Citigroup anticipates that Macau’s gross gaming revenue (GGR) for January 2024 will reach approximately MOP17.5 billion ($2.2 billion), achieving around 70 percent of the level recorded in January 2019, primarily influenced by seasonal factors.

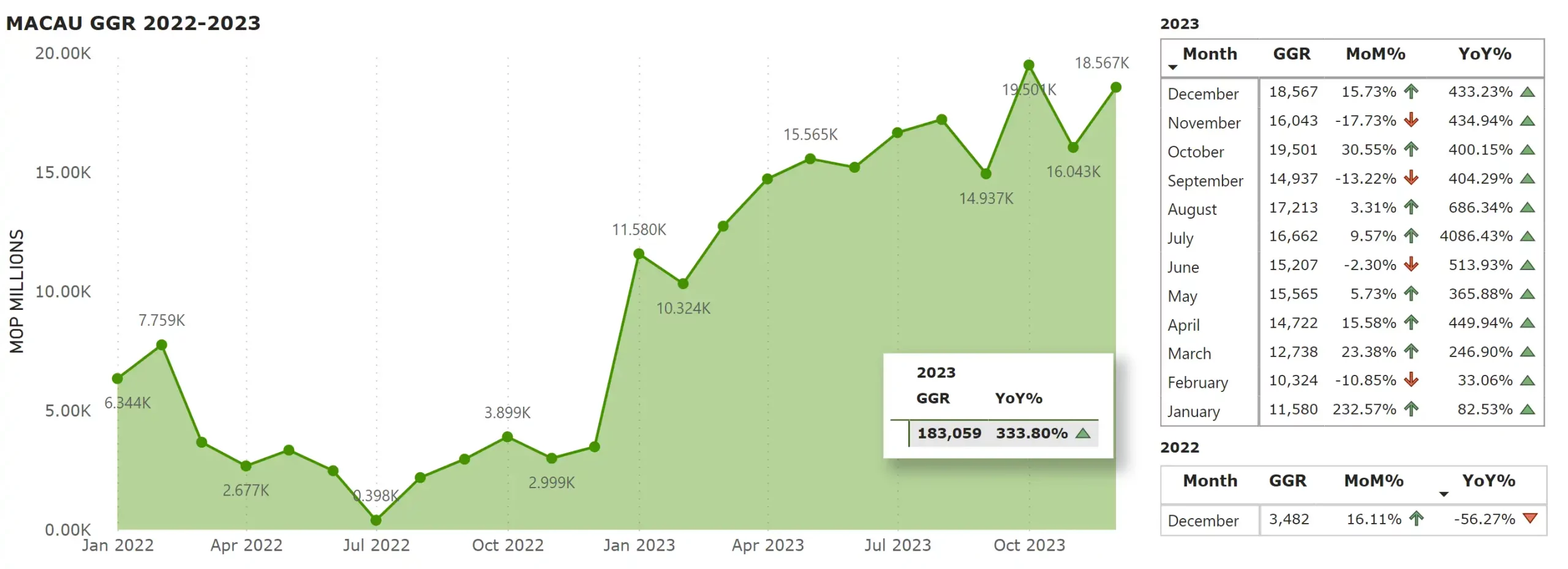

As outlined in a research report from Citigroup, Macau’s GGR in December of 2023 amounted to MOP18.6 billion ($2.3 billion), equivalent to a daily run-rate of nearly MOP600 million ($74.5 million). The recovery has surged to approximately 81 percent of the pre-pandemic level, surpassing both the market’s and the broker’s expectations by approximately 6 percent.

Analysts from Citigroup observed a rise in the average daily run-rate in late December, reaching around MOP683 million ($84.8 million) compared to MOP543 million ($67.5 million) the preceding week. The firm anticipates a sustained increase in the average daily run rate.

Meanwhile, in another research note, analysts Praveen Choudhary and Gareth Leung from Morgan Stanley project that Macau’s GGR in January is anticipated to stay consistent, with a projected total of MOP18.8 billion ($2.3 billion), equivalent to 75 percent of the figures recorded in 2019.

