Macau’s gaming industry faced a challenging fourth quarter of 2024, with December’s gross gaming revenue (GGR) falling below projections due to President Xi Jinping’s three-day visit to the SAR, brokerage Seaport noted. But things are looking up for 2025.

The long-term outlook for Macau’s gaming industry remains positive, with Vitaly Umansky, senior analyst for Seaport Research Partners, expecting a growth rate of 8 percent in 2025, supported by improving economic conditions in China.

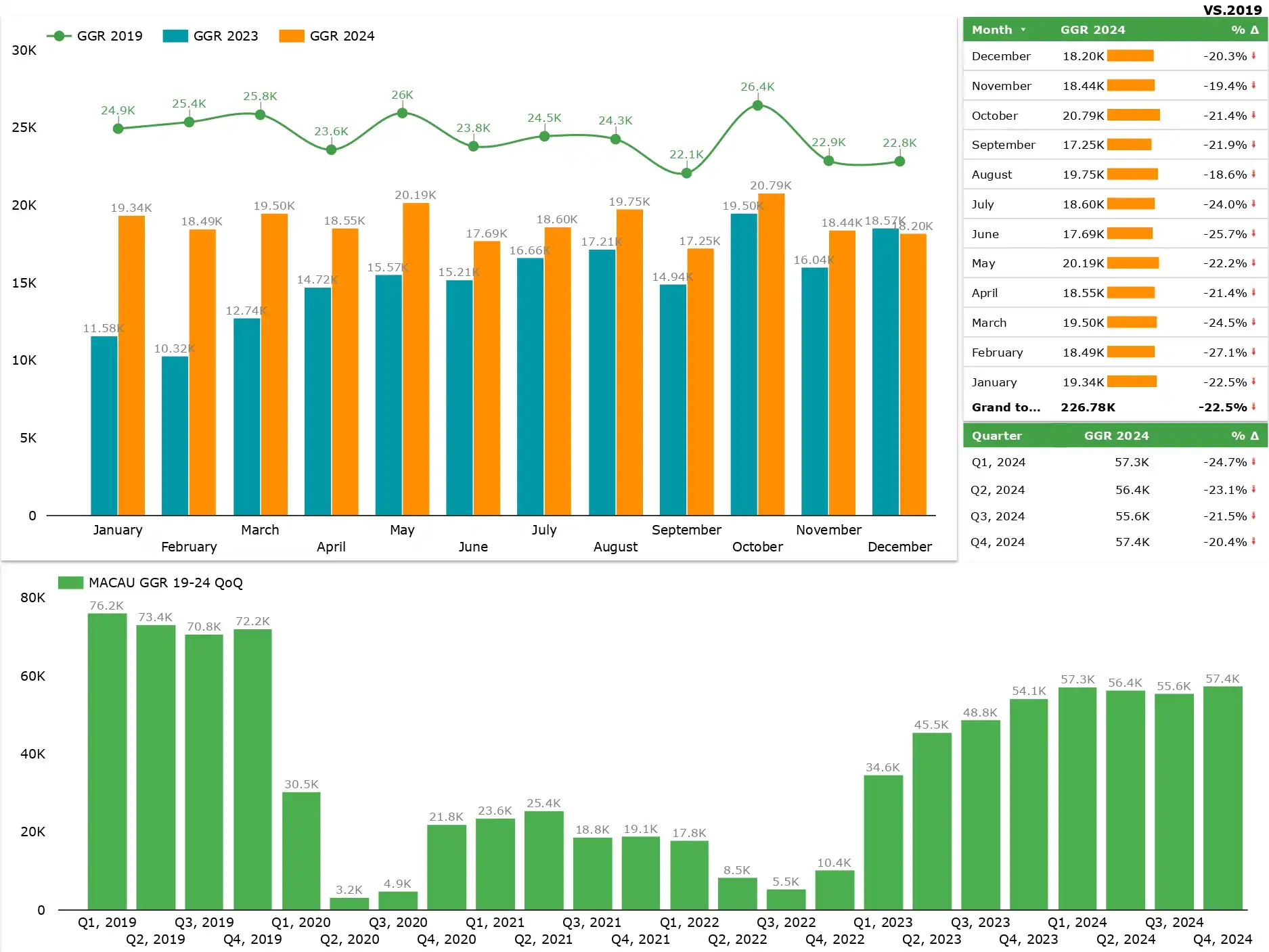

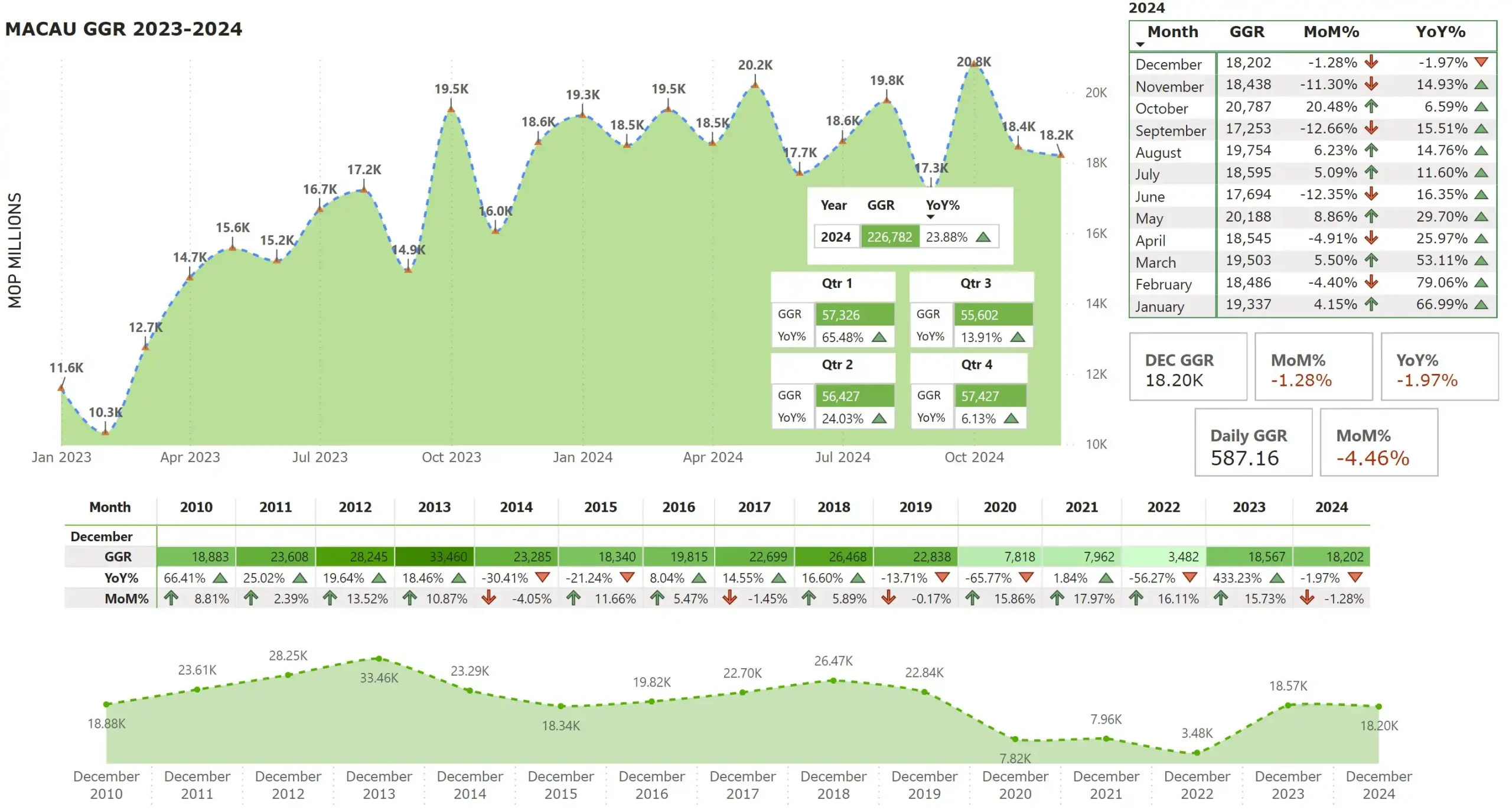

The total GGR for Q4 reached MOP57.4 billion ($7.15 billion), reflecting a year-on-year increase of 6.1 percent and a 3.3 percent rise from the previous quarter. However, this figure remains at 79.6 percent of the GGR from 4Q19.

For the whole of 2024, Macau’s GGR totaled MOP226.8 billion ($28.17 billion), marking a robust year-on-year growth of 23.9 percent.

Mass market gaming contributed significantly, accounting for over 88 percent of the total GGR. Despite this, the annual growth slightly underperformed against earlier estimates of 25 percent.

“December’s GGR was particularly disappointing, coming in at MOP18.2 billion ($2.27 billion). This represented a decline of 2 percent year-on-year and a 1.3 percent month-on-month drop, falling short of early month predictions that anticipated a 5 percent increase compared to the previous year”, indicated Umansky.

