After facing severe hardship, Macau’s VIP segment is poised to attract new investors, potentially leading to a growth in the number of junket licensees.

Speaking to AGB, U Io Hung, the president of the Macau Professional Association of Gaming Promoters, revealed that new investors are in the process of preparing the necessary documents for submission to the Macau gaming regulator to apply for junket licenses. He believes that this could result in an increase in the city’s number of junket operators in the coming months.

As of now, applicants are required to submit the necessary documents to the Gaming Inspection and Coordination Bureau (DICJ) by September 30th.

According to information from the Secretary for Economy and Finance, each junket licensee is required to provide a guarantee of MOP1.5 million ($186,000), with the highest junket commission rate being capped at 1.25 percent of the total net rolling amount. The minimum corporate capital required is MOP10 million ($1.24 million).

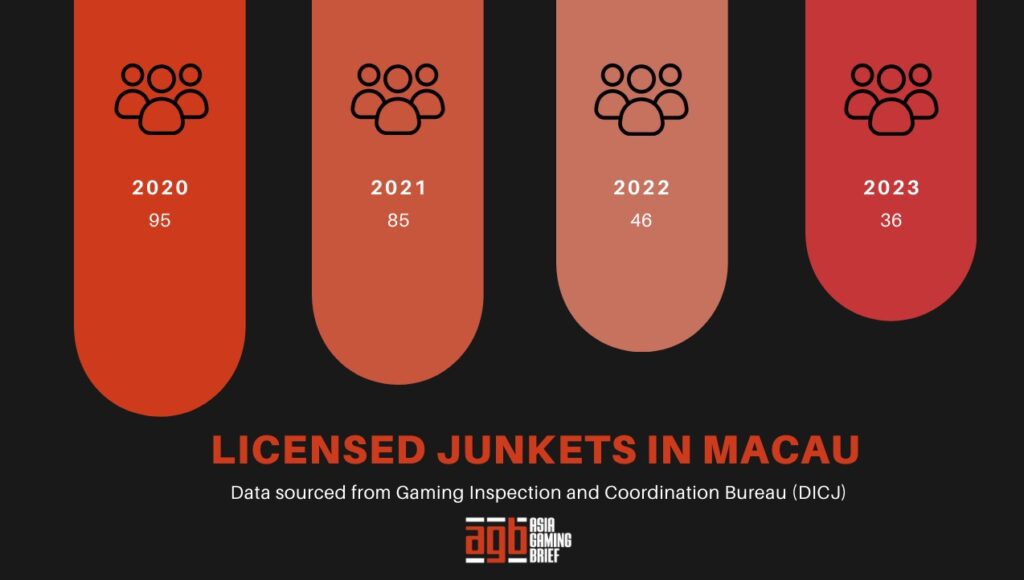

Macau’s junket sector has witnessed an 85 percent decline over the past decade, with only 36 operators registering this year.

Macau’s casinos reached their peak in 2014, with gaming revenue exceeding $45 billion, three times that of Las Vegas. In the previous year, 235 junket operators had registered to operate under licenses in Macau, collectively contributing around 60 percent of the casino revenues.

VIP revenue rebounds

U also notes that the anticipated increase in the number of junkets is a response to the rapid rebound in gambling revenues. While Macau’s VIP business share (VIP baccarat) accounted for only 26 percent of Macau’s gross gaming revenue (GGR) in the first half of the year, casino GGR increased by 263 percent in the first seven months of the year compared to the previous year, reaching MOP96.80 billion ($12 billion).

U mentions that concessionaires are also seeking more junkets as they aim to boost the rebound in VIP revenue. According to U, “the 36 licensees are not sufficient to meet the demand.”

Currently, as the junket sector undergoes a recovery process, concessionaires are actively expanding their self-directed VIP programs. Despite facing heightened competition, U maintains that the junket sector has contributed to over half of the VIP revenue.

Addressing the new scenario, the president of the Macau Professional Association of Gaming Promoters has mixed feelings, suggesting that the performance of the junket sector is not solely determined by the number of licenses issued but also by operational skills. He states, “the real challenge lies in whether the junkets can establish a viable business.”

At the same time, U asserts that the current environment remains unchanged, as Chinese authorities continue to closely monitor cross-border gambling activities. He adds that “border controls lack clear guidelines, and individuals with frequent cross-border records might face scrutiny at checkpoints.”

High rollers remain

U explains that it’s common for more former VIP clients to shift to the premium mass sector, stating that “the VIP sector previously had hundreds of gaming tables before the crackdown; now, it only has dozens, so naturally, people are shifting to the mass sector.”

The experienced gaming veteran believes that high-rollers will continue to be active in the market despite the current state of the Chinese economy.

Citigroup reported last week that it had identified 24 high-value players (whales) in the first three weeks of August, marking the highest count in a single month this year and only three fewer than during the Chinese New Year in 2019. The term “whale” refers to players who wager between HK$100,000 and HK$500,000 ($12,800 to $64,000) per hand or more.

The survey suggests that an increase in high rollers likely indicates the return of more casual Premium Mass players as well.