Air links and visa issues are identified as key factors contributing to China’s outbound travel rebound in 2024, according to research. With an increasing number of Asian countries lifting visa requirements for Chinese travelers, this shift may potentially impact casinos in the region that heavily depend on Chinese punters.

According to the “Outlook on the Outbound Tourism Demand Trend of Chinese Nationals in 2024”, conducted by the Tongcheng Research Institute, some 63.9 percent of respondents clearly stated they have plans for outbound travel, with over 40 percent planning to complete more than two outbound trips in 2024.

Meanwhile, about 13.5 percent of respondents wish to have outbound travel during the upcoming Chinese New Year, with 21.6 percent eyeing the summer vacation and 13.7 percent considering China’s National Day Golden Week in October.

However, 46.8 percent of respondents confess that they are avoiding public holiday periods for outbound travel.

Tongcheng is one of the largest online travel agencies in China, operating under the Elong brand. Elong is a Nasdaq-listed company and is also one of the main shareholders of the online travel booking platform Expedia.

Visa-free policies as a catalyst

The same research notes that visa-free policies for Chinese nationals have become a catalyst for boosting China’s outbound travel at the beginning of 2024. The release of visa-free policies in Singapore and Thailand has caused a boom in travel searches this month.

Tongcheng’s data reveal that visa-free policies have already helped some travel destinations jump to the top for Chinese travelers in the upcoming Chinese New Year (CNY).

The most wanted travel destinations include gaming jurisdictions: Macau (1st), Singapore (2nd), Malaysia (6th), and South Korea (8th). Additionally, Thailand is ranked 3rd on the list, with the country discussing legalizing gaming. Japan holds the 4th position on the list, with its first casino in Osaka under construction.

Singapore and Malaysia

Early last week, China and Singapore signed an agreement for mutual visa exemption. The policy is set to take effect from February 9th, right before the CNY break.

Malaysian authorities have removed the visa requirement for Chinese travelers since last December.

The visa exemption allows Chinese nationals to stay in Singapore and Malaysia for 30 days without requiring a visa. Maybank, in an investment memo issued early this month, noted that the Genting group’s casino operations in Asia – specifically in Singapore and Malaysia – are likely to benefit in 2024, anticipating an “en masse return of Chinese tourists.”

Samuel Yin Shao Yang, an analyst from Maybank Investment Bank, anticipated a resurgence in outbound Chinese tourism in the post-COVID period, which would positively impact the gaming operations of the Genting group across Asia.

The analyst further emphasized that this trend could contribute to business expansion at Genting Singapore’s Resorts World Sentosa casino property, especially as the seat capacity for flights from China to Singapore recovers.

Regarding the Malaysian market, Maybank predicted that visitor arrivals to Resorts World Genting, Malaysia’s exclusive casino resort, are expected to return to pre-COVID-19 levels this year.

However, in a previous interview with AGB, Yin also pointed out that the visa-free policy for Malaysia, despite the government’s enthusiasm to boost tourism and the economy, may not be the catalyst for the Malaysian gaming sector’s growth.

He exemplifies that Chinese visitors constituted a mere 4 percent of Resorts World Genting’s total arrivals in 2019. The overwhelming majority, approximately 85 percent, were from local and Singaporean markets, making the expected surge in Chinese tourists seem inconsequential to the gaming giant.

For the first eleven months of last year, Singapore received over 1.23 million Chinese visitors, and mainland China has been the second largest single source of visitor arrivals to Singapore before and after COVID-19.

In mid-January, the number of flights between China and Singapore in a week reached 356, returning to 90 percent of pre-pandemic levels.

Thailand and Cambodia

Thailand has permanently removed the visa requirement for Chinese nationals, starting in March.

The move follows the slow recovery of Chinese tourists in 2023. According to official statistical data, even though Thailand continues to be a top destination for Chinese outbound travel, it has only received nearly 3.4 million tourists, while the government has set a goal to reach 8 million this year.

Despite Cambodia’s efforts to position itself as a Chinese tourist hub, with initiatives like the ‘China Ready’ strategy and the recent opening of a China-funded airport near Angkor Wat, the return of Chinese tourists has been slow post-pandemic, and a visa is still necessary for Chinese nationals to visit.

In the first 10 months of 2023, Cambodia received about 450,000 Chinese tourists, according to Cambodia’s Ministry of Tourism, which is only one-third of pre-pandemic levels.

According to a recent investment memo from China International Capital Corporation (CICC) Hong Kong Securities Ltd, it is expected that NagaWorld casino in Cambodia will record a 26 percent yearly increase in gross gaming revenue (GGR) for 2024.

NagaCorp’s management also noted that the continuous resumption of international travels is key to improving the business.

South Korea

South Korea has decided to prolong the visa free exemption initiative for Chinese group travelers, extending it until the end of 2024. The existing program, waiving the standard $15 fee for these travelers, was initially implemented in September and was set to expire at the end of 2023.

The country only received 514,000 Chinese visitors in the first half of 2023, a figure significantly lower compared to the peak in 2016 – when South Korea welcomed over 8 million Chinese visitors.

