Although some research shows that the willingness of Chinese tourists to spend in Macau remains high, recent market changes signal a potential decline in consumption.

The expansion of non-gaming facilities surrounding casinos has faced some headwinds recently. Hidden risks are emerging, highlighted by news that Macau’s leading luxury retailer, DFS, has implemented voluntary unpaid leave for all employees during the summer season, which is typically characterized by high seasonality.

The retailer in question has reportedly experienced a 40 percent drop in sales revenue this year compared to the same period last year, a trend that starkly contrasts the ongoing recovery in visitor arrivals this year.

Looking at the official data, Macau received nearly 14.2 million visitor arrivals from January to May this year, up 50.2 percent year-on-year. In May alone, Macau visitor arrivals rose 21.6 percent year-on-year to just over 2.69 million, with the city’s gross gaming revenue (GGR) reaching MOP20.19 billion ($2.51 billion), the best monthly performance since January 2020.

However, the most recent official data also indicate that all types of interviewed retailers registered a year-on-year decline in sales in April, with Watches, Clocks & Jewellery Retailers recording the largest decrease of 44.6 percent.

Specifically, sales in department stores dropped 32.7 percent year-on-year in April, cosmetics and sanitary articles dropped 36.5 percent, and adult clothing decreased 33.5 percent compared to the same period last year.

The conflicting data between GGR, visitor arrivals, and retail numbers suggests that the challenges faced by DFS may indicate a broader issue within the industry.

Consumption reshaping

In an interview with AGB, Nelson Kot, president of the Macau Comprehensive Social Research Association, noted that according to projections, Macau could achieve MOP210 billion ($26.12 billion) in GGR in 2024. However, he emphasized that consumption patterns are “reshaping”.

“The luxury retail shops in Macau are targeting mainland Chinese, and more and more of these duty-free shops opening in recent years will make Macau less attractive,” Kot noted.

At the same time, the higher currency rate of the pataca (Macau’s currency) is also a negative factor for retail, as the advantage of duty-free shopping has been reduced. Chinese shoppers find themselves with less buying power when using Renminbi.

In a long-term analysis, Kot mentioned that the end of the junket business has also decreased high-end spending in Macau.

