More premium mass baccarat tables were launched this month in Macau casinos, directly driving the increase in total wagers.

According to Citigroup’s Table Survey, there are 98 additional premium mass baccarat tables across the city in January, with 55 of them originating from the newly opened Qilong Club at Studio City‘s Epic Tower and Galaxy Macau‘s Pavilion South.

There are also 43 more premium mass tables at other casinos, indicating that player demand remains robust. The results were echoed by the 26 percent monthly increase in total wagers observed in the survey.

Analysts from Citigroup conclude that players’ passion for gaming does not seem to be impacted by the current state of the Chinese economy.

Among the new offerings in mass premium baccarat tables, Citigroup notes that Qilong Club at Studio City’s Epic Tower had a ‘solid debut,’ as the same survey suggests that this new room is already appealing to many of the top players in the market.

‘It operates 12 tables with an average minimum bet of HK$6,000 ($767). When we were there, 11 tables were in play, and we saw a total of 17 players betting over HK$1 million (128,000) in aggregate, equivalent to an average wager per player of HK$61,294 ($7,838) (about 10x the average minimum bet there). This is good enough for the room to rank second in wager per player amongst major premium mass rooms we surveyed. Five of the 17 players were whales, betting HK$100,000 (12,787)-HK$270,000 ($34,526).’

Total wagers increased by 26 percent in January due to a higher player count. Analysts from Citigroup, George Choi and Ryan Cheung, note that the survey team has seen 534 premium mass players versus 404 seen in December last year. This represents a 32 percent monthly increase and is also 5 percent higher than the October figure during the National Day Golden Week period.

The total wager observed in January rose to HK$11.5 million ($1.5 million). The wager per player of HK$21,581 ($2,760) is marginally lower month-over-month compared to HK$22,677 ($2,900) in December 2023 but is 45 percent higher than the figure in January 2019.

Lessons learned from Junket commission price war

In another study report, the same investment bank notes that Macau is a six-player oligopoly. So, reducing one’s spending on player reinvestments is no different from gifting market share to its competitors.

‘The six operators learned their lessons from the junket commission price war back in 2008-09. This is why, even though player reinvestment costs have been increasing, we do not see any out-of-proportion, irrational market-buying behavior by any operators.’

Citigroup anticipates the industry EBITDA margin in 4Q23 to remain largely unchanged quarter-to-quarter at 28.5 percent. At an individual operator level, analysts believe the quarter-to-quarter volatility in EBITDA margins has more to do with the operator’s market share change for the quarter, rather than the amount spent on player reinvestments.

Macau gaming operators are about to announce their 4Q23 earnings next month. Citigroup forecasts that Macau’s industry EBITDA improved to $1,951 million, up 6 percent quarter-to-quarter.

The 4Q23 industry EBITDA forecast implies an 80 percent EBITDA recovery versus 4Q19.

‘We open 30-day positive Catalyst Watches on SJM (we expect Grand Lisboa Palace to EBITDA-breakeven) and Wynn Macau (thanks to normalization of its mass hold rates) as we expect them to be the two casino operators with the greatest quarter-to-quarter EBITDA improvements.

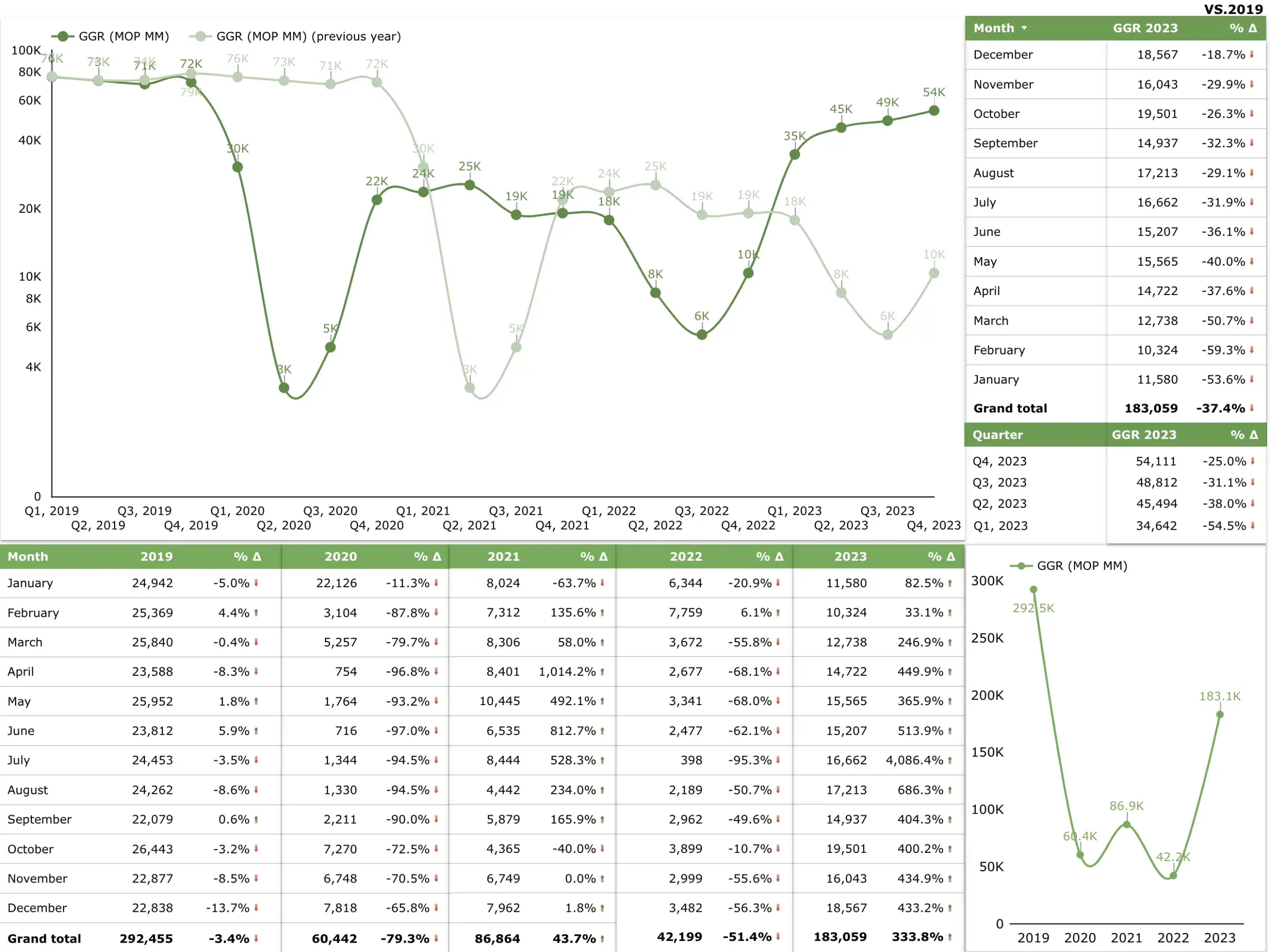

The fourth quarter is seasonally strong; Macau generated a total GGR of MOP54,111 million ($6.72 billion), up 11 percent quarter-to-quarter. Macau had a solid performance in December, with GGR recovering to MOP600 million ($74.5 million) per day, thanks to the continued recovery in visitation. Citigroup also indicates that the more important mass GGR has recovered to around 100 percent of the 4Q19 level.

Market share

Given its strong execution track record, Citigroup says that Galaxy is expected to gain market share in 2024, and earnings growth re-acceleration should follow.

The research team believes Sands China will be able to defend its market share in the premium mass segment with its premium product offerings at Londoner and Plaza.