Four out of the six gaming operators in Macau have already announced a pay raise for staff in 2024. The majority of them have increased their salaries by 2.5 percent, a figure “lower than expected” for industry employees, notes an association head.

Speaking to AGB, Cloee Chao Sao Fong, head of the local gaming labor activist group New Macau Gaming Staff Rights Association, noted that the real income for industry employees, especially croupiers, has decreased compared to 2019 levels.

Chao indicates that the cut in the summer bonus offsets pay raises, leading to a salary decrease for industry employees. “The annual salary adjustment was suspended during COVID and the summer bonus, equivalent to one month’s salary, has been canceled for at least four years. This is why industry employees didn’t applaud the bonuses and pay raises this time,” she said.

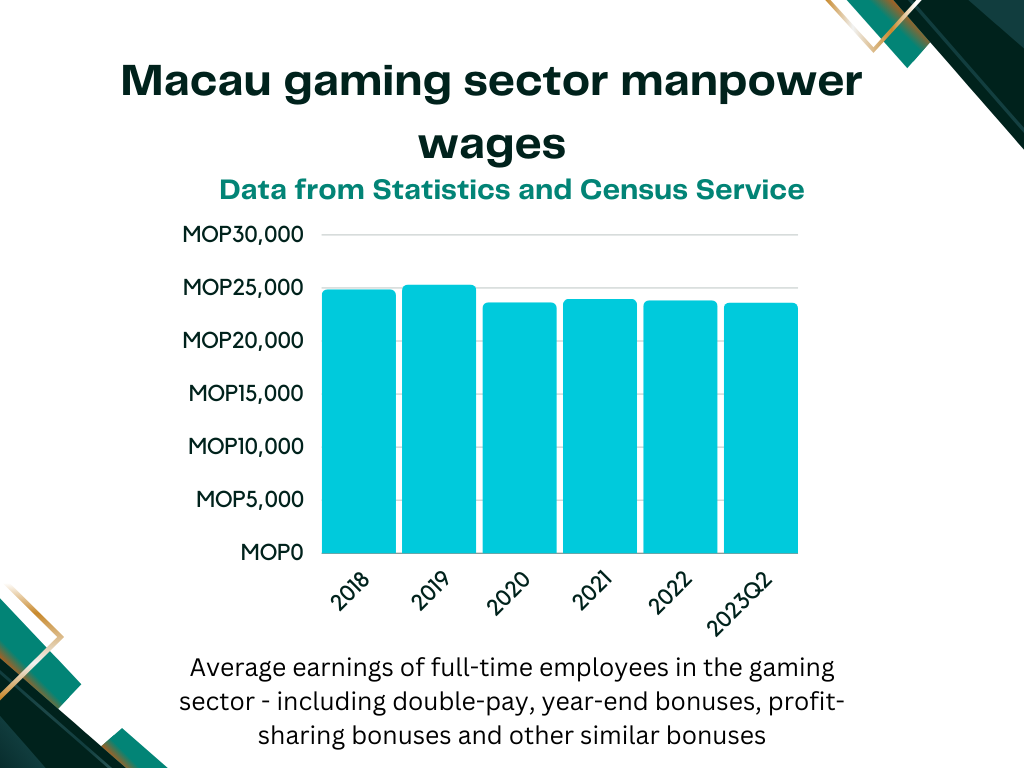

According to data from the official Statistics and Census Service, the average wage of full-time employees in the gaming sector, including all bonuses, decreased nearly 6 percent from MOP25,330 ($3,140) in 2019 to MOP23,840 ($2,955) by the end of 2022.

However, the latest figure for 2Q23 shows that the industry-wide wage level returned to pre-COVID levels, reaching MOP25,630 ($3,177).

Challenges from technology

Meanwhile, innovative technology has posed a significant challenge for industry employees. Chao indicates that some gaming operators have introduced advanced equipment for payouts, resulting in a significant reduction in the demand for certain jobs in casinos.

“Before, the payout needed to be checked by a supervisor, but now, as new technology is largely used for this process, casinos have no demand for hiring supervisors,” she noted.

Lack of mobility

Lack of mobility for gaming workers is another characteristic in the post-COVID era. Chao pointed out that only MGM has added more gaming tables during COVID, so the croupier job supply is very low, resulting in no new croupiers entering the market.

As the number of jobs was cut, particularly the superior positions, this has caused an inactive promotion process.

At the same time, during COVID, some casino employees were transferred to another department, such as the hospitality segment. However, the Gaming Workers Association observed that almost all transferred employees have returned to the casino, as gaming operators have hired thousands of non-resident workers after Macau’s reopening at the beginning of last year.

