As countries in east Asia begin to welcome pandemic-weary tourists, casinos outside of Macau have begun to resume normal operations. Cautious optimism has, however, been tempered by fears of a global recession, fueled in large part by inflation, and the impact that these economic factors could have on the gaming industry’s recovery.

Up until 2007, it was largely believed that casinos were immune to recessions. The Great Recession of 2007-2009 dispelled that belief. Casinos in regional US markets saw revenue declines that took years to recover.

The Las Vegas tourism economy was devastated by the events that led to this recession, starting with the collapse of the US housing market, which in turn brought a near total breakdown in bank lending.

Today, vestiges of that economic collapse can be found in three notable projects: the Fontainebleau Las Vegas, the St. Regis Suites at the Palazzo, and the recently completed Resorts World Las Vegas.

Construction on the Fontainebleau Las Vegas began in 2007, and the 68-floor structure was topped off in November of 2008. It was to be comprised of a 95,000 sq. ft casino, 2,781 hotel rooms, 1,018 condominium units, a shopping mall, and convention facilities.

Lenders terminated funding for the project in 2009 and construction was halted with the project 70 percent completed. It has stood that way for fourteen years, through bankruptcy and a succession of owners. Construction only recently resumed with completion now scheduled for 2023.

The Echelon Resort was a $4.8 billion integrated casino resort that was to be built near the Fontainebleau. The 63-acre site was to include a 140,00 square foot casino, four hotels with 5,300 rooms, twenty-five restaurants and bars, a shopping mall, and a 650,000 square-foot convention center. Construction started in June of 2007 with a planned opening in 2010.

Building was suspended in August of 2008 when Morgans Group and General Growth Properties, two development partners in the project, could not secure financing. In 2013, Boyd Gaming, the original developer sold the site to the Genting Group.

The partially built steel frame stood unfinished until 2017 when construction finally resumed. Resorts World Las Vegas ultimately opened in June of 2021, fourteen years after the original groundbreaking.

The St. Regis Residences was originally planned as a 50-story luxury condominium tower that was to rise above the Palazzo shopping mall at the Venetian. It was to include 398 units. Construction of the $465 million tower began in early 2007. In November of 2008, construction was halted due to the Great Recession.

In 2011, the developers wrapped the steel superstructure in giant sheets that were printed with murals that resembled a finished building. Uncertainty in the high-end residential market continued to postpone completion of the project.

Today, the steel framework remains, hidden in plain sight, and only a discerning eye can make out the unfinished structure, with two construction cranes serving as the only visible cue that the building remains uncompleted.

The lending crisis quickly spilled over to Macau where construction on a number of projects on the Cotai Strip came to a halt. Construction on Plots 5 and 6, what were to become Sands Cotai Central, stopped in mid-2008 with 65 percent of the project completed. Ultimately, construction resumed in 2010, and the project opened in 2012.

The recession also slowed the completion of Galaxy Macau. Originally conceived in 2002, the project was well underway when the recession hit.

In 2009, the project’s construction decelerated to a point where it took two additional years to complete. It ultimately opened in May of 2011.

The threat of recession in 2022

The banking crisis and the recession that it spawned was a once-in-a-generation economic collapse that affected countries and industries across the globe. It is unlikely that such an economic event could re-occur in 2022 and have a similar impact on the global economy.

Rather, the gaming industry should be more concerned with inflation and its more immediate impact on consumer spending. For this, an examination of various US gaming markets serves as a bellwether for what Asian gaming jurisdictions might expect.

Casino gaming is perhaps the most discretionary of consumer purchases. Given all of the non-essential expenditures that consumers can cut down on, casino gambling is probably the first to go.

An examination of casino performance in the regional US markets along with Las Vegas provides a reasonable predictor for what Asian gaming jurisdictions can expect.

The United States was one of the first countries to restart its economy after a brief lockdown that began in March of 2020. Casinos in regional markets began to re-open in May 2020 and Las Vegas came back to life in June. As vaccines became widely available, more consumers ventured out with March 2021 probably representing the first month of a full recovery.

While consumer prices rose throughout 2021 due to pent-up demand, supply chain disruptions, and changes in consumer preferences, the 2022 war in Ukraine and its impact on fuel and food commodity prices stoked what had been a troublesome economic trend into the highest rate of inflation in forty years.

By April of 2022, gas prices in the United States reached record levels, and consumer prices rose across a broad range of products and services.

When examining gaming trends in the United States, it is important to distinguish between the Las Vegas gaming market and regional casino markets across the United States. Trips to Las Vegas tend to be planned over a longer time horizon while decisions to visit casinos in regional markets are often made spontaneously. As such, they are an excellent gauge of consumer sentiments in the face of rising prices.

