The new $2.1 billion integrated resort in Vietnam’s Van Don economic zone in Quang Ninh is going to be run by developer Sun Group, notes expert Ben Lee. In this Under the Scope, Lee points out the advantages for operators and junkets within the region, and the Sun Group’s likelihoods of success.

Aside from its real estate investments, the company has also partnered with highly-respected international hotel brands for other development project within the country, among other large-scale projects.

“The developer, Sun Group, has under undertaken massive projects all over Vietnam. From luxury resorts in Phu Quoc to Da Nang, theme parks in Da Nang to Halong, glamorous new hotels in Hanoi and Sapa, even an international maritime cruise terminal, the company is one of the fastest growing if not in the region , certainly within Vietnam,” points out the IGamiX Managing Partner.

Ben Lee also notes that the company has “the only known project in the world where the developer has already built and launched its own world-class international airport – the Van Don International Airport, hosting seven aircraft parking lonts and 3.6 kilometer-long runways capable of handling Boeing 787s. It also has a designed capacity of 2.5 million passengers per year.

Local gaming

Upon opening, the new Van Don casino would be one of only two which can offer a casino experience to locals, after a trial run in Phu Quoc at the Corona casino. But given the limited success of the latter, no real test of the market has yet been achieved.

“Local gaming is still in its infancy and unproven. With Corona (Resort) in Phu Quoc as the only test case; bearing in mind, the casino was set up by an European operator with no experience in Asia, and its current management structure is still rudderless since opening, Corona is probably not the best outcome one could have hoped for,” he opines.

Corona was previously owned by Vingroup but operated by a third party, although it is believed that since then Vingroup may have divested themselves of that property, notes Lee.

“The Sun Group which has catapulted to the top in terms of luxury hospitality developments probably has the best chance of success given their proven history of building iconic tourism landmarks such as the Golden Bridge otherwise known popularly as the Hands of God,” indicates the expert.

“Understandably, Sun Group and Vingroup (Vietnam’s largest conglomerate) were given the only two local licenses in the country. Vingroup in Phu Quoc, and Sun Group in Van Don,” points out Lee.

Not the first rodeo

Interestingly, Van Don had previously been proposed as a location for a foreigner-owned casino. Lee points out that “Van Don was first offered to (Sheldon) Adelson, who instead wanted the urban cities of Ho Chi Minh City and Hanoi.”

Adelson in around 2013 proposed up to $6 billion in investment for integrated resorts in the two cities – hoping for approval for locals gambling after also looking into Van Don.

Adelson is renowned as being the visionary behind the Cotai Strip, as well as seeing massive success with the Marina Bay Sands. However, the mogul’s Vietnam IR aspirations never bore fruit.

Junkets and VIP

Looking at the possibility of junket and VIP play for the multi-billion-dollar resort, Lee notes that conditions are favorable.

“The service culture in Vietnam is very welcoming and the costs of holidays there are amongst the lowest in the region, all important factors for junket/VIP incubation”.

“Vietnam is extremely accommodating of junkets. The market there is currently serving a wide diversity of junket operators from all over Asia, unlike Macau. This can be seen very clearly in their taxation regime which whilst on paper may seem high, is actually one of the most appealing in the region as they allow junket commissions to be deducted before the application of their taxes,” indicates Lee.

Competition?

The Van Don casino project is expected to cover an area of some 244.45 hectares, according to reports, with a land use duration of 70 years from the day of allocation – of the total, some 62.08 hectares has been reserved for natural forest. The timeline for construction of the project has been speculated at around nine years.

Given how Thailand’s casino legislation is progressing so far, some movement could be expected in the space by the time the Van Don IR comes online.

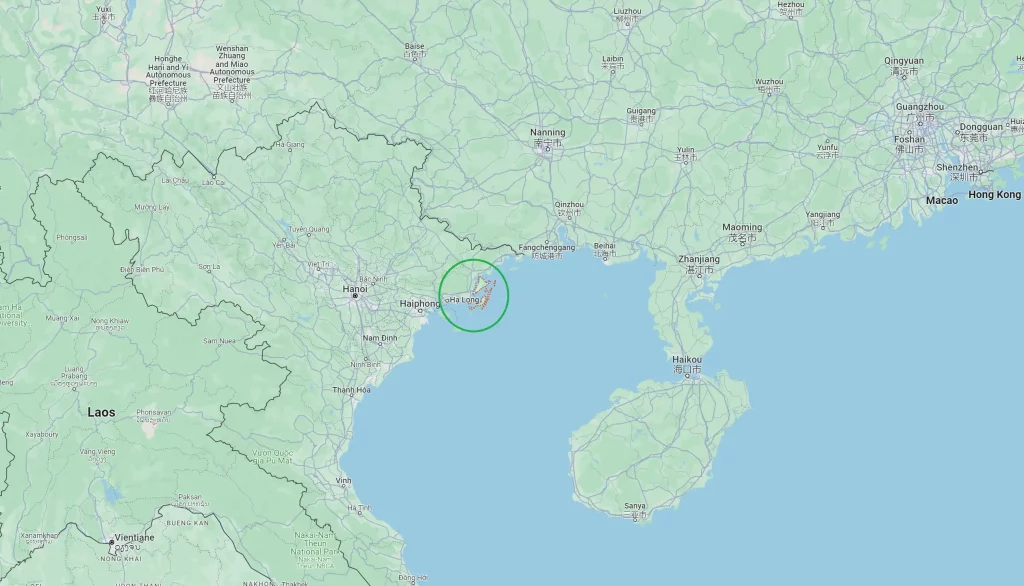

Unlike Thailand, Vietnam does share a border with China and Van Don is located in the northeastern coast of the country. Given their geographical differences, Lee opines that Van Don’s IR is unlikely to pose competition to any future Thailand IR.

“Vietnam poses no threat to Thailand. Its attractions and appeal to the international market are quite varied and different from that of Thailand, which currently appears to have gone over the edge with their excesses of women and weed,” indicates Lee.