Brokerage Morgan Stanley expects that Macau’s gaming industry property EBITDA will decrease by 4 percent, amounting to US$1.97 billion, from the previous quarter.

Analysts with the firm indicate that the projection is based on an assumption of a 3-4 percent quarter-on-quarter increase in operating expenses, though reinvestment costs could be flattening.

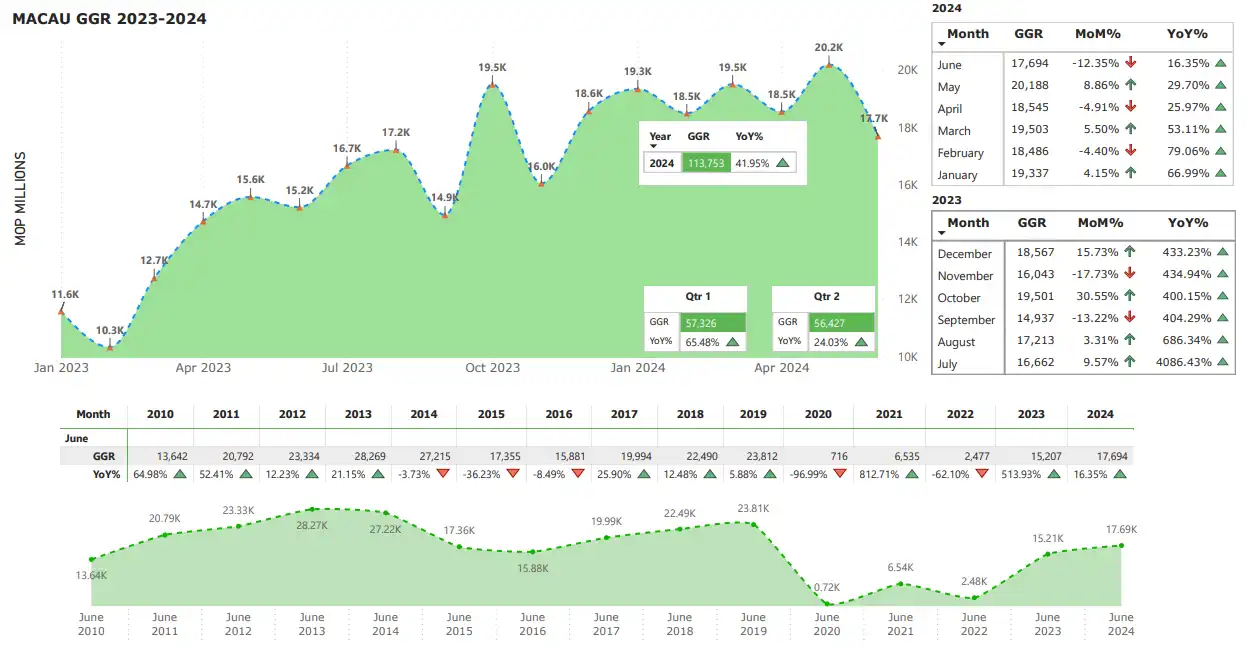

Macau reported June gross gaming revenue (GGR) of MOP17.7 billion ($2.21 billion), reflecting a decrease of 12.4 percent month-on-month and an increase of 16 percent year-on-year, reaching 74 percent of 2019 levels.

In their latest investment memo, analysts Praveen K. Choudhary and Gareth Leung from Morgan Stanley noted that mass GGR is expected to decrease by 2 percent, amounting to approximately $125 million from the previous quarter. They forecast it to reach about 113 percent of 2Q19 levels, totaling $6.2 billion, assuming mass GGR remains at 87 percent of total GGR, consistent with 1Q24.

The brokerage holds a positive outlook on June’s GGR. However, it mentions ongoing concerns in the market, including no free snacks for non-gamblers, fewer referral programs, and weaker retail sales and Chinese macros.

Wealthier travelers diverting to other destinations

In another investment memo, Goldman Sachs notes that for 2Q24 as a whole, Macau’s industry GGR totaled MOP56.4 billion ($7 billion), a 1.6 percent decrease quarter-on-quarter, ‘still outperforming historical seasonality of -3-5 percent quarter-over-quarter.’

Macau’s inbound visitation improved to 79 percent of FY19 levels in May, driven by more travelers from Hong Kong. Visitation from mainland China remained fairly steady at 77 percent.

However, after months of strong performance, Goldman Sachs indicates signs that some Chinese travelers from wealthier provinces (e.g., Shanghai, Beijing) are diverting to other destinations such as Japan, Korea, and Thailand, which have been operating at 102-108 percent of pre-COVID-19 levels in recent months (versus 120-150 percent in late FY23). Meanwhile, there is an increase in travelers from other provinces such as Zhejiang and Guangdong.

Increased duty-free limit

Beijing has just implemented a duty-free purchase cap increase for mainland Chinese tourists visiting Hong Kong and Macau, raising it from RMB5,000 ($688) to RMB12,000 ($1,650) effective July 1st. When combined with purchases made in duty-free shops at the border checkpoints, mainland Chinese traveling to Hong Kong or Macau can bring back items worth up to RMB15,000 ($2,063) tax-free.

Goldman Sachs notes: ‘This change follows several months of lobbying by Hong Kong politicians, as Hong Kong’s retail market has remained soft for over a year after reopening.’

Although this still represents a substantial gap compared to the RMB100,000 ($13,750) annual duty-free quota for Chinese visitors to Hainan, the brokerage believes ‘the policy will encourage purchases of more big-ticket items in Macau, thereby supporting tenant sales at casino operators’ malls, especially as we head into the summer peak season.’