Macau’s gaming law amendments will result in a significant reorganization of its satellite casinos, which account for about 45 percent of the total. However, they are unlikely to be eradicated altogether. Carlos D. Simões, a partner with law firm DSL, and associate Paulo Rowett, take us through some of the likely solutions to one of the key concerns in the new legislation.

On January 18th this year, the Macau government published the draft amendments to its Gaming Law, kicking off the current discussion on the fate of the satellite casinos.

Although the term is widely used in gaming industry lingo, there is no legal definition of “satellite casino” under Macau laws.

“Satellite casinos” can be described as arrangements between a concession holder and a third party-owner, under which the hotel owner requests the use of a concessionaires’ license to run gaming operations in a designated area of the hotel, or property.

The concessionaire undertakes all gaming operations, namely supervision of gaming staff, leaving the operation of other hotel services, such as cleaning, F&B, etc. to the owner. In sum, these are gaming establishments technically managed by the gaming concessionaires but de facto indirectly owned and managed by the independent investors in their properties.

Currently, pursuant to Section 7 of Law 16/2001 (Gaming Law), the commercial operation of casino games of chance can only be pursued by one of the three original concessionaires; SJM, Galaxy Casino, S.A. and Wynn Resorts (Macau) S.A., or its sub-concessionaires: MGM Grand Paradise, S.A.; Venetian Macau, S.A. and Melco Crown (Macau) S.A..

“In reality, satellite casinos are a legacy that goes back to STDM times, which was the predecessor of SJM.”

During that era there were no integrated resorts, no foreign operators and no Cotai. These satellite casinos were a simple way to diversify the offer available and to involve other business partners.

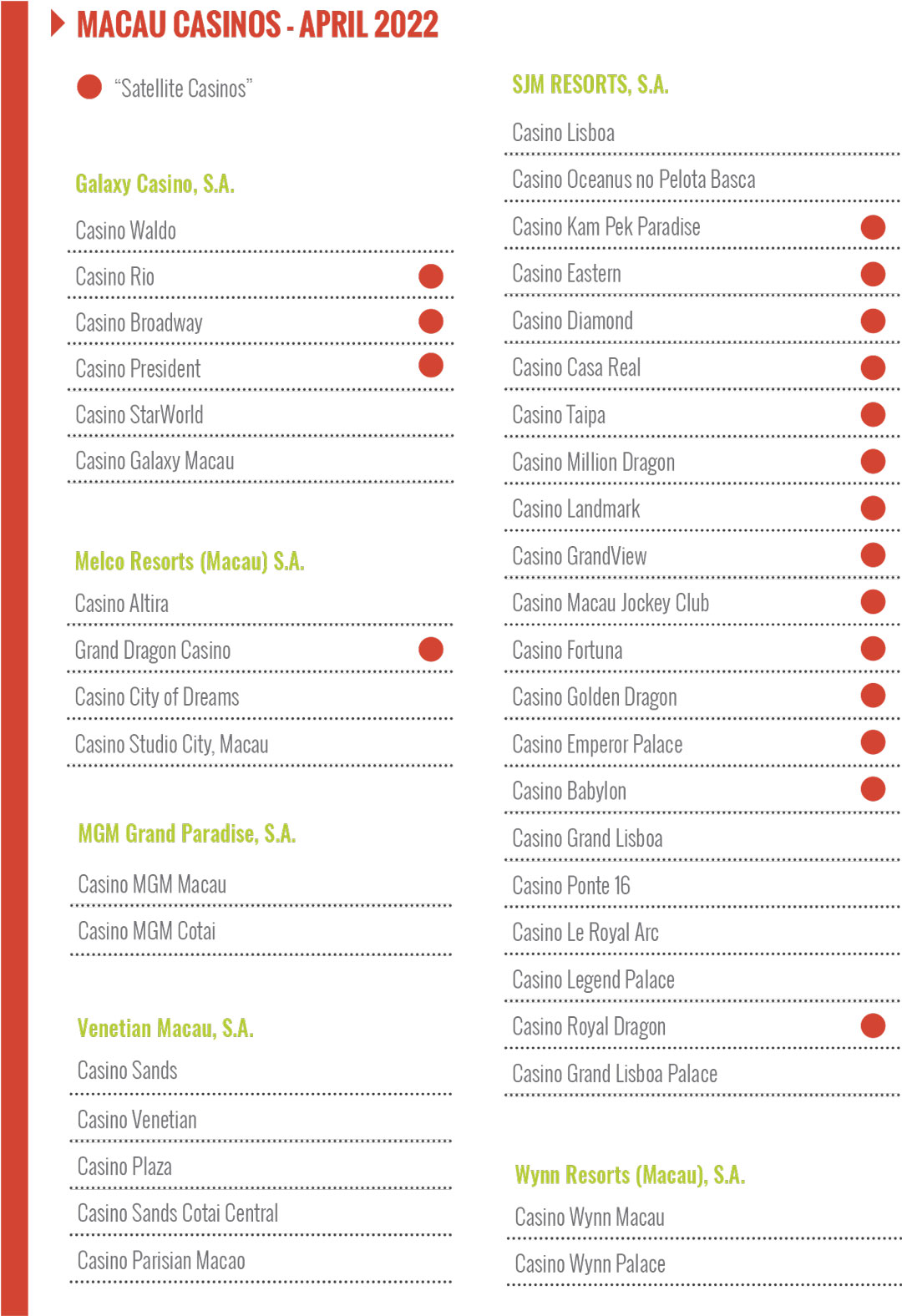

At the end of 2021 there were 40 casinos operating in Macau:

Of those 40 casinos, 18 qualify as satellites. Only 22 are directly owned and managed by the concessionaires. Of the 18 satellite casinos, a total of 14 satellite casinos are under the umbrella of SJM, while the other four are under Galaxy and Melco Resorts.