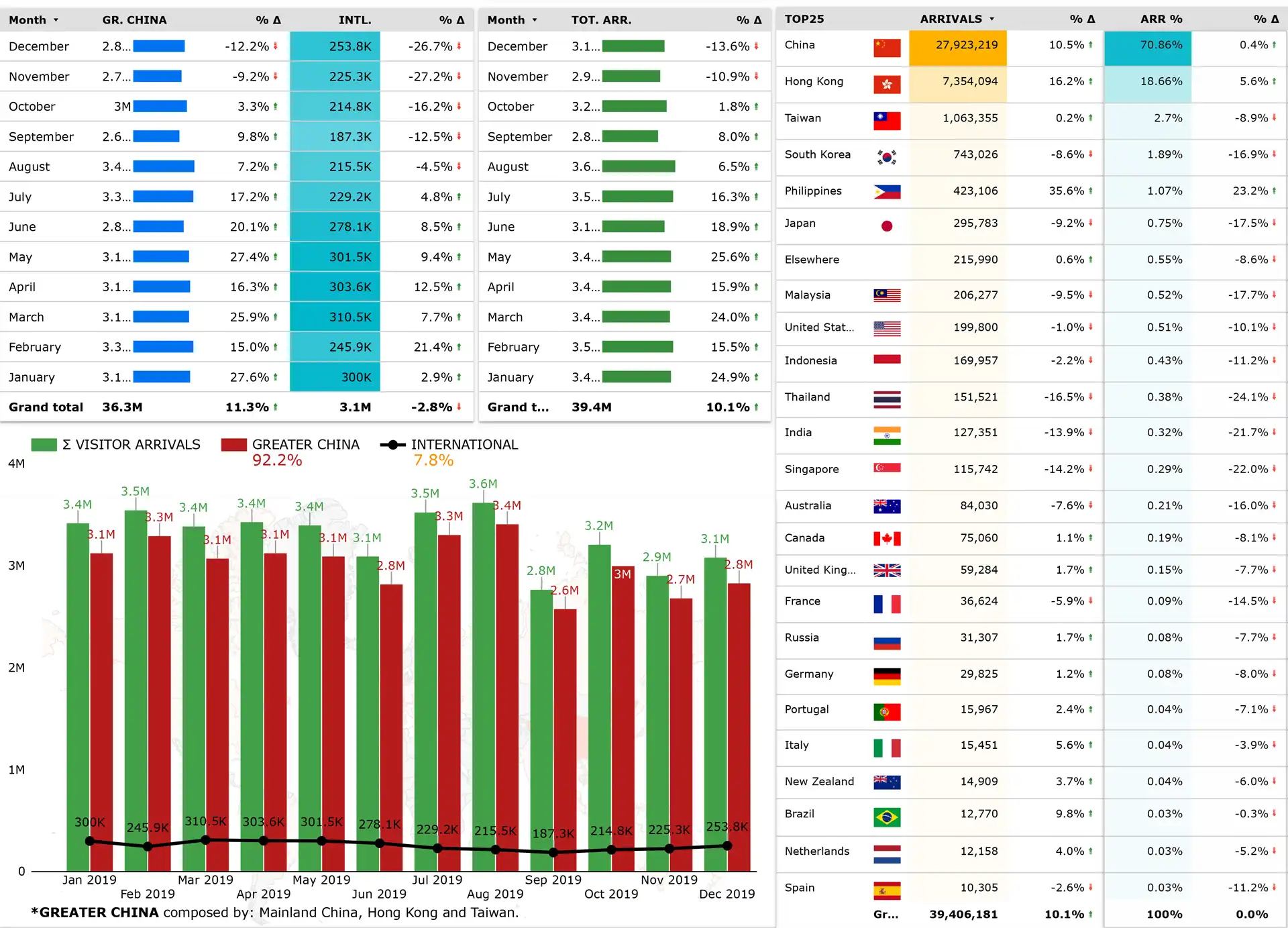

Macau welcomed nearly 40 million visitors in 2019, a year before the COVID outbreak, which is why investors in luxury products were confident in market expansion in Macau.

However, the tourist demographics show that more leisure and family tourists have appeared in the post-COVID era, indicating that tourists are seeking experiences rather than shopping, as in the past.

Amid increasing competition and China’s economic challenges, Nelson Kot considers that it is “too early to declare overcapacity” in Macau’s retail industry. He pointed out that DFS will open a new shop in the M8 shopping mall near Senado Square in the city center.

In this context, Kot believes that business owners are more attuned to the true data, “which helps them decide whether to shut some shops or find new locations closer to more middle-class customers instead of focusing solely on the high-end market”.

Increasing duty-free limit for Chinese visitors

The weaker-than-expected recovery in consumption in Macau and Hong Kong is also under scrutiny by the Chinese central government.

Beginning July 1st, Chinese visitors will be allowed up to RMB15,000 ($2,064) in duty-free shopping in Hong Kong and Macau, nearly doubling the current limit.

This measure was introduced as both cities have experienced a slowdown in the post-pandemic recovery of their retail and tourism industries, cornerstones of their economies, due to reduced spending by Chinese visitors.

The announcement follows previous research from investment bank CLSA that indicated Chinese visitors continue to have a high willingness to spend in Macau.

The research found that 85 percent of respondents would at least maintain their gaming budget, particularly in the base mass and premium mass segments. Additionally, 40 percent have a per-person gaming budget of above RMB25,000 ($3,460).

For non-gaming activities, 32 percent of participants would spend RMB20,001 ($2,770) or more per person.