According to statistics, the number of non-resident employees increased 23.8 percent from 151,878 in January 2023 to 175,675 in November last year. For the gaming sector, there were 51,693 full-time employees at the end of the second quarter of 2023, a decrease of 1,899 year-on-year. Among them, croupiers totaled 23,675, down by 418 year-on-year.

Cost pressure on operators

Melco, Sands China, Galaxy Entertainment, MGM China and Wynn Macau are the gaming concessionaires that have already announced their pay-raising schemes so far. According to an investment memo commenting on Galaxy’s expenditure from Goldman Sachs, it said that a 2 to 3 percent pay raise is ‘less drastic’ than what the market feared, as casino salaries have seen hikes of 5-8 percent in the prior upcycle.

‘Even though Macau has a tight job market, China’s deflationary environment may have helped to mitigate some of the upward pressure,’ note the analysts.

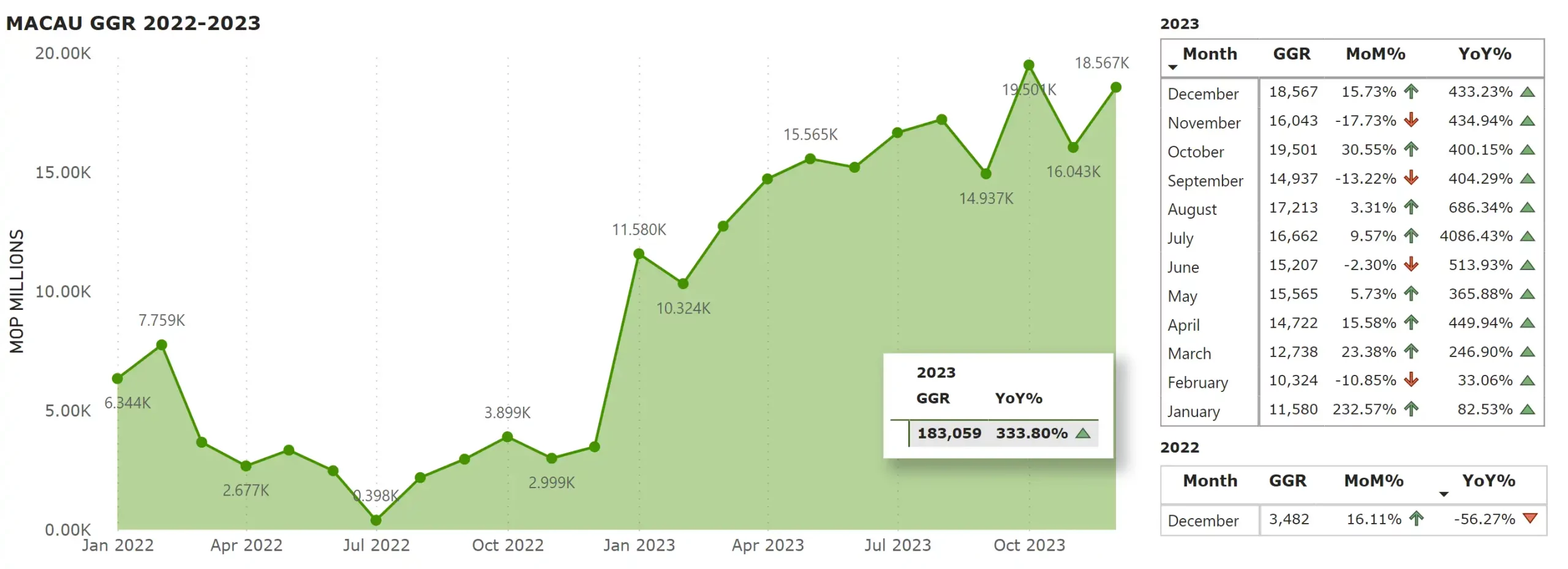

However, concerning non-gaming commitments, all six gaming operators have investment commitments for the next 10 years under their new gaming concessions. And 2023 gross gaming revenue (GGR) has exceeded MOP180 billion ($22.4 billion), meaning that casino firms have to increase their collective MOP108.7 billion ($13.5 billion) non-gaming and overseas-marketing spending pledges by up to 20 percent.

Just to recall, the labor shortage in the beginning period of Macau’s reopening had some negative impact on the gaming industry. Nearly 10 percent of the total hotel rooms in Macau had to shut down due to a lack of staff.

In addition, after years of hardship during COVID, gaming operators were on a deleveraging trajectory. Gaming firms have been obliged to have a prudent attitude toward expenditure due to the massive drops in GGR seen during the pandemic.