Fast forward 20 years and it now seems such heritage is to be discarded, or “purged” as some commentators have noted.

Under an amendment to Section 5, number 3 of the Proposed Gaming Law, the reality of satellite casinos is being reshaped by a draft that rules that “a concessionaire must operate games of chance in casinos in a location where it holds ownership of the real estate (…).” In one stroke, by inserting this new requirement, the Proposed Gaming Law rules that “satellite casinos” are over and done.

Needless to say this provision has proved to be a focal point in the Legislative Assembly discussions, where local business sectors are well represented – the same business sectors that are also well engaged in the existing satellite casinos.

The recent announcement of the closure of the four satellite casinos managed by the Golden Dragon Group has also served to build up the pressure in the current discussions.

The main controversial point is the transitional period, which will allow some time for the satellite casinos to get adapted to the “new reality.”

The government has proposed a grace period of three years to allow the current operators reasonable time to realign with the provisions of the draft law.

The “start” of the three-year grace period for satellites will match the start date of the new gaming concessions. However, a further extension is being considered by the Legislative Assembly of up to five years, according to recent government announcements.

The government is conducting site checks on satellite casinos, investigating and inspecting all properties of the concessionaires for the bill amendment to better suit the local needs.

But the reality is that some solution(s) will be needed once the transitional period ends. What will happen to the satellite casinos after three, or five years?

A possible outcome is the purchase of satellite properties by the concessionaires. Such a solution increases the concessionaires’ responsibilities, granting them full administration and control of non-gaming services and facilities. It is, however, very unlikely that concessionaires will undertake such a considerable investment when the market is performing so poorly.

“Whatever the outcome of this conundrum, the fact is that concessionaires are not overly concerned.”

So far, there is much speculation over ways to address this option. Must the premises on which a casino is operated be 100 percent owned, or just majority-owned (over 50 percent) by the concessionaire? Would a joint ownership or equity investment of less than 50 percent be possible on those properties?

On the other hand, hotel owners may consider dividing the property and transferring the strata area related to the casino, instead of considering a transfer of the entire property, since only the property associated with gaming activity needs to be owned by the concessionaire.

This is seen as the best-case scenario and one that will certainly be the case if the third-party operators are allowed to transfer an undetermined share of the overall property and not the specific part where the casino operates.

Of course satellite venue owners may simply take the decision to close when faced with such a transition requirement, resulting in jobs being lost.

But it is also unlikely that all the existing satellite casinos will close once deprived of the casino part because there is value in the remaining hotel operations.

It’s undeniable that there is huge demand in Macau for low-cost or budget hotels and this could represent an opportunity to explore.

To this extent, the new Law no. 8/2021 on Hotel Activity, that came into force on January 1st, 2022, already introduced a new concept: low cost and budget accommodation.

The new hotel activity law states that low-cost hotels may choose to provide accommodation in single or shared rooms (where a lease can be made per bed). The rooms may lodge four or eight visitors similar to accommodation in hostels.

While offering accommodation in private homes remains illegal, by regulating affordable, legal accommodation solutions, the law amplifies the spectrum of visitors and addresses the usual short nature of their stays in town.

This may be an opportunity available for former satellite casinos if they are deprived of their gambling revenues. Whatever the outcome of this conundrum, the fact is that concessionaires are not overly concerned.

The existence of “satellite casinos” has undermined a gaming system that is supposed to prevent other investors or operators from entering the gaming market.

“Satellite casinos” have been operating in a grey area under the concession model outlined by the current Gaming Law and represent a regulatory hazard.

Considering the lack of gaming tourism in the territory due to Covid, the sustained losses, depletion of cash flow and recent travel restrictions for Mainland residents’ trips to Macau, if it were up to the concessionaires, the satellites would most certainly face closure.

This would mean that various service industries would suffer, leading to an increase in unemployment and the closure of some companies. It would also undermine the local hospitality sector, where development of gaming peripheral sectors – businesses that combine leisure and hospitality with retail, such as restaurants, bars, café, spa, etc. – are highly inter-dependent.

Although the extinction of “satellite casinos” (as we currently know then) might happen in the near future under the proposed changes to Gambling Law, it’s not likely we will witness the eradication of these small-scale casinos throughout the territory.

These “little casinos” possess a high degree of operational resilience and responsiveness and even with stricter legal provisions, many outcomes are possible.

* About the Authors

Carlos D. Simões is a Partner at DSL Lawyers. Paulo Rowett is an Associate at DSL Lawyers.