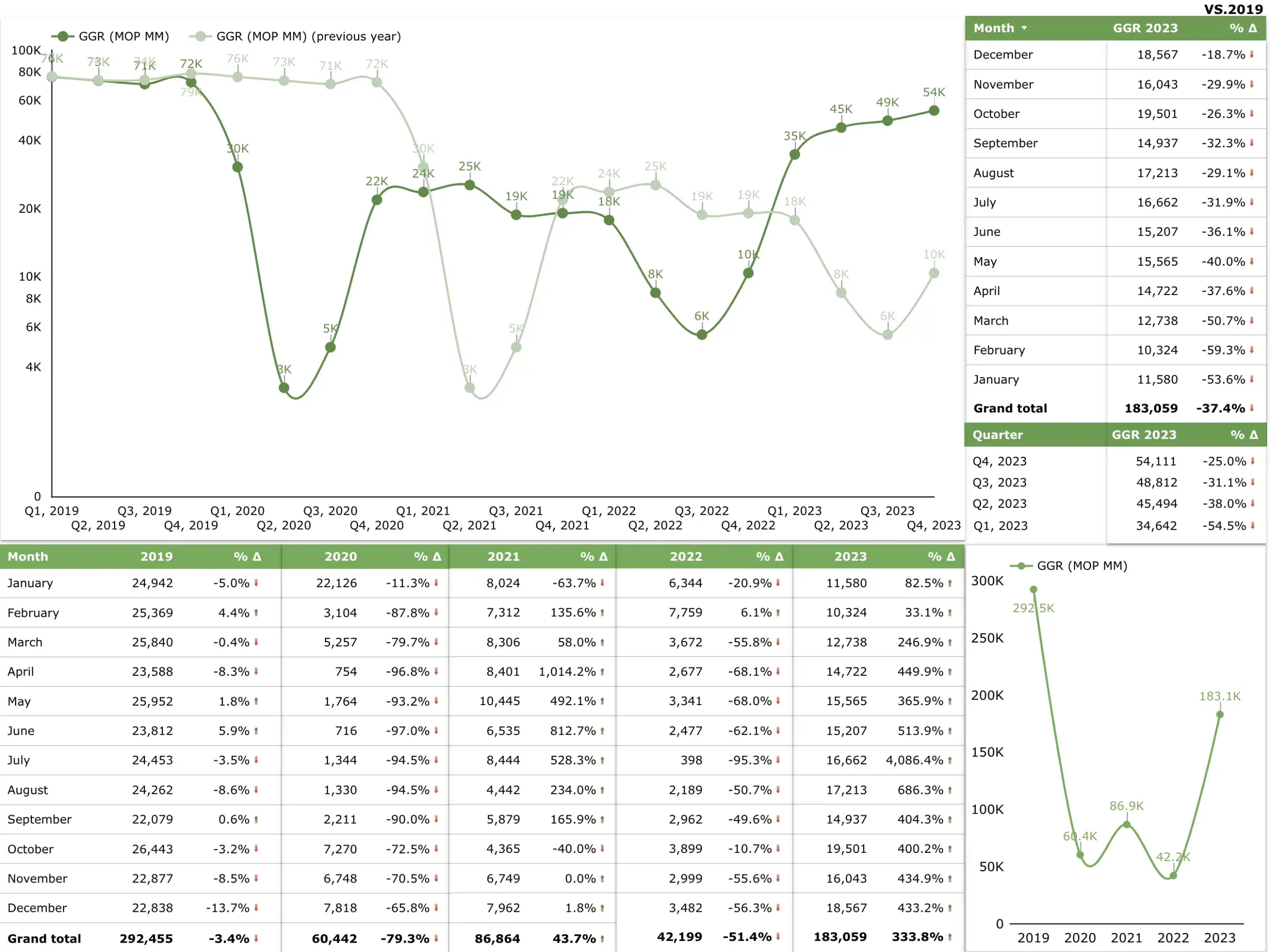

Analysts also expect that Macau’s GGR for 2024 might increase 28 percent yearly, achieving 80 percent of the levels observed in 2019. This marks a notable increase from 2023, where the GGR for the year totaled MOP183.1 billion ($22.76 billion), reaching 62 percent of the pre-COVID-19 pandemic figures from the last year.

Throughout 2023, Macau’s GGR increased by 333.8 percent compared to 2022. The year 2023 symbolized a resurgence for Macau, emerging from the impact of the pandemic and the associated regulations that effectively halted the city for three years.

It also signaled the initial year of the six concessionaires’ fresh gaming licenses, as operators adjusted to a transformed environment that eschewed junkets, transitioned to a mass-market model, and aimed to attract more international gamblers.

Under the new gaming licenses, should Macau’s annual GGR reach or exceed MOP180 billion ($22.4 billion), the six concessionaires are obligated to increase their MOP109 billion ($13.48 billion) non-gaming expenditure by a maximum of 20 percent. Nevertheless, the Special Administrative Region’s Chief Executive has been cautious about revealing the precise obligations of the operators once the designated threshold is surpassed.

High rollers continue to drop

Commenting on the future of Macau’s gaming recovery, the Chairman of the Delta Asia Financial Group, Stanley Au, noted that the VIP segment will continue to drop as the Chinese authorities implement their own digital currency, which he opines will further impact VIP gamblers.

At the same time, the possibility of launching a digital Hong Kong dollar or Pataca will have a direct effect on gaming revenue.

On the metrics for the coming five to 10 years, Stanley Au noted that if Macau’s gaming industry keeps its leading role in the economy, it relies on China’s central government’s attitude towards Macau travel, as Macau is the only Chinese territory where gaming is legal.

According to reports, Au also pointed out emerging competitors from Japan, the Philippines, and Thailand, noting that there will be increasingly intense competition in the region.