Melco Resorts CEO, Lawrence Ho, says that the recovery in Macau so far “has exceeded all of our expectations”. The statement comes as Melco narrowed its loss significantly, to $81.28 million and recorded adjusted property EBITDA of $190.8 million – up nearly four-fold yearly.

The group notes that its rebound “is very much a premium mass-led recovery”, notes the group’s CEO, pointing out that moving ahead from 1Q23 “for Golden Week especially, all of our key volume metrics at mass, slots and premium direct are all exceeding 2019 levels. So I think naturally, the spend per customer is higher than previously.”

Total operating revenues for the group during the quarter were up 51 percent yearly, to $716.48 million, of which casino revenues totaled $599 million.

The group notes that a return to previous visitation levels is expected “in the next few months within this calendar year”, in which case Ho notes that “judging from where our mass and slots and premium direct numbers are, will exceed that of 2019 sooner rather than later”.

Speaking of returning to 2019 levels, the group’s CFO, Geoffrey Davis, notes that the group will require some 110 percent to 115 percent of mass GGR “to have similar EBITDA to 2019”.

City of Dreams Macau

Going by property, the group’s City of Dreams flagship in Cotai was the main generator of revenue, totaling $358.3 million, up 40 percent yearly.

The property generated $94.9 million in adjusted EBITDA, up 113 percent, ‘primarily a result of better performance in the mass market table games segment and non-gaming operations’.

Rolling chip volume amounted to $4.04 billion, up 65 percent yearly, while mass market drop nearly doubled, to $1.02 billion.

The gaming machine handle rose by 72 percent, to $655.7 million.

Altira

At the group’s Taipa property, Altira Macau, revenues were up 71 percent, to $23.8 million, but the property registered negative property EBITDA of $2 million, down from $9.4 million in 1Q22.

Mass market drop nearly doubled yearly, do $82.6 million, while the gaming machine handle rose 47 percent, to $74.3 million.