Regional US gaming markets

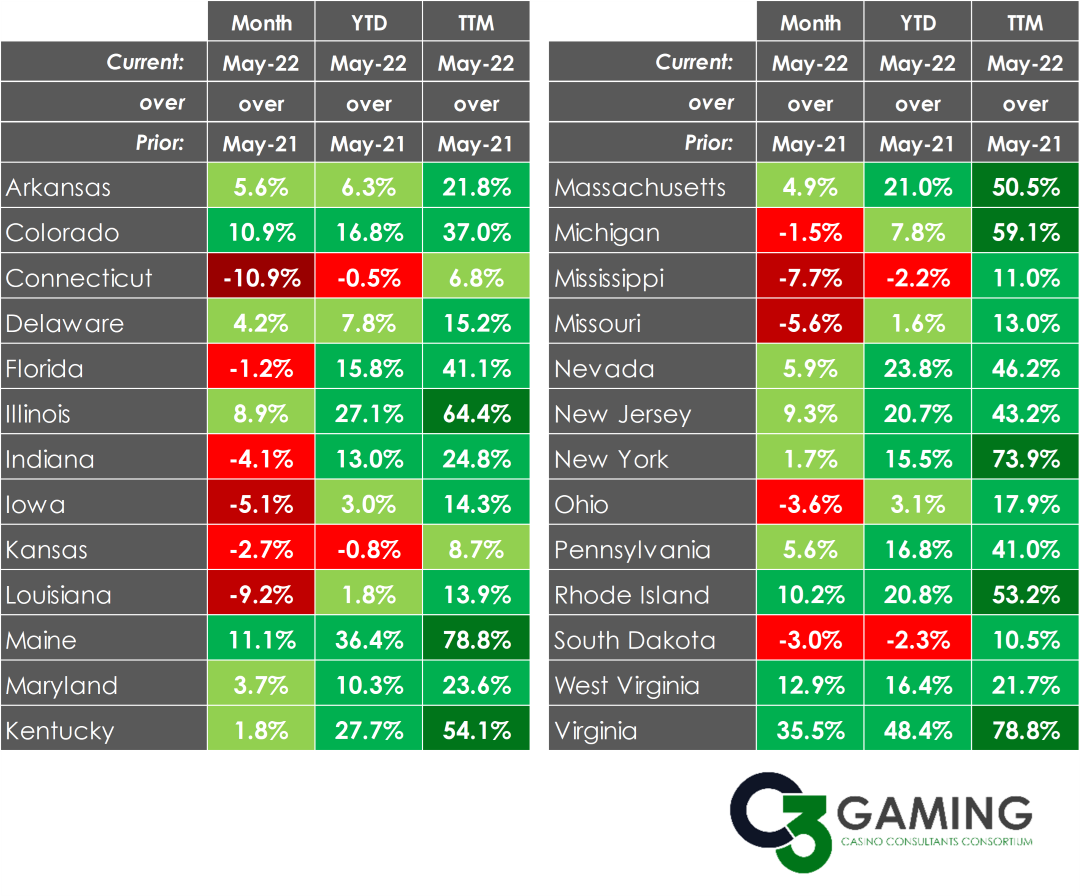

C3 Gaming collects gaming revenue statistics from twenty-six states with commercial casinos and summarizes each state’s performance on a monthly basis. While eleven states showed declines in May over the prior-year period, fifteen states reported growth, a trend that started over a year before.

When looking at individual states, it is important to recognize that casinos compete with those in nearby states, often pulling market share across state lines. For example, while Connecticut’s two Indian casinos saw a 10.9 percent decline in May’s slot revenue, gaming revenue in the adjacent state of Rhode Island grew by 10.2 percent and Massachusetts increased by 4.9 percent.

Looking at Louisiana and Mississippi, which represents the southeast United States, gaming revenues declined 9.2 percent and 7.7 percent, respectively. While of concern, it is important to recognize that these states’ performances are being compared to 2021, an unprecedented year of growth for the US casino industry.

The Las Vegas gaming market

As vaccines became widely available and domestic travel resumed in early 2021, the Las Vegas gaming industry began to experience historic growth, with statewide gaming revenues exceeding $1 billion for fifteen consecutive months, through May 2022.

Also in May, Las Vegas’s Harry Reid International Airport recorded its third busiest month in its history, as measured by total enplanements/deplanements. 4.57 million passengers passed through the airport, leaving that period only 32,000 passengers short of the record set in October of 2019. This record was set despite record-high prices for airline tickets and lodging. If US consumers were concerned by inflation, it was not evident by their travel and spending patterns to Las Vegas.

Looking forward

It is still too early to predict how inflation and the possible slowdown of the global economy will affect regional Asian gaming markets. There remains a tremendous amount of pent-up demand for leisure activities among Asian travelers. Most jurisdictions can expect robust levels of visitation and gaming revenues through the summer travel season, followed by a resumption of business/MICE travel in the fall.

The Great Recession taught us that the gaming industry is not immune to recession. Nevertheless, current indices in the United States, a past predictor for future trends in Asian gaming, suggest that a repeat of 2008-2010 is not in the cards.