Macau hotel bookings are rapidly increasing, accompanied by a rise in hotel room rates, as stated by brokerage firm CLSA.

Four weeks ahead of the Chinese New Year (CNY) weekend (10-11 February), CLSA’s four-week leading average hotel prices have already surged by 27 percent year-on-year. Simultaneously, ten out of the 33 tracked Macau hotels operated by the broker are fully booked for that weekend.

UBS also observes that, out of the 36 hotels monitored by the research team, the 7-day forward average room rate has increased week-over-week to HK$2,500 ($320) per night, compared to HK$2,100 ($268) per night in the previous week.

‘The average hotel price for the upcoming CNY period remains solid at HK$8,900 ($1,138) per night, consistent with the price trend of October Golden Week 2023.’

As the earning season approaches, CLSA analysts Jeffrey Kiang, Stella Liu, and Leo Pan suggest that operational updates during CNY will likely be the focus for concessionaires (likely Galaxy Entertainment and SJM) reporting after the festival. Rebates and the scope of sequential EBITDA margin expansion will remain key investor focuses.

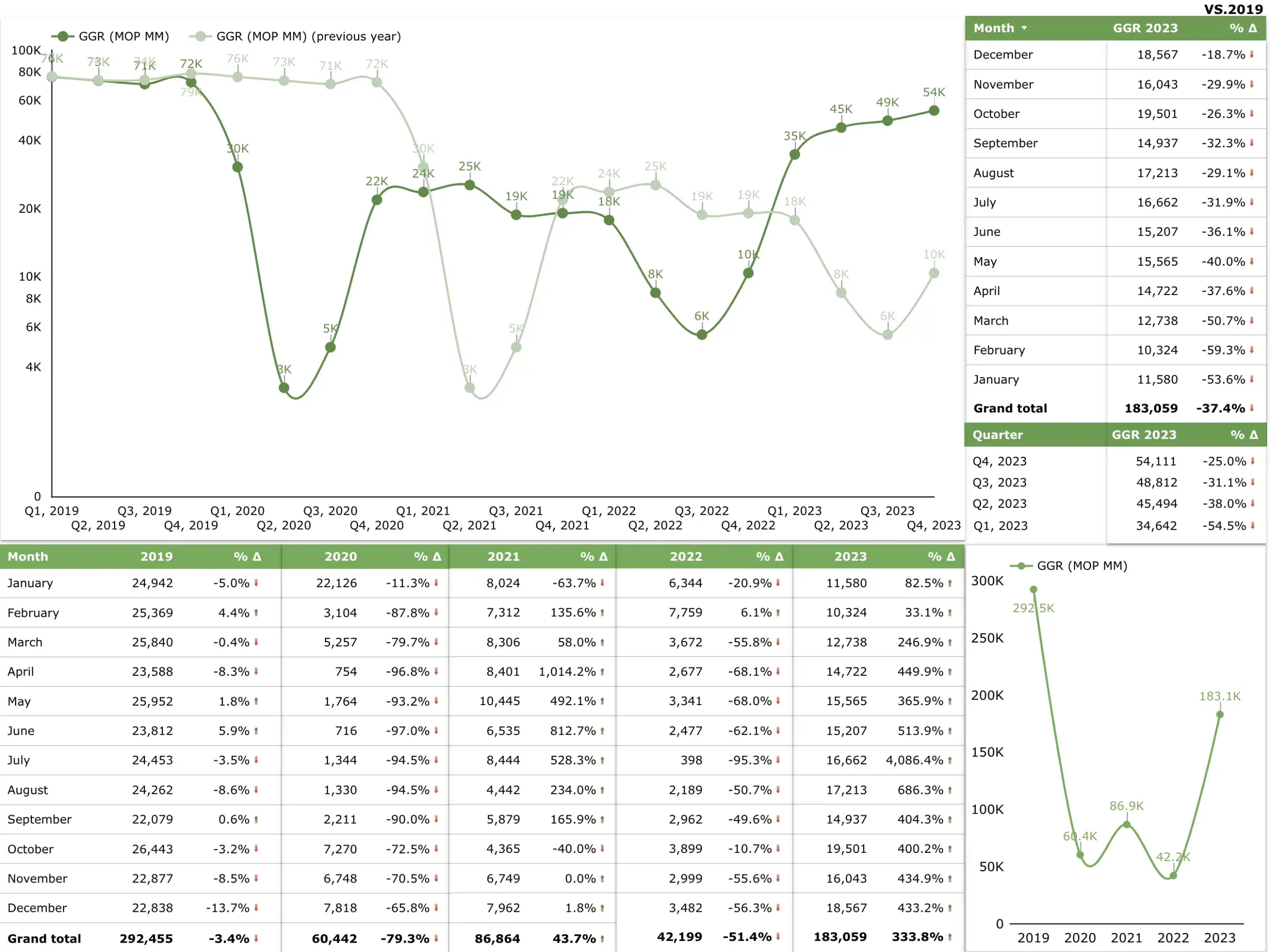

In the general preview, the investment bank notes that despite China-related concerns, the Macau gaming sector is poised to grow 4Q23 adjusted EBITDA by 8 percent quarter-to-quarter, reaching $1.97 billion, underpinned by an 11 percent growth in gaming regulator-reported gross gaming revenue (GGR). The adjusted EBITDA represents 82 percent of 4Q19 levels.

CLSA has adjusted corporate expense forecasts and trimmed the sector EBITDA forecast by roughly 1 percent.

Meanwhile, CLSA expects Macau’s GGR to grow 30 percent year-on-year to $29.2 billion in 2024, slightly higher than the forecast of 28 percent by Morgan Stanley.

Macau’s GGR for 2023 totaled MOP183.1 billion ($22.76 billion), reaching 62 percent of pre-COVID-19 pandemic figures.