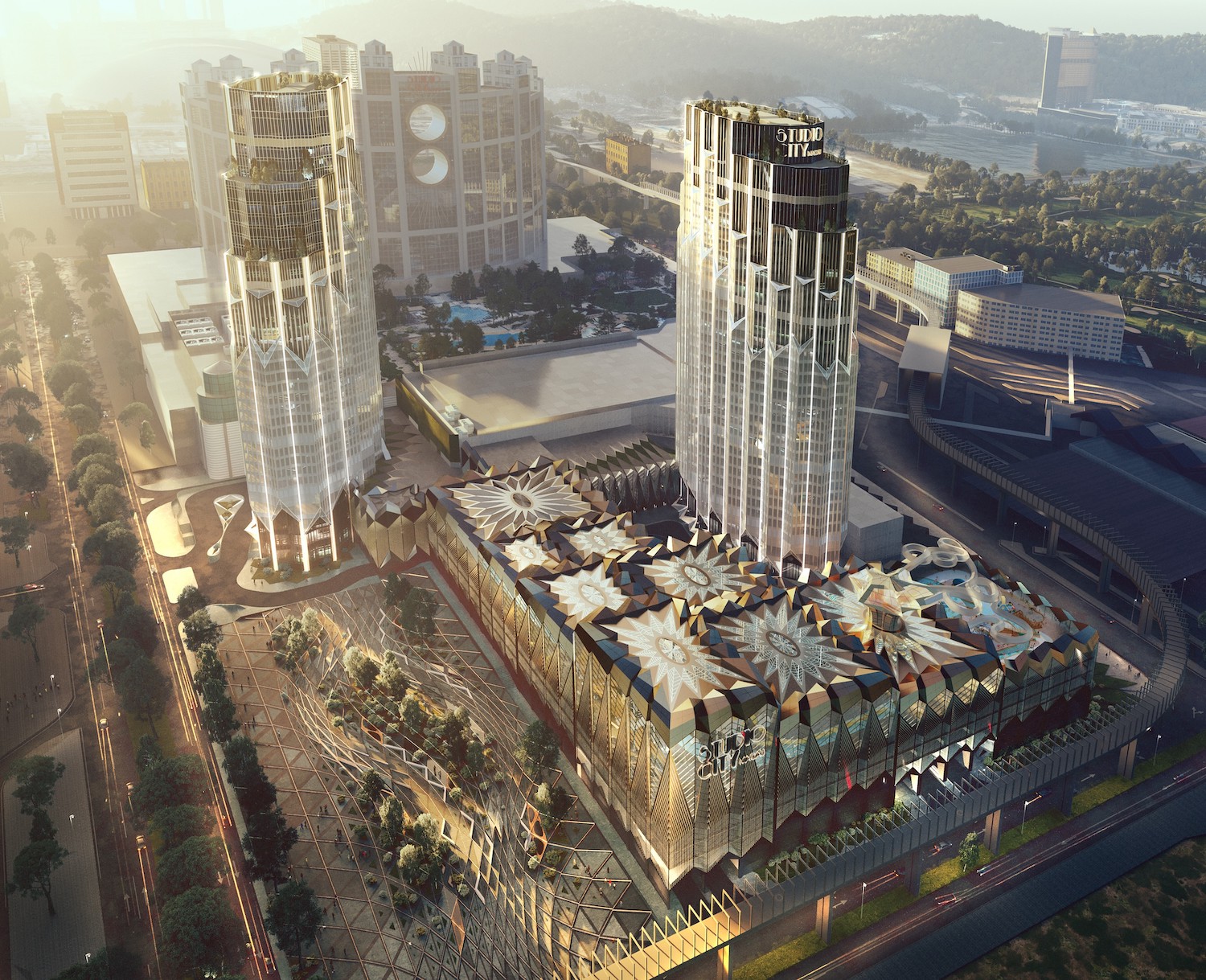

Studio City

The group’s Studio City property saw revenue more than double, to $142.2 ,million, with adjusted EBITDA of $20.6 million – a strong reversal from the $17.3 million loss in 1Q22, largely attributed to better mass and non-gaming.

Rolling chip was $718.5 million, up 63 percent yearly.

Mass table games drop was up 150 percent yearly, toping $480.6 million.

Gaming machine handle was up 85 percent yearly, to $431.7 million.

Philippines

Results in the Philippines also did not disappoint, with revenue at $133.3 million (compared to $86.9 million in 1Q22), while adjusted EBITDA nearly doubled, to $60.9 million.

The result was ‘primarily a result of better performance in all gaming segments and non-gaming operations’.

Rolling chip rose incrementally, to $655.8 million, with mass market drop at $177.1 million, up 39 percent.

The gaming machine handle rose to $979.5 million, up 26 percent yearly.

Cyprus

Regarding Cyprus, where the group is expecting to open its City of Dreams Mediterranean in “mid-June”, the group’s temporary casino and four satellite casinos performed strongly, with revenue of $27.8 million, up 72 percent year-on-year.

A strong rise in adjusted EBITDA was registered, to $8.7 million, from $0.9 million in 1Q22, due to ‘better performance in the mass market segment’.

Rolling chip fell significantly, to $0.5 million, from $2.2 million in 1Q22, while mass drop rose by 57 percent, to $42.2 million.

The gaming machine handle was the primary contributor, at $384.9 million, up 55 percent yearly.

Affecting factors and further openings

The group notes that, in Macau, it continues to operate at limited capacity, starting the quarter with 70 percent of hotel rooms, which rose to 80 percent in April and 90 percent during Golden Week.

The group aims to return to 100 percent “by the end of June”, including its new Epic Tower in Studio City Phase 2.

The property initially opened with 100 rooms, ramping up to 338 rooms and suites during Golden Week.

The group’s COO, David Sisk notes that the new hotel is “going to allow us to really grow our premium mass customers over at Studio City”, noting that drop has risen already 40 percent and “we’re anticipating better results as we go forward”.

The remainder of Studio City’s Phase 2 is expected to open “in September before Golden Week in October,” notes the group’s CEO, adding some 550 rooms to overall supply.

The group notes that it’s currently operating with about 2,000 less full-time employees than in 2019.