its largest value since the beginning of the pandemic.

The companies haven’t yet announced their results, so it’ll be very intriguing to see how that individual split happened. What are your expectations for what they’re going to be telling us?

I think if we focus overall, we see the overall gross gaming revenue reached MOP183 billion in 2023, a remarkable comeback – 62 percent of the overall GGR in 2019, which is really great. But one little fact in there, that I think is really staggering, is that 87 percent of that was mass. And, that’s really showing a huge shift in what was going up, as we saw, and now we’re at a 75 percent/25 percent mix.

And that’s something that the government always wanted, and it’s something that was accomplished very quickly. Now, that takes a lot of people, but we’re at a far lower percentage, we’re only at 71 percent of the visitation. We did that with 29 million versus close to 40 million. So, it’s a really big shift. You’re talking about a lot more – as we used to call – wear on the carpet to earn those dollars. Whole different customer profile.

What about the VIP? So, the VIP now I think has been really interesting because you’re going from the junket operator VIP, which is actually quite difficult for the casinos. They weren’t making a hell of a lot of money out of that, because the huge commissions to the junkets.

So this VIP now, a lot of the growth is coming from premium mass and in-house VIP programs. And those programs are very attractive to ex-junket players, they’re moving over to the casino in-house. There’s now heightened competition between the casinos to bring in those players to their property versus the competition – with huge offerings of comps: great suites, great F&B and travel etc, all different options.

And it’s far more profitable for the casino because it doesn’t have to give away of massive commissions to junkets and I believe that a lot of the customers will enjoy it a lot. Given the fact that they will be really well pampered. Oftentimes the junket experience was not of the luxury type. I’ve often seen, in VIP junket rooms, the junk operator getting takeout food brought in and putting it on our fancy plates to keep their costs down.

Macau has had 20 years of the past concessions and sub concessions, and then we’re now one whole year under the new gaming licenses. So, we do have these legacy players. It’s not like Macau is a fresh new market that’s never been explored before.

Basically, those players, a lot of them are there and have been there for a long time, though, and didn’t want to be recognized. We realized in some of the operations over the years that certain players did not want to join our VIP programs. They didn’t want to be identified.

And if they had their player cards, they would discard them before they returned home. There were great incentives there, they would get percentage, cashback – or comps, I should say. But (with) a very low percentage in some of our premium mass areas, offers were taken up with these players. So, for example, talking about maybe 7 percent of the players in the premium mass areas were taking up the VIP cards. Now, I think that’s changing.

There is also a change in terms of how they can get lines of credit as well because junkets are no longer allowed to provide lines of credit to the customer. So, only the casino can do that. It’ll be interesting to see how that then affects everything moving forward.

I think there’s a lot more transparency now. And I believe that mainland China, and their policy with issuing of visas, will change significantly now that the junkets have been taken out of the picture. I think they’ll feel there’s a lot more control, there’s a lot more regulation. And they feel far more comfortable with their citizens coming and having a leisurely gambling experience, as opposed to some extreme gambling experiences that were witnessed with some of these junket customers.

And that will, I think, increase with the use of RFID technology, you can bring it down to the player, what they’re doing and what they’re up to. And I think it could be very interesting with the digitization of the RMB. Because then you could then bring it down to the individual what they’re spending and what they’re spending it on. So that’s down the road.

It’ll be interesting to see how that can also influence the push for non-gaming spend, or non-gaming engagement, because that has been largely what Macau has been trying to do not only with the shift to mass, but they’ve been promoting non-gaming as the key word, eventually trying to aim towards something like a 60/40 GDP split between gaming and non-gaming.

How are these operators doing so far? They have their new licenses, they have new plans that they’ve had to implement, they’ve each been given a zone of the city to develop and have thrive. How is it feeling? What’s the feedback you’re getting from the operators on their non gaming?

Well, non-gaming (vs) gaming, the split of 60/40 was always the dream of Macau, particularly when it opened up the licenses in the beginning. They went and looked at the numbers in Vegas and Atlantic City, etc. and saw that that was the basic gist of it. So, on the Las Vegas Strip, you would normally have 65 percent non-gaming and 35 percent gaming.

