Analysts at Morgan Stanley are raising their estimates on Macau 2023 EBITDA for the SAR’s six gaming concessionaires by 70 percent ‘as China’s reopening and the resulting revenue/profit for Macau companies came in ahead of our expectations for the first two months of the year’.

The analysts also note that they ‘find comfort in the sustainability of premium mass in the absence of junket business, which is important to achieve the pre-COVID level of EBITDA’.

The group notes its estimates are ‘higher than consensus’ (except for Wynn Macau) in regards to both gross gaming revenue (GGR) and EBITDA for 2023 and 2024, due to ‘higher nominal GDP in China, higher discretionary spending vs. 2019, and higher sustained GGR in Las Vegas and Singapore’, further noting that positive earnings revisions ‘will drive stock prices this year’.

Key concerns remain, however, in particular a possible GGR growth slowdown in February, increase on gaming space rent and commitments to non-gaming investments.

Operators have already pledged $13.4 billion collectively in non-gaming investment over the term of their 10-year concessions.

The analysts have also revised up their GGR estimates by 42 percent for 2023 and 10 percent for 2024, ‘driven by 37 percent and 5 percent higher mass revenue estimates’.

The group notes that ‘structurally Macau becomes mass-centric post-COVID which improves EBITDA margin and earnings quality’, also noting that each Macau operator ‘could have 50-100 percent upside to its current stock price if the deleveraging trade plays out’, noting that Galaxy ‘will have the least upside as it added the least net debt during COVID’.

Expectations are for mass revenue to account for 90 percent of GGR, 75 percent of gross revenue ‘and contribute 80 percent of EBITDA post COVID’. This is a sharp difference from the 60 percent, 55 percent and 70 percent levels, respectively, seen pre-COVID.

In particular, Morgan Stanley notes that MGM China and Galaxy ‘could be better positioned than their peers’, with MGM’s mass market share to increase to 12 percent ‘driven by 200 more gaming tables since the beginning of 2023’- being the only operator to gain tables under the new concession.

The group notes that it expects ‘less market share benefits’ for Melco and SJM, despite both adding capacity post-COVID.

‘For SJM, we expect Lisboa Palace to gain share but its other properties including Satellite Casinos could lose share as SJM lost 540 tables, the most among operators’, note the analysts.

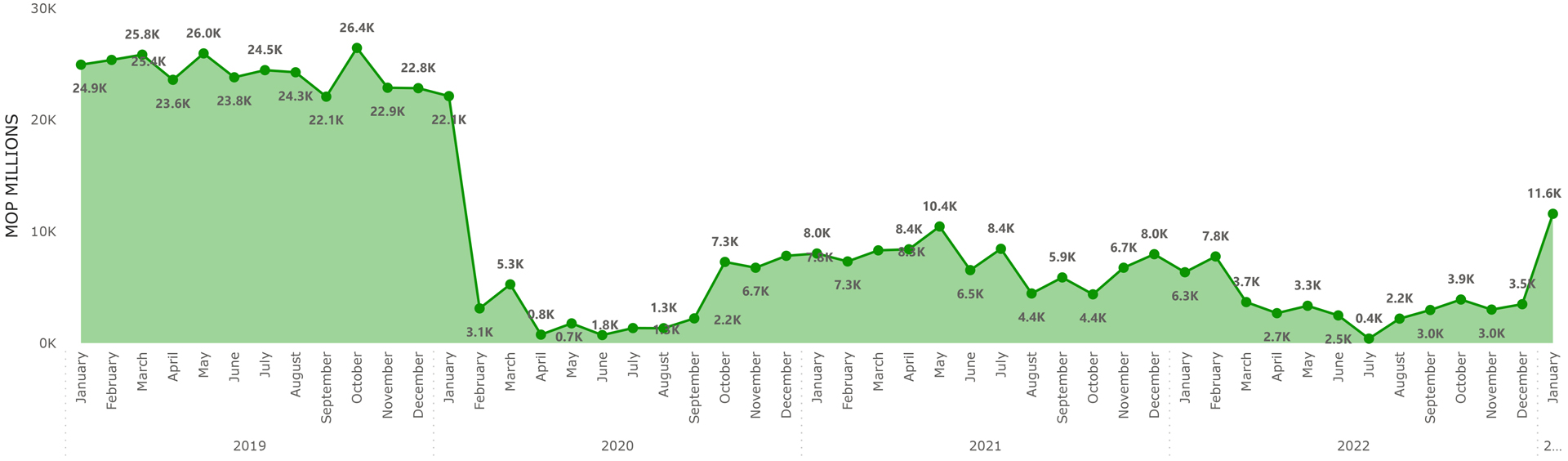

The group notes that February GGR is tracking at MOP10.2 billion ($1.26 billion), 12 percent below January GGR, despite being up 32 percent year-on-year and amounting to 40 percent of GGR in February of 2019.