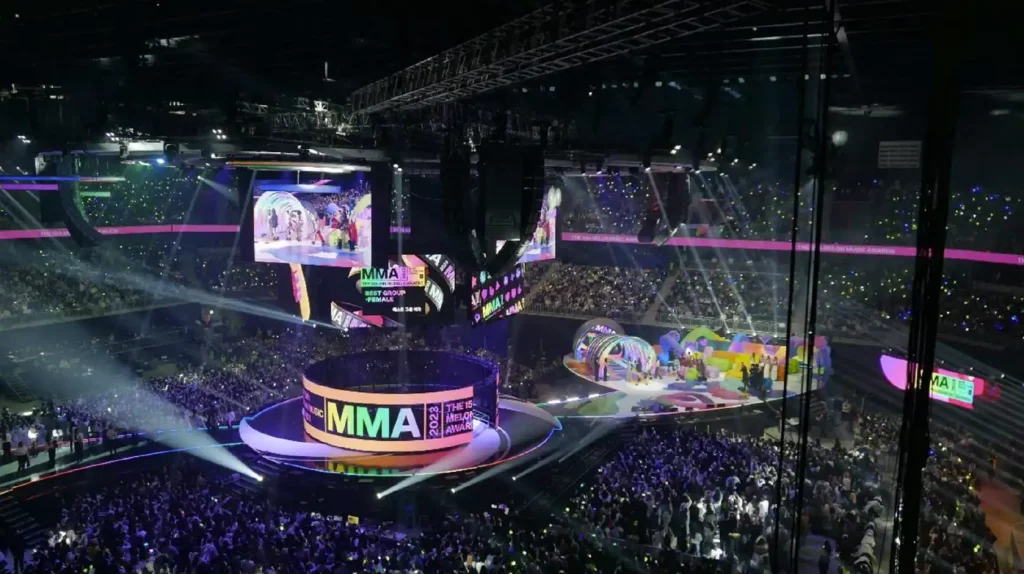

The majority of South Korean casinos are exclusive to foreigners. The newly-opened integrated resort, Mohegan INSPIRE Entertainment Resort, expects to draw 3.5 million annual visitors by leveraging the escalating global allure of K-pop and K-culture.

The company received its casino license last week and is pending the announcement of its casino opening, while the main property opened its doors last November.

INSPIRE anticipates an annual revenue surpassing KRW50 billion ($37 million) from the arena, aiming to make a substantial impact on the KRW1 trillion ($758 million) concert market in the country.

International routes recovery

According to a report from Bloomberg, China’s severed air connectivity has drained about $130 billion from global tourism.

During the fourth quarter, outbound airline capacity from China was approximately 60 percent of the levels recorded in 2019, as reported by the aviation analytics firm Cirium.

In 2019, Chinese travelers embarked on 170 million trips beyond their borders. Their expenditure, totaling $248 billion, encompassed a wide range of items – from plane tickets and hotel rooms to designer brands – constituting 14 percent of the world’s foreign travel spending, according to data from the China Outbound Tourism Research Institute and the World Travel and Tourism Council.

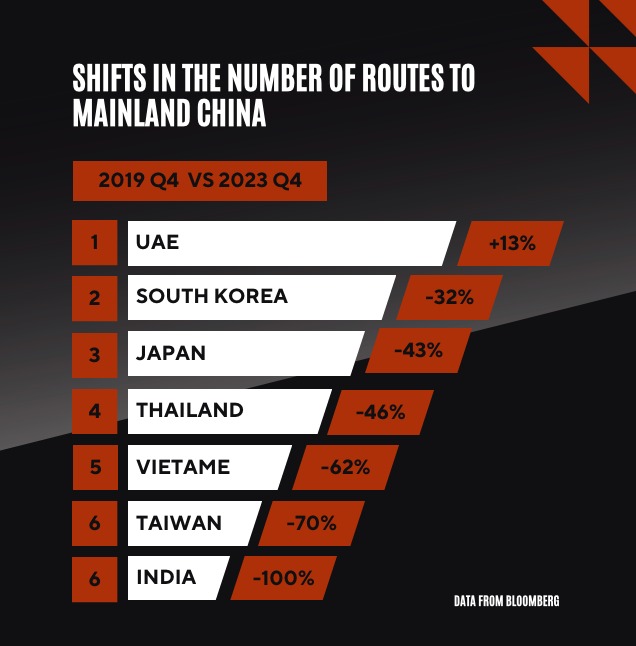

Comparing the number of flight routes to mainland China between 4Q19 and 4Q23, the flight volume from mainland China to the UAE is the only winner, with a 13 percent increase. However, South Korea (-32 percent), Thailand (-46 percent), Japan (-43 percent), Vietnam (-62 percent), Taiwan (-70 percent) and India (-100 percent) are regions that still experienced drastic drops compared to pre-COVID levels.

Rating agency Fitch also noted that China’s aviation sector experienced a highly unbalanced recovery in 2023, primarily due to the lag in the recovery of international travel.

In 2023, China’s domestic passengers more than doubled to 590 million from 2022, surpassing the 2019 level, while international passengers jumped from 1.9 million in 2022 to 29 million, a figure still just 39 percent of the 2019 level.