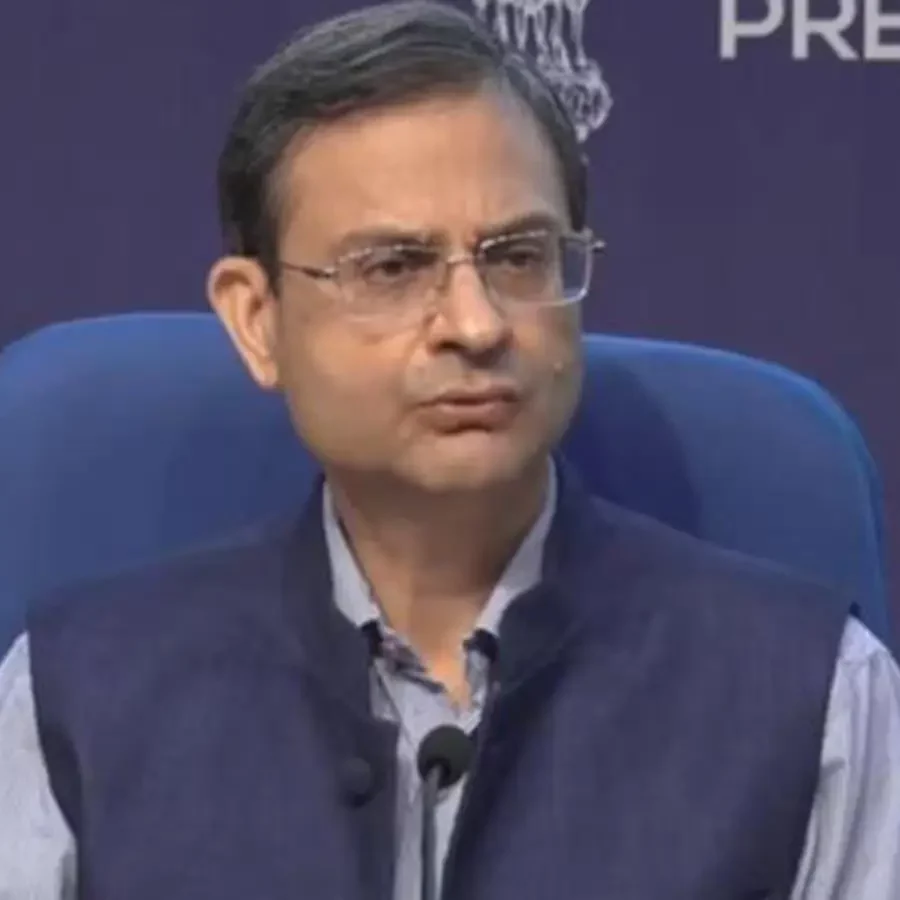

Indian revenue secretary Sanjay Malhotra announced that the Goods and Services Tax (GST) Council will reassess the decision to impose a 28 percent taxon the full face value of online gaming, but only after March 31.

“The review of the GST on online gaming will not occur in the upcoming meeting as the six-month period concludes on March 31. Therefore, it may be addressed in the GST Council meeting thereafter,” Malhotra stated according to Bloomberg.

Sources have indicated that the next GST Council meeting is scheduled for later in February, within this quarter.

Malhotra clarified that a review does not necessarily entail changing the rates but is intended to evaluate if any adjustments are warranted.

The GST Council revised the tax rate on online gaming from 18 percent to 28 percent on the full face value, effective October 1, 2023. Since then, revenue from the sector has increased nearly sixfold, according to the Revenue Secretary.

If the same tax rate is maintained, the government stands to collect a significant portion of GST revenue from online gaming.

It is estimated that the government will generate over 7,000 crore ($84) in FY24 and 14,000 crore ($168) in FY25 in GST revenue from online gaming, up from 1,600 crore ($20) in 2022-23.

“In the last three months, following the introduction of the new tax regime for online gaming, we have witnessed an increase in revenue from 605 crore ($7) to 3,470 crore ($42), resulting in an additional 12,000 crore (144) GST revenue (per year) from online gaming companies,” Malhotra stated.

“Therefore, an expected increase from 1,600 crore ($20) in 2022-23 to over 7,000 crore ($84) this year is anticipated, and 14,000 crore ($168) next year if we are able to maintain the same rate as in the first three months after the implementation of the revised tax rates. Effective October 1, 2023, a 28 percent GST is levied on the face value every time a player makes a deposit on an online gaming platform. For tax purposes, the deposit duration is significant, not the gaming time.”