You went as far as Mandalay Bay, which was on the end of the Strip, they were up to 73 percent non-gaming. So, they had to do a lot more to draw and attract that customer profile that’s attracted most to Vegas.

Then Sheldon Adelson really turned it around with his MICE model. And his MICE model was very, very specific. When we were writing the mission, vision and values to introduce to the team, I asked him “Who are we competing with in Vegas?” and he said “We’re not competing with anybody in Vegas. I’m competing with New York City.”

And with Opryland, in Nashville. They were doing huge conventions.

They had massive convention centers with supporting hotel rooms in the cities. And so the biggest shows in America were being held in those cities. He wanted to bring them to Vegas. So, he had to invent that product. So, the 1.2 million square foot Convention Center, linked directly to 3,000 all-suite, business-oriented customers, was the solution.

And that’s exactly when the pendulum started to shift in Vegas, from it being just entertainment, food and beverage, etc. – with the gaming – to more MICE.

Now this is really significant because we’re there was no problem filling the rooms on the weekend from Friday , with the big checkouts on Sunday, that was never a problem with free independent travelers. The problem was filling it Monday through Thursday, and some of the big properties had problems. They were making profits on the weekends but losing it during the week in their self-owned restaurants and operations, etc.

So, this was the gist behind what we were attempting to do – replicate that model here in in Macau. The hope at that time would be visa changes and access to conventions would be loosened, which will allow mainland Chinese MICE visitors to come in for six days.

The logistics of that and the complexities of that have still not been worked out to the extent that it’s been opened up. However, I believe that just like mainland China and Macau gave the world the gift of the gaming capital of Asia, we could be the MICE capital of Asia, if a few changes were made.

So, for example, if Beijing decided that they were to turn around to their main government-owned enterprises, and said, you must hold one major convention a year in Macau. That’s it. You’re talking about thousands of institutions. And we would then have, what our dream was – like in Vegas – we had over 36 shows a year in excess of 20,000 visitors at the Venetian (Las Vegas).

That could happen in Macau, if the One Country, Two Systems decides that that’s the way to go.

The other way that it can happen is simply by – because mass requires a lot more people, you remember, the individual visitor scheme (IVS) isn’t available in every province in China, and just need to turn on one or two more provinces at a time, if and when we’re ready to handle it, to bring that volume through to make that mass versus VIP look even stronger. And I believe that mainland China is 100 percent behind us.

That hotel room supply, I wanted to get into that because we also have the Hengqin angle which could potentially contribute. Do we have enough hotel rooms in Macau to be able to make that future MICE growth a possibility?

No, absolutely not. I go back to the boardroom in 2004, when I was with Sands, and our senior vice president of MICE kept saying “We do not, even when we are at full build-out on Cotai – we do not have enough rooms, and we will not have enough rooms”. And now you’re talking about with guesthouse accommodation – 55,000 rooms in Macau.

Now, I don’t know if you’re aware, but a massive percentage of those rooms are taken up by complementaries to gaming players and they get first preference. So, the availability even if you’re talking about 80/85/90 percent occupancy, maybe 70 percent of that is taken up by gaming players. So for a MICE or non-gaming visitor who comes here, there are very few rooms available.

And the inventory that’s on the market is on a supply and demand; and the rates will go up. The average daily rates for free independent traveler are quite steep. And you’re also talking about the majority of the rooms that are available in Macau are five-star. Where are the IBIS and Holiday Inns and other more bargain-oriented rooms? They’re not available. So, do we need more? Absolutely.

While I still have you, we do have the Chinese New Year coming up, which is the main period for Macau. I mean, we’ve got Chinese New Year and Golden Week in October. How is it looking so far? Is there a lot of excitement? Do you think that we could potentially surpass what we saw back in 2019?