The month’s performance was adversely affected by a visit from Chinese President Xi Jinping to celebrate the SAR’s 25th handover anniversary, which dampened the influx of high-spending customers. However, the latter half of December showed signs of recovery as spending picked up.

The average daily GGR for December was MOP587 million ($73.4 million), the second lowest of the year, trailing only behind September. The comparisons to December 2023 were challenging, primarily due to having two fewer weekend days and the impact of high-profile visits on customer traffic.

Looking ahead, Umansky expects January 2025 to show significant improvement over December, with the Lunar New Year holiday from January 28th to February 3rd anticipated to boost visitor numbers.

Predictions indicate a 6.6 percent year-on-year increase in GGR for January, along with a 13.3 percent month-on-month rise. The first quarter of 2025 is projected to see a 4.2 percent increase compared to the same period in 2024.

Despite the mixed signals in 4Q24, the long-term outlook for Macau’s gaming industry remains optimistic, according to Seaport, with continued growth expected throughout 2025.

Umansky estimates an annual growth rate of 8 percent, supported by improving economic conditions in China.

Recent changes in visa policies are set to enhance accessibility for mainland Chinese visitors, particularly from Zhuhai and Hengqin, who can now obtain multi-entry visas allowing weekly visits, the analyst adds.

“The country has enhanced various visa policies for mainland visitors to Macau, including expedited processing times and improved procedures for business visas, the expansion of IVS cities, and new multi-entry visas for hotel guests in Hengqin, as well as multi-entry visas for conventions”, Umansky noted.

Starting January 1st, 2025, residents of Zhuhai, a mainland city of 2.5 million people adjacent to Macau, have been able to obtain multi-entry visas allowing them to enter Macau as frequently as once a week, a shift from the previous policy of one visa every two months, with the same applying to Hengqin residents.

“This new visa policy aligns with a similar initiative for Shenzhen residents, which took effect on December 1st, 2024, permitting daily visits to Hong Kong. Visitors from Zhuhai account for over 26 percent of the total visitors from Guangdong to Macau, a crucial province for the region’s tourism (with over 53.2 percent of mainland visitors to Macau this year coming from Guangdong)”.

Furthermore, ongoing government stimulus measures in China, particularly aimed at revitalizing the real estate market, are expected to bolster consumer confidence and spending. As the Macau economy adjusts, the gaming sector’s resilience is highlighted by robust spending per visitor, particularly within the premium segment.

Despite the challenges posed by a crackdown on illegal money changers and associated criminal activities, analysts maintain a favorable view on gaming stock valuations. With many stocks in the sector remaining undervalued, the risk/reward ratio for investors continues to look promising.