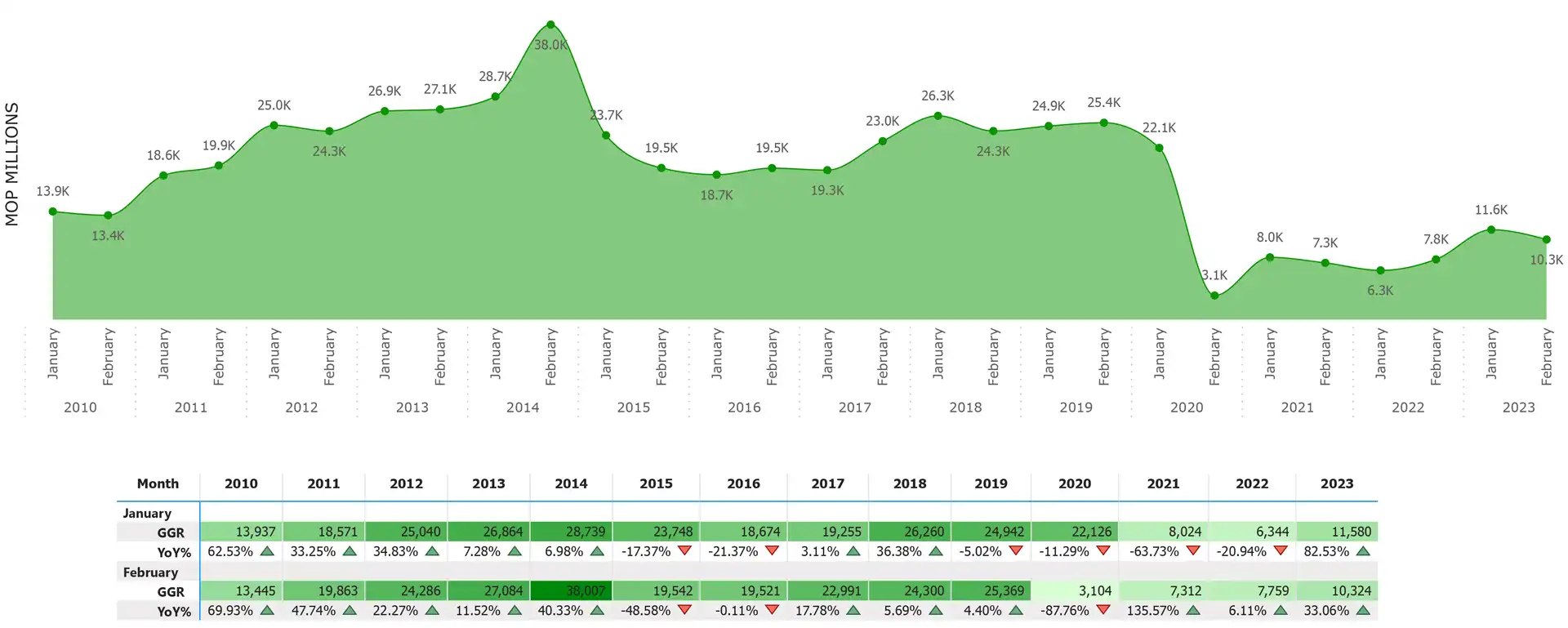

Interestingly, we look back to the numbers on Chinese New Year, so you basically compare January to February. And the uptake is surprisingly small. It’s on average, in 2017/18 and 19, the difference between January and February was 4 percent. So if we look at our January now, which is predicted to be closing at MOP17.5-18 billion, if we follow what happened pre-pandemic, you’re looking at maybe MOP18.8 billion for February.

Now, when you look back to 2019, we did 25 billion. That’s a big jump from a projection of like MOP18.8 or MOP19 billion. However, our biggest month in 2023 was MOP19.5 billion. So, if I was conservative and say “Oh, we’ll do MOP18.8 (billion) but I think it’s highly likely that we can hit and or possibly exceed the October number of MOP19.5 (billion) you are close to MOP20 (billion) which is still five shy of the record.

Do I think we could exceed it? Probably not. But again, people are totally surprised with the amount of visas that have been issued and the inflow of guests from mainland China. If the taps are open and the visas are issued, we could possibly hit that MOP25 billion.

Niall, I probably shouldn’t steal any more of your time. I think we’ve covered a lot of bases here, but I’m sure that we’re going to be talking to you very soon in the future. Thank you very much again. Niall Murray, the chairman of Murray International.

Thank you very much. It was a pleasure and look forward to speaking to you again soon.